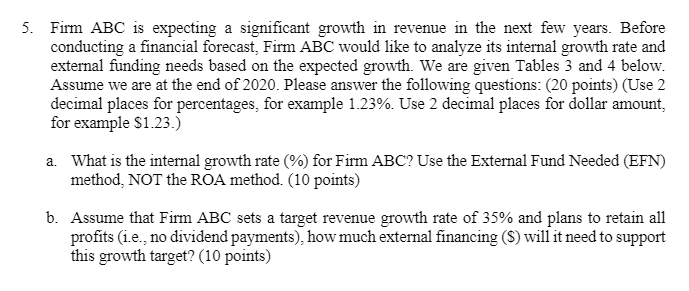

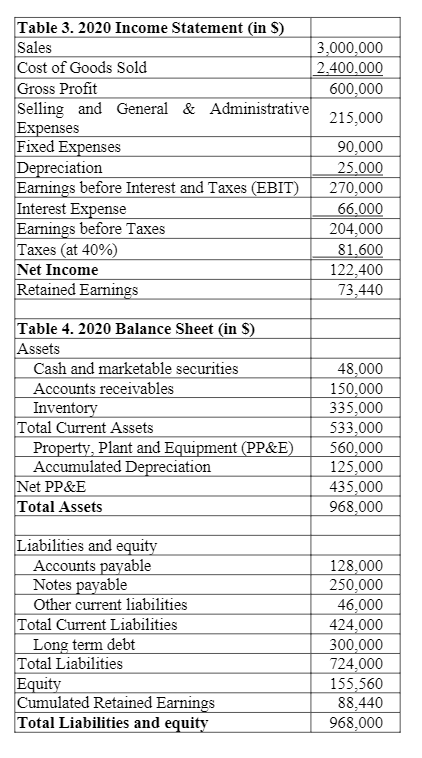

5. Firm ABC is expecting a significant growth in revenue in the next few years. Before conducting a financial forecast, Firm ABC would like to analyze its internal growth rate and external funding needs based on the expected growth. We are given Tables 3 and 4 below. Assume we are at the end of 2020. Please answer the following questions: (20 points) (Use 2 decimal places for percentages, for example 1.23%. Use 2 decimal places for dollar amount, for example $1.23.) a. What is the internal growth rate (%) for Firm ABC? Use the External Fund Needed (EFN) method, NOT the ROA method. (10 points) b. Assume that Firm ABC sets a target revenue growth rate of 35% and plans to retain all profits (1.e., no dividend payments), how much external financing (S) will it need to support this growth target? (10 points) Table 3. 2020 Income Statement in S) Sales 3,000,000 Cost of Goods Sold 2,400,000 Gross Profit 600,000 Selling and General & Administrative 215,000 Expenses Fixed Expenses 90,000 Depreciation 25.000 Earnings before Interest and Taxes (EBIT) 270,000 Interest Expense 66.000 Earnings before Taxes 204,000 Taxes (at 40%) 81.600 Net Income 122,400 Retained Earnings 73,440 Table 4. 2020 Balance Sheet (in %) Assets Cash and marketable securities Accounts receivables Inventory Total Current Assets Property, Plant and Equipment (PP&E) Accumulated Depreciation Net PP&E Total Assets 48,000 150,000 335,000 533,000 560,000 125,000 435,000 968,000 Liabilities and equity Accounts payable Notes payable Other current liabilities Total Current Liabilities Long term debt Total Liabilities Equity Cumulated Retained Earnings Total Liabilities and equity 128,000 250,000 46,000 424,000 300,000 724,000 155,560 88,440 968,000 5. Firm ABC is expecting a significant growth in revenue in the next few years. Before conducting a financial forecast, Firm ABC would like to analyze its internal growth rate and external funding needs based on the expected growth. We are given Tables 3 and 4 below. Assume we are at the end of 2020. Please answer the following questions: (20 points) (Use 2 decimal places for percentages, for example 1.23%. Use 2 decimal places for dollar amount, for example $1.23.) a. What is the internal growth rate (%) for Firm ABC? Use the External Fund Needed (EFN) method, NOT the ROA method. (10 points) b. Assume that Firm ABC sets a target revenue growth rate of 35% and plans to retain all profits (1.e., no dividend payments), how much external financing (S) will it need to support this growth target? (10 points) Table 3. 2020 Income Statement in S) Sales 3,000,000 Cost of Goods Sold 2,400,000 Gross Profit 600,000 Selling and General & Administrative 215,000 Expenses Fixed Expenses 90,000 Depreciation 25.000 Earnings before Interest and Taxes (EBIT) 270,000 Interest Expense 66.000 Earnings before Taxes 204,000 Taxes (at 40%) 81.600 Net Income 122,400 Retained Earnings 73,440 Table 4. 2020 Balance Sheet (in %) Assets Cash and marketable securities Accounts receivables Inventory Total Current Assets Property, Plant and Equipment (PP&E) Accumulated Depreciation Net PP&E Total Assets 48,000 150,000 335,000 533,000 560,000 125,000 435,000 968,000 Liabilities and equity Accounts payable Notes payable Other current liabilities Total Current Liabilities Long term debt Total Liabilities Equity Cumulated Retained Earnings Total Liabilities and equity 128,000 250,000 46,000 424,000 300,000 724,000 155,560 88,440 968,000