5) Compute the Profit Margin and Return on Assets under the 3 scenarios. Assume current average assets are $250,000. Average current assets for Alternative 1: Bakery would be $300,000, and Alternative 2: Drive-thru would be $400,000. 6) Compute the Degree of Operating Leverage for Alternative 1: Bakery and Alternative 2: Drive-Thru

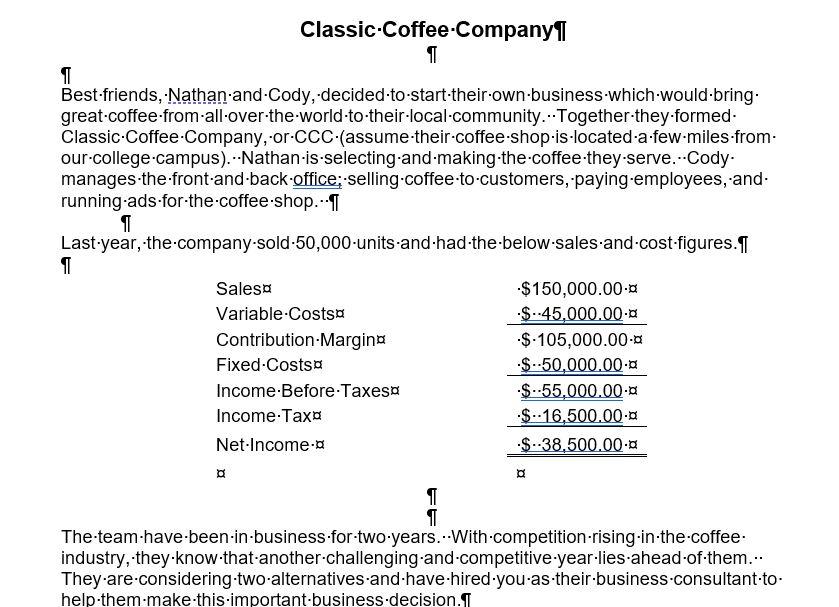

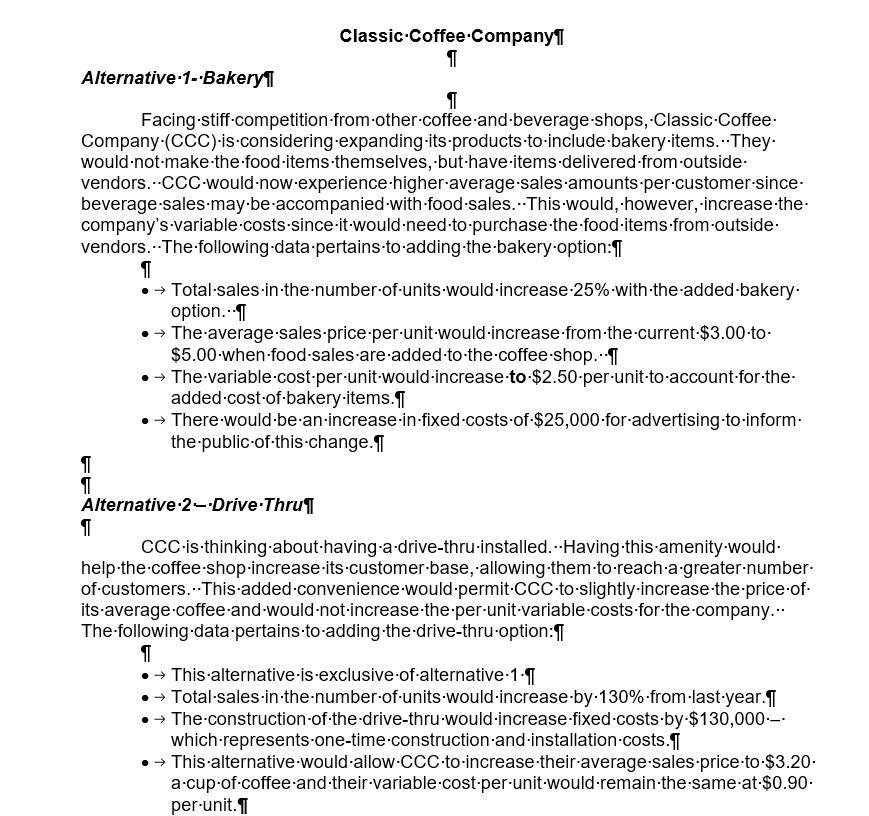

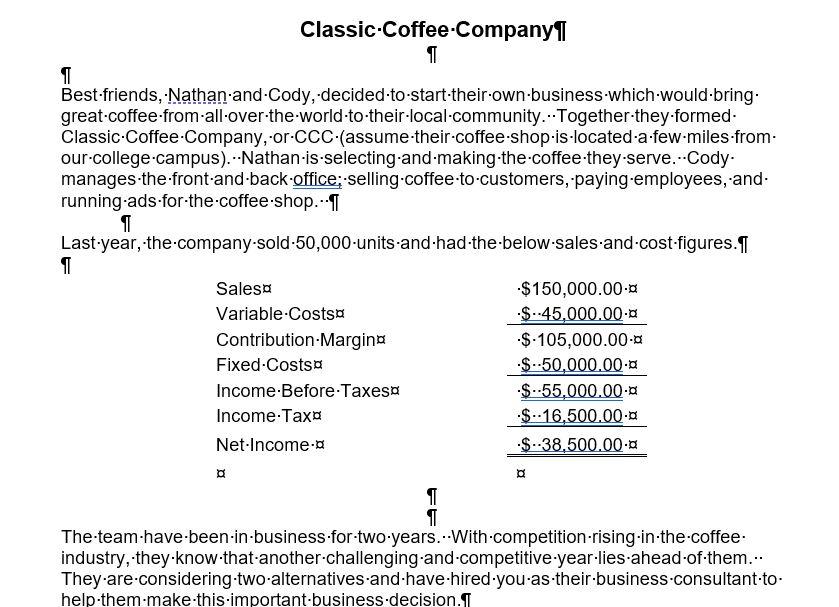

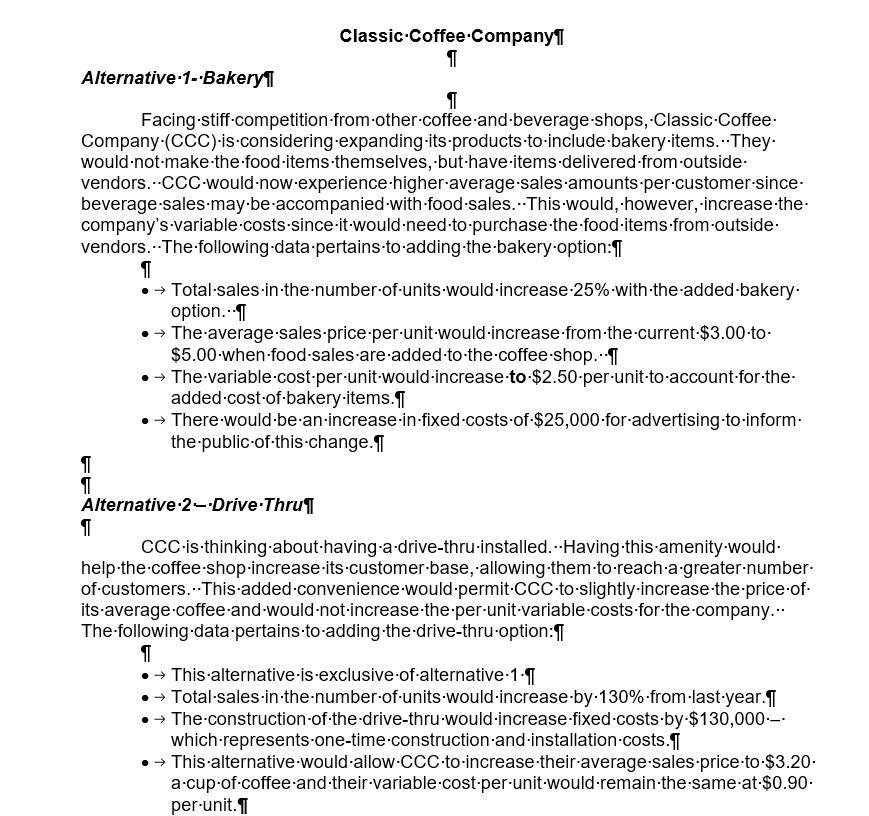

Classic Coffee Company 1 Best.friends, Nathan-and-Cody, decided to start-their-own-business which would bring. great-coffee-from-all-over-the-world-to-their-local-community...Together they formed Classic Coffee Company, or.CCC (assume their-coffee-shop.is located a few miles from our-college-campus).--Nathan-is-selecting and making the coffee-they.serve.-Cody. manages the front and back office;-selling coffee to customers, paying employees, and running.ads-for-the-coffee-shop. 1 Last year, the company-sold-50,000 units and had the below.sales and cost-figures. I 1 Sales -$150,000.00.6 Variable Costso $-45,000.00-0 Contribution-Margina $ 105,000.000 Fixed-Costa $--50,000.00.0 Income Before Taxeso $ 55,000.00.0 Income Taxo $ 16,500.00.0 Net-Income. $-38,500.00-0 11 The-team-have-been-in-business for two years. With competition-rising-in-the-coffee. industry, they know that another challenging and competitive-year-lies-ahead-of-them. They are considering two-alternatives and have hired-you-as-their-business consultant-to- help them-make-this-important business decision. Classic Coffee Company 1 Alternative-1--Bakery1 1 Facing.stiff-competition-from-other-coffeeandbeverage-shops, Classic-Coffee Company (CCC) is considering.expanding its products-to-include bakery.items...They. would not make the food-items-themselves, but-have-items-delivered from outside. vendors... CCC-would-now.experience higher average-sales amounts-per-customer-since. beverage-sales-may be accompanied-with-food-sales.