Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. Illustrating Amortization. Heather McIntosh of Watertown, South Dakota, recently purchased a home for $190,000. She put $25,000 down and took out a 25-year loan

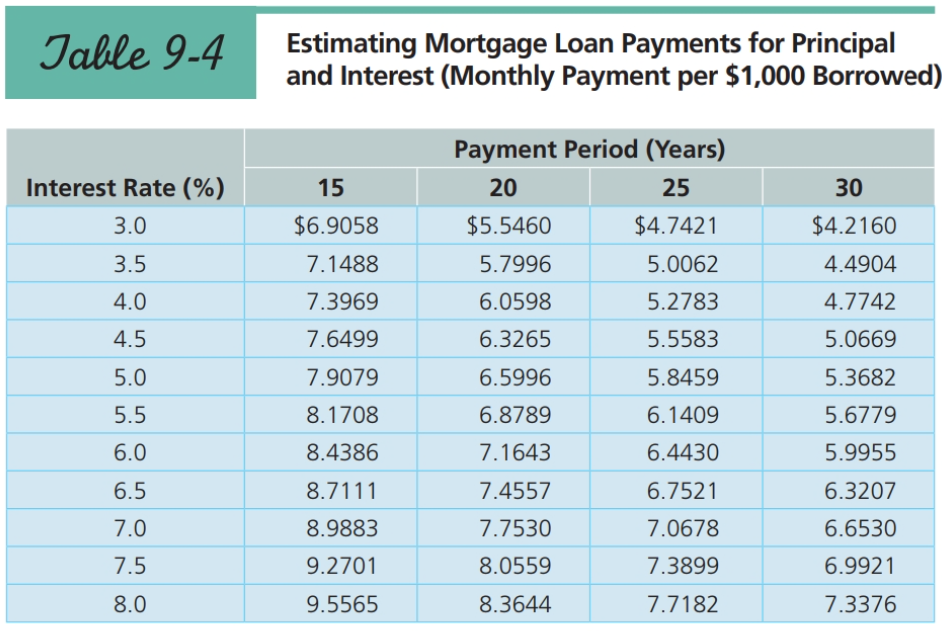

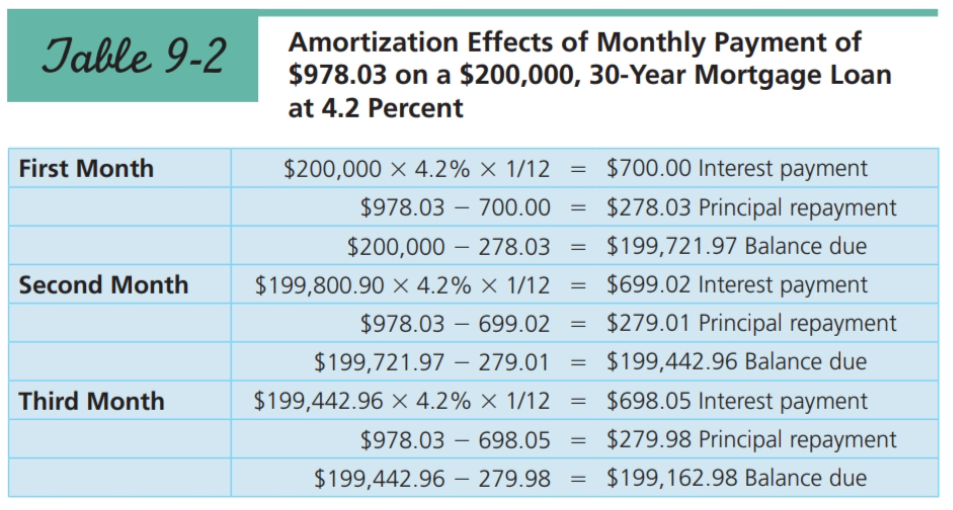

5. Illustrating Amortization. Heather McIntosh of Watertown, South Dakota, recently purchased a home for $190,000. She put $25,000 down and took out a 25-year loan at 5.5 percent interest. a. Use Table 9-4 on page 285 to determine her monthly payment.  b. How much of her first payment will go toward interest and principal and how much will she owe after that first month? c. How much will she owe after three months. Hint: Use the logic of Table 9-2 on page 283.

b. How much of her first payment will go toward interest and principal and how much will she owe after that first month? c. How much will she owe after three months. Hint: Use the logic of Table 9-2 on page 283.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started