5. Constant growth stocks

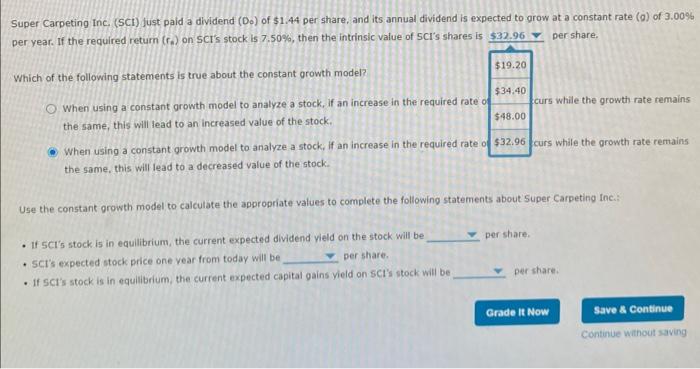

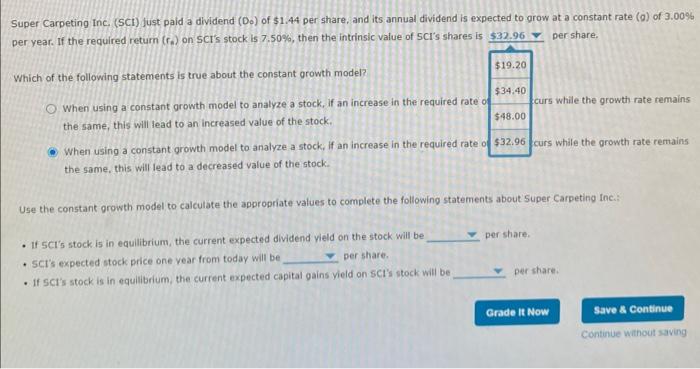

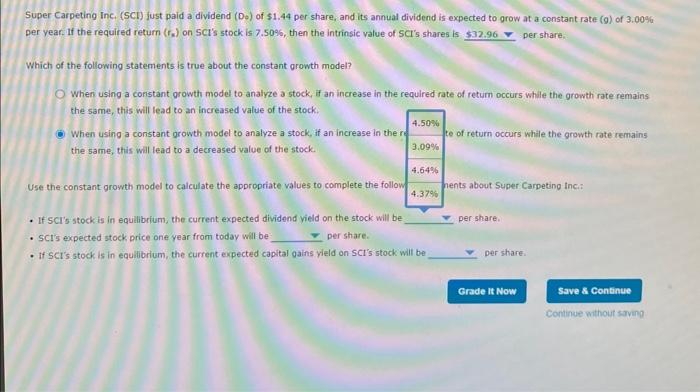

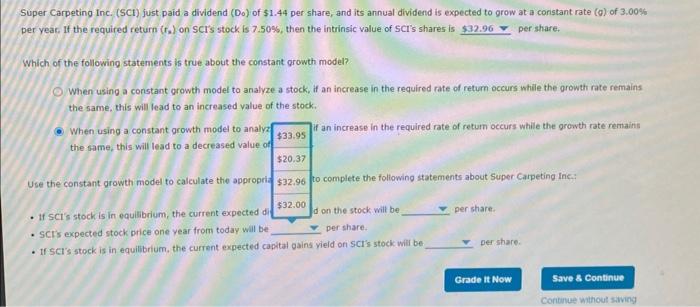

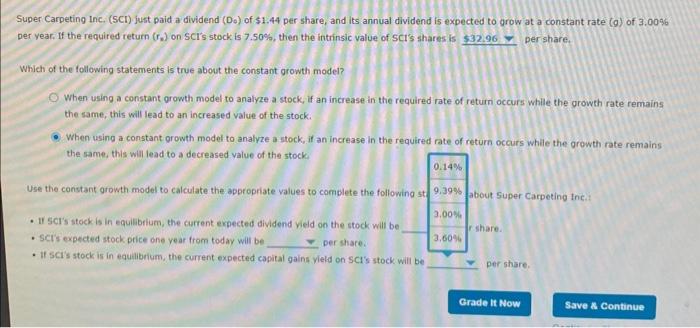

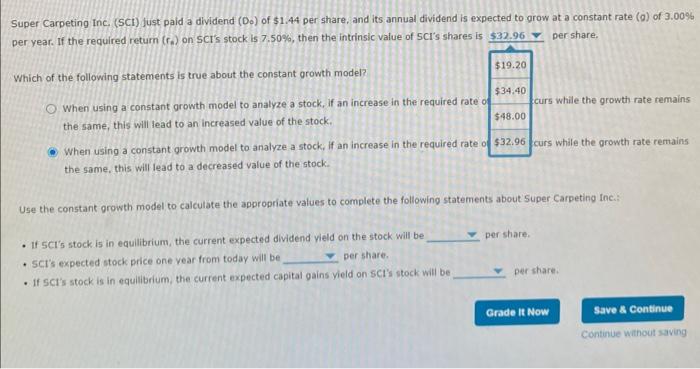

Super Carpeting inc. (SCI) Just paid a dividend (Do) of $1.44 per share, and its annual dividend is expected to arow at a constant rate ( 9 ) of 3.00%. per year. If the required return (r) on 5CI 's stock is 7.50%, then the intrinsic value of 5Cl 's shares is per share. Which of the following statements is true about the constant growth model? When using a constant growth model to analyze a stock, if an increase in the required rate of $34.40 curs while the growth rate remains the same, this will lead to an increased value of the stock, When using a constant growth model to analyze a stock, if an increase in the required rate of $32.96 curs while the growth rate remains the same, this will lead to a decreased value of the stock. Use the constant growth model to calculate the appropriate values to complete the following statements about Super Carpeting inc.: - If 5Cl5 stock is in equilibrium, the current expected dividend vield on the stock will be per share. - Sct's expected stock price one vear from today will be per share. - If Scl's stock is in equilibrium, the current expected capital gains vield on SCl's stock will be Super Carpeting Inc. (SCl) Just paid a dividend (De) of $1.44 per share, and its annual dividend is expected to grow at a constant rate (g) of 3.00%. per share. Which of the following statements is true about the constant growth model? When using a constant growth model to analyze a stock, if an increase in the required rate of retum occurs while the growth rate remains When using a constant growth model to analyze a stock, if an increase in the ro 4.50% te of return occurs while the growth rate remains the same, this will lead to an increased value of the stock. the same, this will lead to a decreased value of the stock. Use the constant growth model to calculate the appropriate values to complete the follow 4.3796 - If SCl's stock is in equilibrium, the current expected dividend vield on the stock will be per share. - SCI's expected stock price one year from today will be per share. - If ScI's