Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. In 2012, the plan purchased an annuity contract from Prudential, the effect of which was to transfer to Prudential the obligation to provide retirement

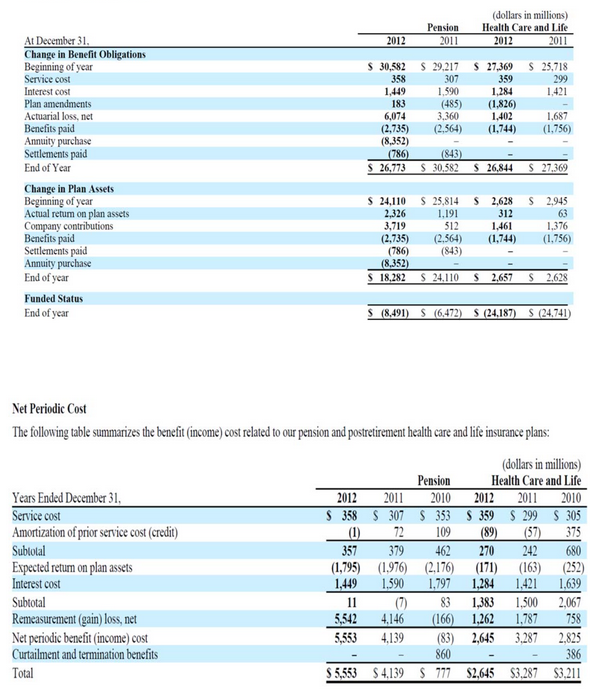

5. In 2012, the plan purchased an annuity contract from Prudential, the effect of which was to transfer to Prudential the obligation to provide retirement benefits to approximately 41,000 retirees who began receiving pensions prior to 2010. The purchase did not affect the plan assets. Going forward, how will the annuity purchase affect interest cost and service cost?

6. Moody's Investors Service called the Verizon deal a credit negative for Prudential. What do you think is the reason for Moodys concern?

(dollars in millions) Pension Health Care and Life 2011 2012 2012 At Change in Benefit obligations Beginning of year 30,582 S 29,217 S 27.369 S 25,718 Service cost 359 Interest cost 1,449 1,590 1,284 421 183 (485) (1826 Actuarial loss, net 6,074 3.360 1,402 Benefits paid (2,7350 (2,564) (,744) (1756) Annuity purchase (8,352) Settlements paid 843) End of Year 26,773 S 30,582 S 26,844 27,369 Change in Plan Assets Beginning of year S 24.110 S 25,814 S 2,628 S 2,945 Actual retum on plan assets 2,326 1,191 312 3,719 Company contributions 512 1,461 376 Benefits paid (2,7350 (2,564) (,7440 (,756) Settlements paid (786) (843) Annuity purchase 8,352 End of year S 18.282 S 24. 0 2,657 2.628 Funded Status End of year S (8,49 S (6,472) S (24,187 S (24,74 Net Periodic Cost The following table summarizes the benefit(income) cost related to our pension and postretirementhealthcare and life insurance plans: (dollars in millions) Health Care and Life Pension Years Ended December 31, 2012 201 2010 2012 2011 2010 Service cost S 358 S 307 S 353 S 359 S 299 S 305 Amortization of prior service cost (credit) (1) 72 109 (89) (57 375 Sublolal 357 379 462 270 242 680 Expected retum on plan assets (,7950 Interest cost 1,449 590 1,797 1,284 1,421 1,639 Subtotal 11 83 1383 ,500 2,067 5.542 4.146 (166 1,262 1,787 758 Remeasurement (gain) loss, net Net periodic benefit (income) cost 5.553 4,139 (83) 2,645 3287 2,825 Curtailment and termination benefits 860 Total S 5,553 $4,139 S 777 $2,645 $3.287 S3.211 (dollars in millions) Pension Health Care and Life 2011 2012 2012 At Change in Benefit obligations Beginning of year 30,582 S 29,217 S 27.369 S 25,718 Service cost 359 Interest cost 1,449 1,590 1,284 421 183 (485) (1826 Actuarial loss, net 6,074 3.360 1,402 Benefits paid (2,7350 (2,564) (,744) (1756) Annuity purchase (8,352) Settlements paid 843) End of Year 26,773 S 30,582 S 26,844 27,369 Change in Plan Assets Beginning of year S 24.110 S 25,814 S 2,628 S 2,945 Actual retum on plan assets 2,326 1,191 312 3,719 Company contributions 512 1,461 376 Benefits paid (2,7350 (2,564) (,7440 (,756) Settlements paid (786) (843) Annuity purchase 8,352 End of year S 18.282 S 24. 0 2,657 2.628 Funded Status End of year S (8,49 S (6,472) S (24,187 S (24,74 Net Periodic Cost The following table summarizes the benefit(income) cost related to our pension and postretirementhealthcare and life insurance plans: (dollars in millions) Health Care and Life Pension Years Ended December 31, 2012 201 2010 2012 2011 2010 Service cost S 358 S 307 S 353 S 359 S 299 S 305 Amortization of prior service cost (credit) (1) 72 109 (89) (57 375 Sublolal 357 379 462 270 242 680 Expected retum on plan assets (,7950 Interest cost 1,449 590 1,797 1,284 1,421 1,639 Subtotal 11 83 1383 ,500 2,067 5.542 4.146 (166 1,262 1,787 758 Remeasurement (gain) loss, net Net periodic benefit (income) cost 5.553 4,139 (83) 2,645 3287 2,825 Curtailment and termination benefits 860 Total S 5,553 $4,139 S 777 $2,645 $3.287 S3.211Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started