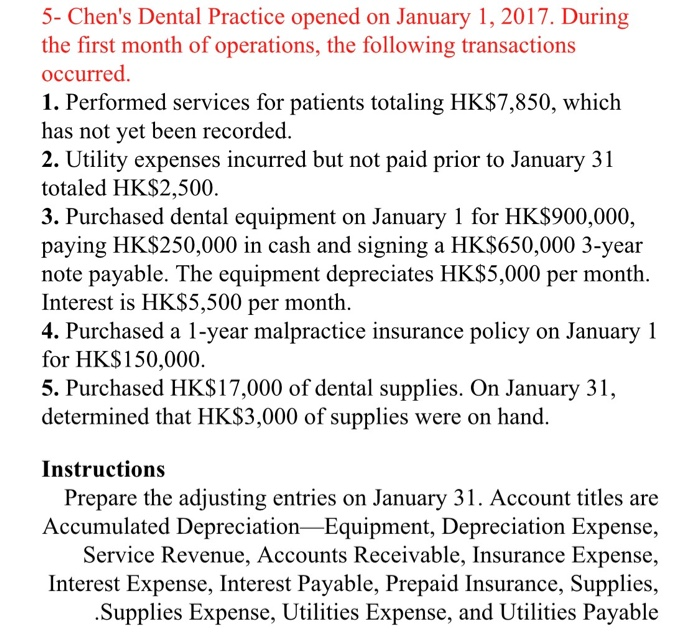

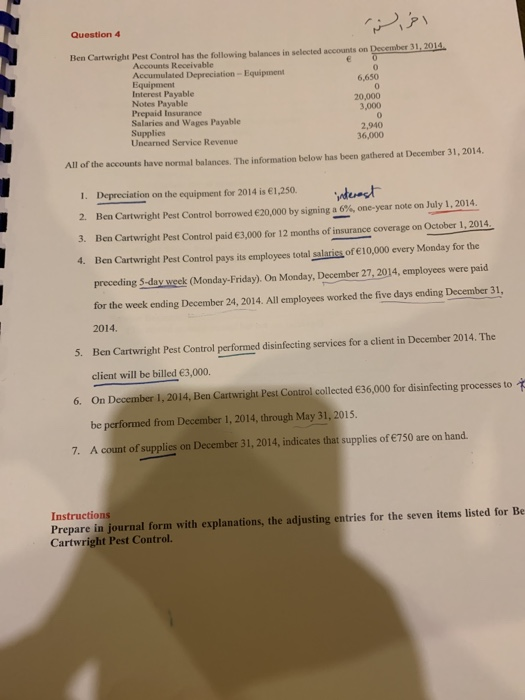

5- Chen's Dental Practice opened on January 1, 2017. During the first month of operations, the following transactions occurred. 1. Performed services for patients totaling HK$7,850, which has not yet been recorded. 2. Utility expenses incurred but not paid prior to January 31 totaled HK$2,500. 3. Purchased dental equipment on January 1 for HK$900,000, paying HK$250,000 in cash and signing a HK$650,000 3-year note payable. The equipment depreciates HK$5,000 per month. Interest is HK$5,500 per month. 4. Purchased a 1-year malpractice insurance policy on January 1 for HK$150,000. 5. Purchased HK$17,000 of dental supplies. On January 31, determined that HK$3,000 of supplies were on hand. Instructions Prepare the adjusting entries on January 31. Account titles are Accumulated DepreciationEquipment, Depreciation Expense, Service Revenue, Accounts Receivable, Insurance Expense, Interest Expense, Interest Payable, Prepaid Insurance, Supplies, .Supplies Expense, Utilities Expense, and Utilities Payable Visi Question 4 Ben Cartwright Pest Control has the following balances in selected accounts on December 31, 2014 Accounts Receivable 0 Accumulated Depreciation - Equipment 0 Equipment 6,650 Interest Payable 0 Notes Payable 20,000 Prepaid Insurance 3,000 Salaries and Wages Payable 0 Supplies 2,940 Unearned Service Revenue 36,000 All of the accounts have normal balances. The information below has been gathered at December 31, 2014 1. Depreciation on the equipment for 2014 is 1.250. interest 2. Ben Cartwright Pest Control borrowed 20,000 by signing a 6%, one-year note on July 1, 2014 3. Ben Cartwright Pest Control paid 3,000 for 12 months of insurance coverage on October 1, 2014 4. Ben Cartwright Pest Control pays its employees total salaries of 10,000 every Monday for the preceding 5-day week (Monday-Friday). On Monday, December 27, 2014, employees were paid for the week ending December 24, 2014. All employees worked the five days ending December 31, 2014. 5. Ben Cartwright Pest Control performed disinfecting services for a client in December 2014. The client will be billed 3,000. 6. On December 1, 2014, Ben Cartwright Pest Control collected 36,000 for disinfecting processes to be performed from December 1, 2014, through May 31, 2015. 7. A count of supplies on December 31, 2014, indicates that supplies of 750 are on hand. Instructions Prepare in journal form with explanations, the adjusting entries for the seven items listed for Be Cartwright Pest Control