--This-would, however, increase the company's variable costs-since-it-would need to purchase the food-items-from-outside. vendors. The following.datapertains-to-addingthe-bakery option: 11 Total-sales-in-thenumber of units-would-increase-25%-with-the-added-bakery. option...1 The average-sales-price-per-unit-would-increase-from-the current-$3.00-to- $5.00-when-food-sales are added to the coffee-shop. The variable cost-per-unit-would-increase-to-$2.50-per-unit-to-account for the added cost-of-bakery-items. There-wouldbe-an-increase-in-fixed-costs-of-$25,000 for advertising-to-inform. the public of this change. I 1 1 Alternative 2-Drive-Thru 1 CCC-is-thinking about having a drive-thru-installed.--Having this amenity-would- help.the-coffee-shop-increase-its-customer-base, allowing them to reach a greater-number: of customers. This added.convenience-would-permit CCC-to-slightly increase the price of. its-average-coffee-and-would-not-increase the per-unit-variable costs for the company.-- The following data pertains-to-addingthe-drive-thru-option:1 1 This alternative-is-exclusive-of-alternative 1.1 Total-sales-in-the-numberof-units-would-increase by.130%-from-last year. I The construction-of-the-drive-thru-would-increase-fixed-costs-by-$130,000.- which-represents-one-time-construction-and-installation costs. I This alternative-would-allow.CCC-to-increase their-average-sales-price-to-$3.20. a cup of coffee-and-their-variable cost-per-unit-would-remain-the-same-at-$0.90. per-unit. 1