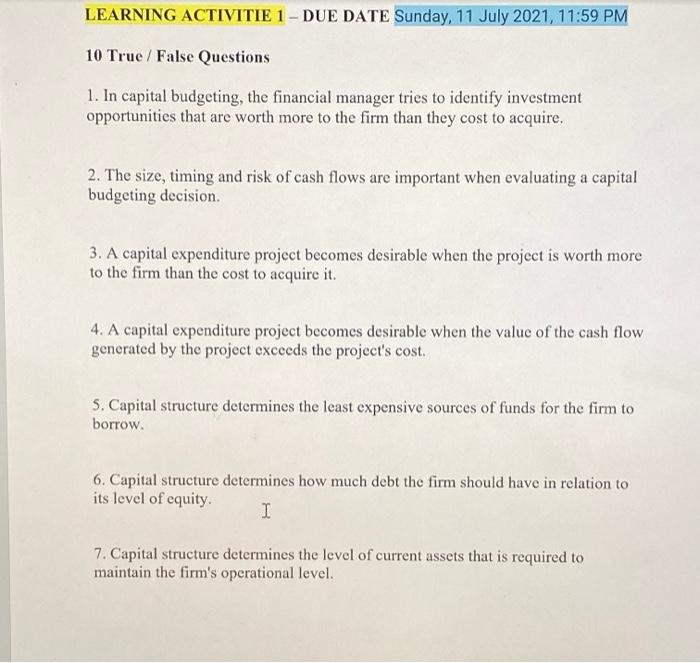

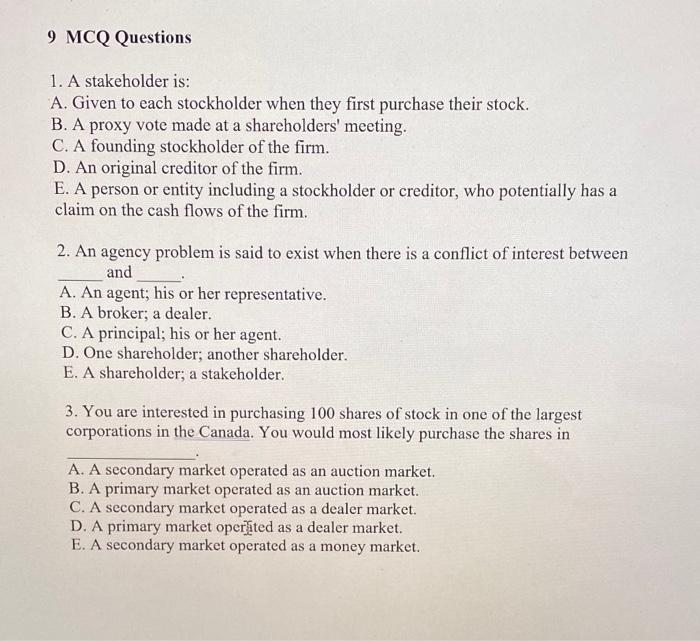

LEARNING ACTIVITIE 1 - DUE DATE Sunday, 11 July 2021, 11:59 PM 10 True / False Questions 1. In capital budgeting, the financial manager tries to identify investment opportunities that are worth more to the firm than they cost to acquire. 2. The size, timing and risk of cash flows are important when evaluating a capital budgeting decision. 3. A capital expenditure project becomes desirable when the project is worth more to the firm than the cost to acquire it. 4. A capital expenditure project becomes desirable when the value of the cash flow generated by the project exceeds the project's cost. 5. Capital structure determines the least expensive sources of funds for the firm to borrow. 6. Capital structure determines how much debt the firm should have in relation to its level of equity. I 7. Capital structure determines the level of current assets that is required to maintain the firm's operational level. 9 MCQ Questions 1. A stakeholder is: A. Given to each stockholder when they first purchase their stock. B. A proxy vote made at a shareholders' meeting. C. A founding stockholder of the firm. D. An original creditor of the firm. E. A person or entity including a stockholder or creditor, who potentially has a claim on the cash flows of the firm. 2. An agency problem is said to exist when there is a conflict of interest between and A. An agent; his or her representative. B. A broker, a dealer. C. A principal; his or her agent. D. One shareholder, another shareholder. E. A shareholder; a stakeholder. 3. You are interested in purchasing 100 shares of stock in one of the largest corporations in the Canada. You would most likely purchase the shares in A. A secondary market operated as an auction market. B. A primary market operated as an auction market. C. A secondary market operated as a dealer market. D. A primary market operated as a dealer market. E. A secondary market operated as a money market. And Singh U UNT 1 CASE NOTES WITH LEARNING ACTIVITITES QUESTIONS Den LV Helen M TAXA A ES A. ABO 4 Winch of the following account does not relates wing capitalet dece A. Ale Long term dhe C. Aceable Dvory Short-term del The peace of planning and monitors called A Working Capital Bancal depreciation y cola D. Capital beding E Capital structor 6. The mixture of any by the first A Woment B Financial depot Agency costly D. Capital bodging F.Capital 7. This process of minimo met A Working capital depec . D Di Capital E Capital de 1 The matem A. Wat B. CA D. Colch Bonus Halden CA 13 come O M MOR CK de End Po 3 $ 4 3 & 7 5 6 8