Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5 i got everything in there, youre just trying to get me to pay more. im reporting you for this BS. literally all the info

5

i got everything in there, youre just trying to get me to pay more. im reporting you for this BS. literally all the info is in there

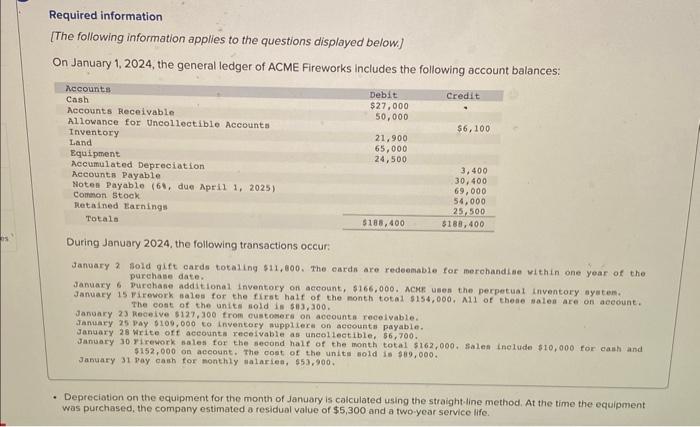

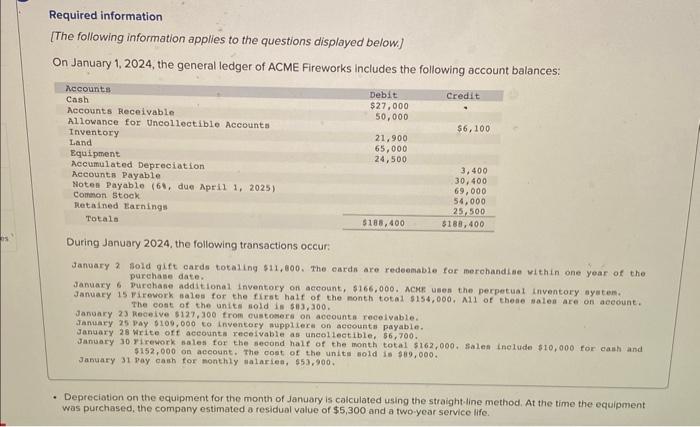

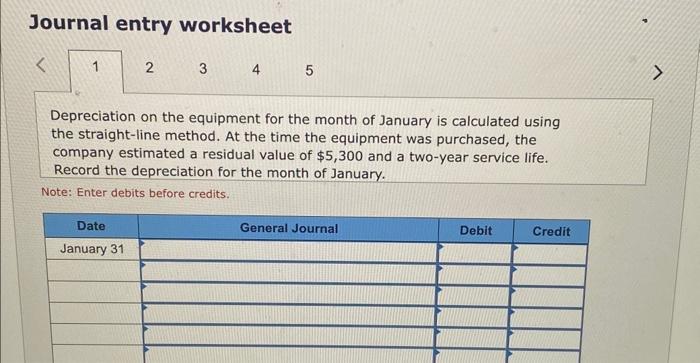

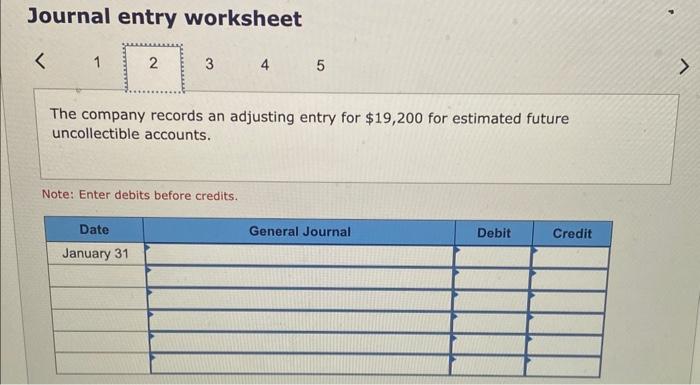

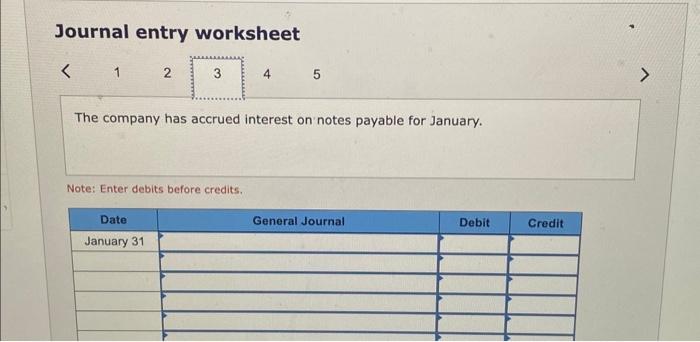

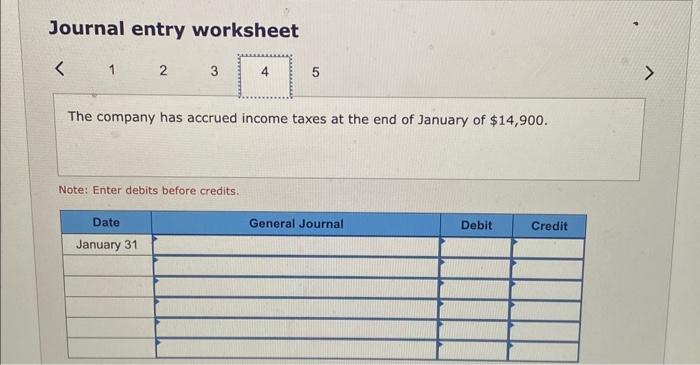

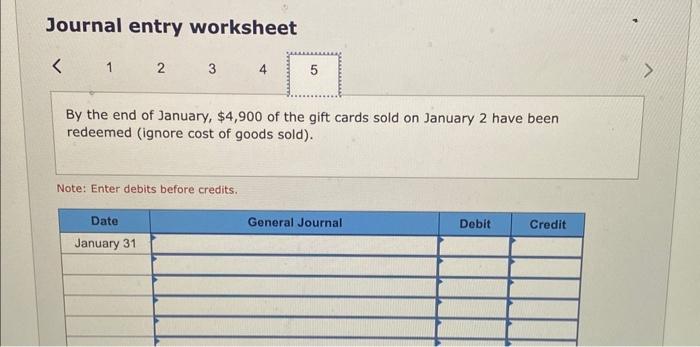

Required information [The following information applies to the questions displayed below] On January 1, 2024, the general ledger of ACME Fireworks includes the following account balances: During January 2024, the following transactions occur: January 2 Sold gift eards totaling $11,000. The eardn are redeemable for merchandise within one year of the purchase date. January 6 purchane additional inventory on aceount, 5166,000 . Acris usen the perpetual Lnventory aysen. The eost of the unite sold in 513,300. January 23 Receive 5127,300 from customera on aceounta recelvabie. Tanuary 25 pay $100,000 to inventory auppilera on account payabie. January 28 Write of t aceounta recelvable as uncol1ectible, 56,700. January 30.Y resork sales for the seoond hale of the month total $162,000,851 es inelude $10,000 for cauh and $152,000 on account. The cost of the units sold is $89,000, January 31 Pay cash for nonthly walariea, 553,900. - Depreciation on the equipment for the month of January is calculated using the straight-line method, At the time the equipment was purchased, the company estimated a residual value of $5,300 and a two-year service life. Journal entry worksheet Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equipment was purchased, the company estimated a residual value of $5,300 and a two-year service life. Record the depreciation for the month of January. Note: Enter debits before credits. Journal entry worksheet 5 The company records an adjusting entry for $19,200 for estimated future uncollectible accounts. Note: Enter debits before credits. Journal entry worksheet 5 The company has accrued interest on notes payable for January. Note: Enter debits before credits. Journal entry worksheet The company has accrued income taxes at the end of January of $14,900. Note: Enter debits before credits. Journal entry worksheet The company has accrued income taxes at the end of January of $14,900. Note: Enter debits before credits. Journal entry worksheet By the end of January, $4,900 of the gift cards sold on January 2 have been redeemed (ignore cost of goods sold). Note: Enter debits before credits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started