Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5) Bankers Corp. has a very conservative beta of .7, while Biotech Corp. has a beta of 2.1. Given that the T-bill rate is

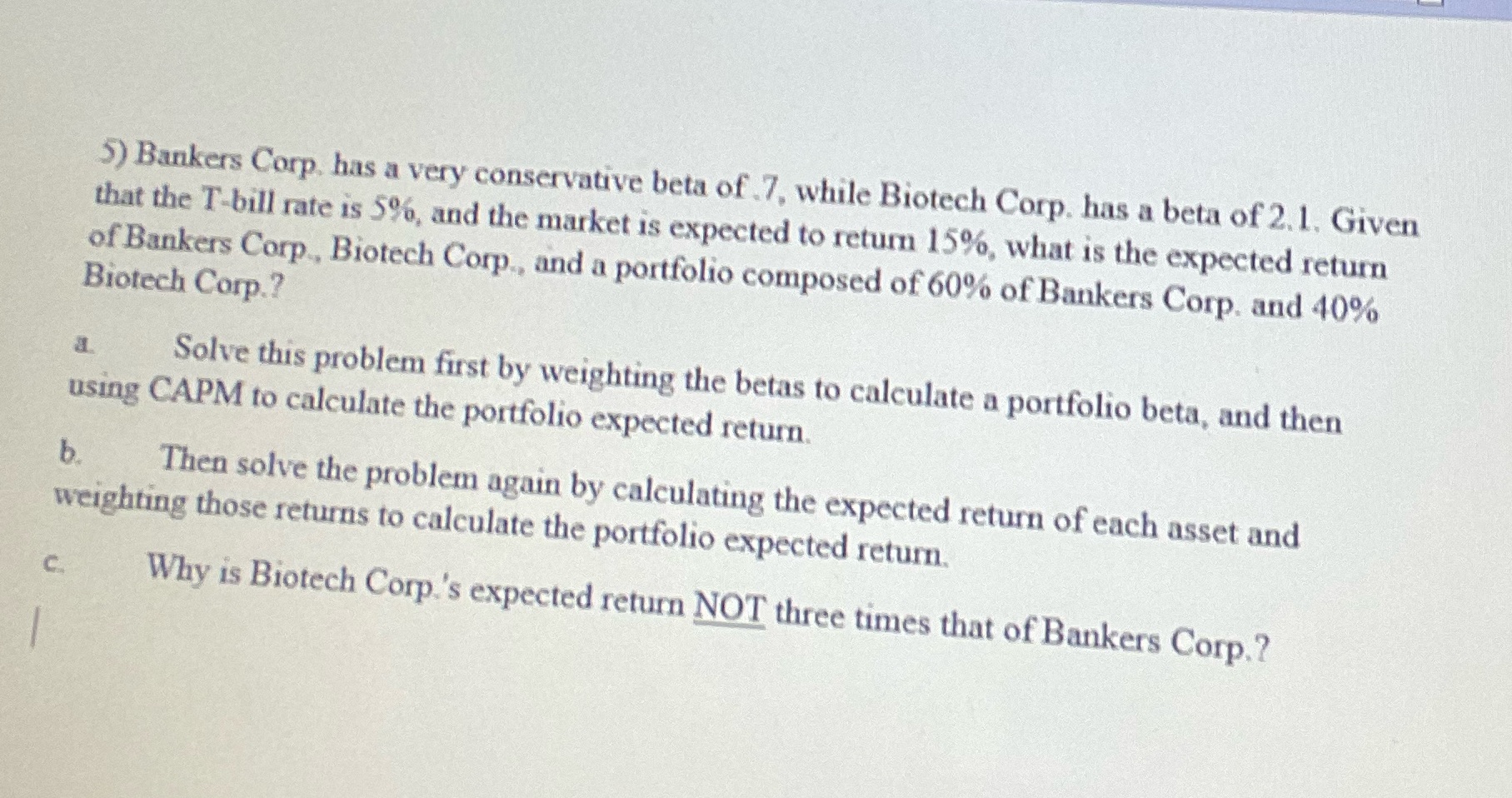

5) Bankers Corp. has a very conservative beta of .7, while Biotech Corp. has a beta of 2.1. Given that the T-bill rate is 5%, and the market is expected to return 15%, what is the expected return of Bankers Corp., Biotech Corp., and a portfolio composed of 60% of Bankers Corp. and 40% Biotech Corp.? a. Solve this problem first by weighting the betas to calculate a portfolio beta, and then using CAPM to calculate the portfolio expected return. b. Then solve the problem again by calculating the expected return of each asset and weighting those returns to calculate the portfolio expected return. C. Why is Biotech Corp.'s expected return NOT three times that of Bankers Corp.?

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Sure I can help you solve this problem The question asks for the expected return of Bankers Corp Biotech Corp and a portfolio composed of 60 of Bankers Corp and 40 Biotech Corp We can solve this probl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started