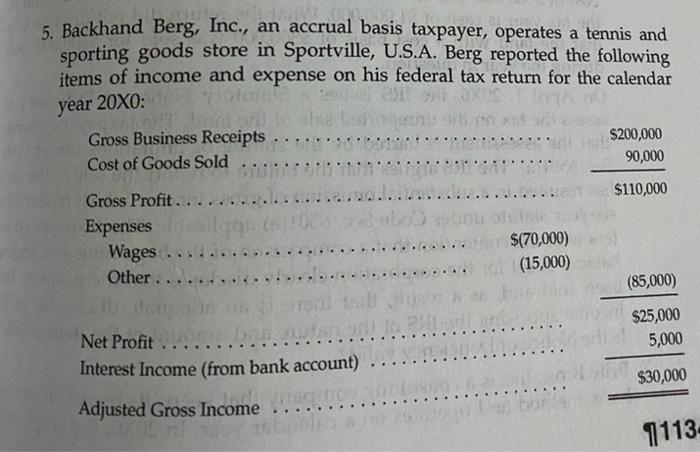

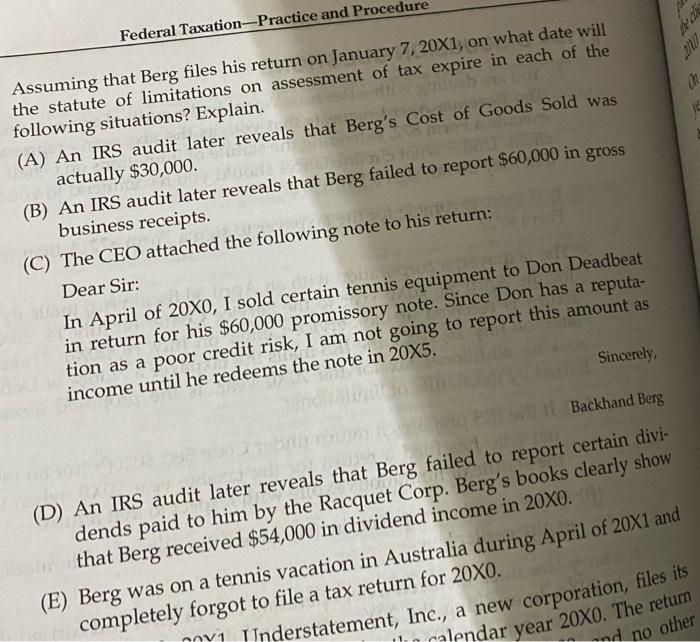

5. Backhand Berg, Inc., an accrual basis taxpayer, operates a tennis and sporting goods store in Sportville, U.S.A. Berg reported the following items of income and expense on his federal tax return for the calendar vear 20X0: Assuming that Berg files his return on January 7, 20X1, on what date will the statute of limitations on assessment of tax expire in each of the following situations? Explain. (A) An IRS audit later reveals that Berg's Cost of Goods Sold was actually $30,000. (B) An IRS audit later reveals that Berg failed to report $60,000 in gross business receipts. (C) The CEO attached the following note to his return: Dear Sir: In April of 200, I sold certain tennis equipment to Don Deadbeat in return for his $60,000 promissory note. Since Don has a reputation as a poor credit risk, I am not going to report this amount as income until he redeems the note in 205. (D) An IRS audit later reveals that Berg failed to report certain divi dends paid to him by the Racquet Corp. Berg's books clearly show that Berg received $54,000 in dividend income in 20X0. (E) Berg was on a tennis vacation in Australia during April of 201 an completely forgot to file a tax return for 200. Assuming that Berg files his return on January 7,201, on what date will the statute of limitations on assessment of tax expire in each of the following situations? Explain. (A) An IRS audit later reveals that Berg's Cost of Goods Sold was actually $30,000. (B) An IRS audit later reveals that Berg failed to report $60,000 in gross business receipts. (C) The CEO attached the following note to his return: Dear Sir: In April of 20X0, I sold certain tennis equipment to Don Deadbeat in return for his $60,000 promissory note. Since Don has a reputation as a poor credit risk, I am not going to report this amount as income until he redeems the note in 205. Sincerely, Backhand Berg (D) An IRS audit later reveals that Berg failed to report certain dividends paid to him by the Racquet Corp. Berg's books clearly show that Berg received $54,000 in dividend income in 20X0. (E) Berg was on a tennis vacation in Australia during April of 201 and completely forgot to file a tax return for 200