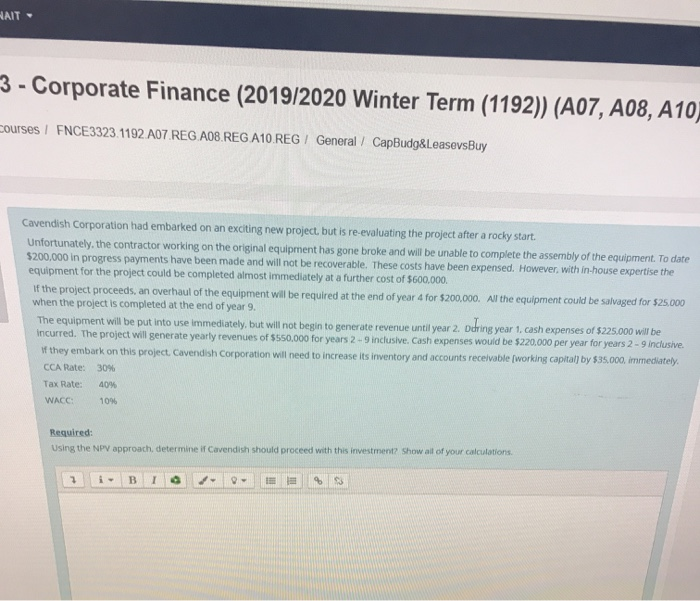

5 - Corporate Finance (2019/2020 Winter Term (1192)) (A07, A08, A10) burses/ FNCE3323. 1192 A07 REG A08. REG A10 REG/ General / CapBudg&LeasevsBuy Cavendish Corporation had embarked on an exciting new project, but is re-evaluating the project after a rocky start. Unfortunately, the contractor working on the original equipment has gone broke and will be unable to complete the assembly of the equipment. To date $200,000 in progress payments have been made and will not be recoverable. These costs have been expensed. However, with in-house expertise the equipment for the project could be completed almost immediately at a further cost of $600.000 If the project proceeds, an overhaul of the equipment will be required at the end of year 4 for $200,000. All the equipment could be salvaged for $25.000 when the project is completed at the end of year 9. The equipment will be put into use immediately, but will not begin to generate revenue until year 2. Ddring year 1. cash expenses of $225.000 will be incurred. The project will generate yearly revenues of $550.000 for years 2 - 9 inclusive. Cash expenses would be $220.000 per year for years 2 - 9 inclusive. If they embark on this project. Cavendish Corporation will need to increase its inventory and accounts receivable (working capital) by $35.000, immediately CCA Rate: 30% Tax Rate: 40% WACC: 104 Required: Using the NPV approach, determine if Cavendish should proceed with this investment? Show all of your calculations 5 - Corporate Finance (2019/2020 Winter Term (1192)) (A07, A08, A10) burses/ FNCE3323. 1192 A07 REG A08. REG A10 REG/ General / CapBudg&LeasevsBuy Cavendish Corporation had embarked on an exciting new project, but is re-evaluating the project after a rocky start. Unfortunately, the contractor working on the original equipment has gone broke and will be unable to complete the assembly of the equipment. To date $200,000 in progress payments have been made and will not be recoverable. These costs have been expensed. However, with in-house expertise the equipment for the project could be completed almost immediately at a further cost of $600.000 If the project proceeds, an overhaul of the equipment will be required at the end of year 4 for $200,000. All the equipment could be salvaged for $25.000 when the project is completed at the end of year 9. The equipment will be put into use immediately, but will not begin to generate revenue until year 2. Ddring year 1. cash expenses of $225.000 will be incurred. The project will generate yearly revenues of $550.000 for years 2 - 9 inclusive. Cash expenses would be $220.000 per year for years 2 - 9 inclusive. If they embark on this project. Cavendish Corporation will need to increase its inventory and accounts receivable (working capital) by $35.000, immediately CCA Rate: 30% Tax Rate: 40% WACC: 104 Required: Using the NPV approach, determine if Cavendish should proceed with this investment? Show all of your calculations