Answered step by step

Verified Expert Solution

Question

1 Approved Answer

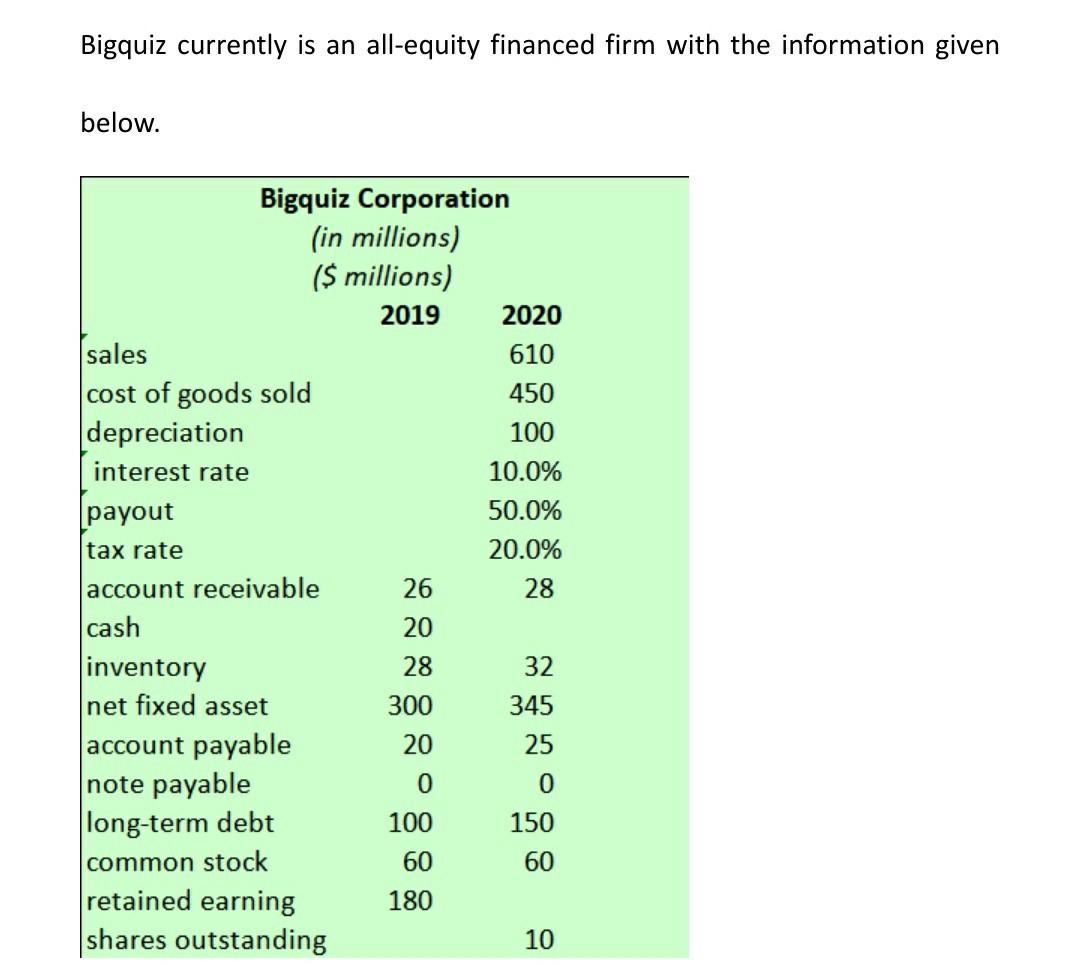

5. BigQuiz is considering to issue 50 million long-term debt to buy back its existing stocks. How many shares can be bought? Suppose the new

5. BigQuiz is considering to issue 50 million long-term debt to buy back its existing stocks. How many shares can be bought? Suppose the new debt has the same interest rate as the existing debt, how much will be EPS before and after the stock repurchase? List three reasons that firms may prefer stock repurchase to cash dividend. List another three reasons that firms may prefer cash dividend.

Bigquiz currently is an all-equity financed firm with the information given below. Bigquiz Corporation (in millions) ($ millions) 2019 2020 sales 610 cost of goods sold 450 depreciation 100 interest rate 10.0% payout 50.0% tax rate 20.0% account receivable 26 28 cash 20 inventory 28 32 net fixed asset 300 345 account payable 20 25 note payable 0 0 long-term debt 100 150 common stock 60 60 retained earning 180 shares outstanding 10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started