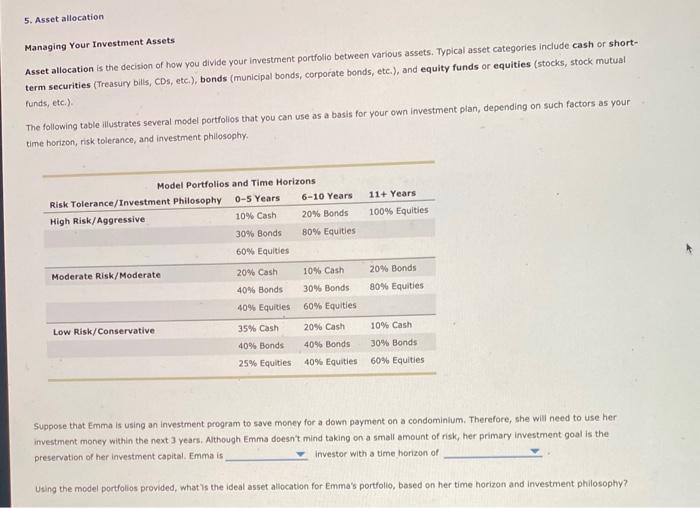

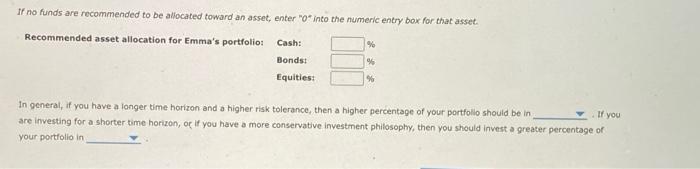

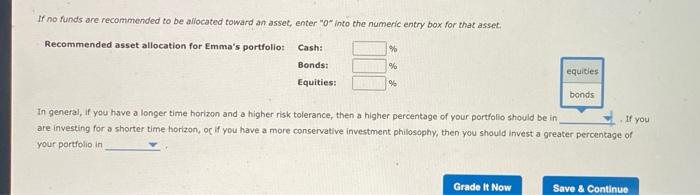

5. Asset allocation Managing Your Investment Assets Asset allocation is the decision of how you divide your investment portfolio between various assets. Typical asset categories include cash or shortterm securities (Treasury bilis, CDs, etc.), bonds (municipal bonds, corporate bonds, etc.), and equity funds or equities (stocks, stock mutual funds, etc.). The following table illustrates several model portfolios that you can use as a basis for your own investment pian, depending on such factors as your time horizon, risk tolerance, and investment philosoghy. Suppose that Emma is using an investment program to save money for a down payment on a condominium. Therefore, she wisl need to use her investment money within the next 3 years. Athough Emma doesn't mind taking on a small amount of risk, her primary investment goal is the preservation of her investment capital. Emena is investor with a time horizon of Using the model portfolios provided, what 's the ideal asset aliocation for Emma's portfolio, based on her time horizon and investment philosophy? 5. Asset allocation Managing Your Investment Assets Asset allocation is the decision of how you divide your investment portfolio between various assets. Typical asset categories include cash or shortterm securities (Treasury bils, CDs, etc.), bonds (municlpal bonds, corporate bonds, etc.), and equity funds or equities (stocks, stock mutual funds, etc.). The following table illustrates several model portfolios that you can use as a basis for your own investment plan, depending on such factors as your time horizon, risk tolerance, and investment phillosophy. Suppose that Emma is using an investment program to save money for a down payment on a condominium. Therefore, she will need to use her Investment money within the next 3 years. Athough Emma doesn't mind taking on a small amount of risk, her primary investment goal is the preservation of her investment capital. Emma is investor with a time horizon of Using the model portfolios provided, what is the ion for Emma's portfolio, based on her time horizon and investment philosophy? If no funds are recommended to be allocated toward an asset, enter "o" into the numeric entry box for that asset. 5. Asset allocation Managing Your Investment Assets Asset allocation is the decision of how you divide your investment portfollo between various assets. Typical asset categories include cash or shortterm securities (Treasury bills, CDs, etc.), bonds (municipal bonds, corporate bonds, etc.), and equity funds or equities (stocks, stock mutual. funds, etc.). The following table llilustrates several model portfolios that you can use as a basis for your own investment plan, depending on such factors as your ime horizon, risk tolerance, and investment philosophy. Suppose that Emma is using an investment program to save money for a down payment on a condominium. Therefore, she will need to use her investment money within the next 3 years. Although Emma doesn't mind taking on a small amount of risk, her primary investment goal is the preservation of her investment capital. Emma is investor with a time horizon of Using the model portfolios provided, what is the ideal asset allocation for Emma's portfolio, based on h ivestment philosophy? If no funds are recommended to be allocated toward an asset, enter "o into the numeric entry box for that asset. In general, if you have a ionger time horizon and a higher risk tolerance, then a higher percentage of your portfollo should be in If you are investing for a shorter time horizon, or if you have a more conservative investment philosophy, then you should invest a greater percentage of your portfolio in If no funds are recommended to be allocated toward an assec, enter "O" into the numeric entry box for that asset. In general, if you have a longer time horizon and a higher risk tolerance, then a higher percentage of your portfolio should be in - If you are investing for a shorter time horizon, oc if you have a more conservative investment philosophy, then you should invest a greater percentage of your portolio in In general, if yc ger time horizon and a higher risk tolerance, then a higher percentage of your portfolio should be in If you are investing fo me horizon, of If you have a more conservative investment philosophy, then you should invest a greater percentage of your portfolio in