stock is in equilibrium, the current expected capital gains yield on SCI's stock will be per share. Super Carpeting Inc. (SCl) just paid a dividend (Do) of $1.44 per share, and its annual dividend is expected to grow at a conistant rate ( (0 ) of 3.00% per yeat, If the required return (rs) on SCI's stock is 7.50%6, then the intrinsic value of SCI's shares is per share. Which of the following statements is true about the constant growth model? When using a constant growth model to analyze a stock, if an increase in the required rate of return occurs while the growth rate remains the same, this will lead to an increased value of the stock. When using a constant growth model to analyz $33.95 if an increase in the required rate of return occurs while the growth rate remtainis the same, this will lead to a decreased value of Use the constant growth model to calculate the appropria \$32.96 to complete the foliowing statements about Super Carpeting Inc: - If SCl 's stock is in equilibrium, the current expected di $32.00 d on the stock will be per share. - Sci's expected stock price one year from today will be per share. - If sci's stock is in equilibrium, the current expected capital gains vield on sci's stock will be per share. Super Carpeting Inc. (SCI) just paid a dividend (Do) of \$1.44 per share, and its annual dividend is expected to grow at a constant rate (g) of 3.0046 per year. If the required return. (rn) on SCl's stock is 7.50%, then the intrinsic value of Sci's shares is pershare. Which of the following statements is true about the constant growth model? When using a constant orowth model to analyze a stock, if an increase in the required rate of return occurs while the groweh rate remains the same, this will lead to an increased value of the stock. When using a constant growth modeh to analyze a stock, if an increase in the required rate of return occurs while the growth rate remains the same, this will lead to a decreased value of the stocki Use the constant growth model to calculate the appropriate values to comblete the following - II Scl's stock is in equilibrium, the carrent expected dividend vield on the stock will be - scis expected stock price one vear from today will be per Mhare. - If sci's stock is in equilibricm, the current expected capital gains vield on SCi's stock. will be