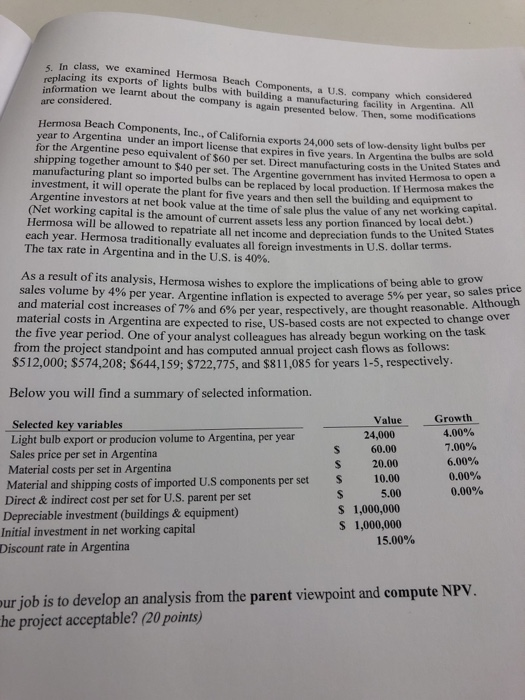

5. In class, we examined Hermosa Beach Components, a U.S. company which considered replacing its exports of lights bulbs with building a manufacturing facility in Argentina ions information we learnt about the company is again presented below. Then, some modithen are considered. All Hermosa Beach Components, Inc,, of California exports 24,000 sets of low-density ligh ba are sold year to Argentina under an import license that expires in five years. In Argentina for the Argentine peso equivalent of $60 per set. Direct manufacturing costs in the Unitea to open shipping together amount to $40 per set. The Argentine government the bulbs are sold manufacturing plant so imported bulbs can be replaced by local production. If Hermoss has invited Hermosa to open a investment, it will operate the plant for five years and then sell the building and equipmen makes the Argentine investors at net book value at the time of sale plus the value of any net wo t to (Net working capital is the amount of current assets less any portion financed by o tnited States Hermosa will be allowed to repatriate all net income and depreciation funds to t local debt.) each year. Hermosa traditionally evaluates all foreign investments in U.S. doliar the United States The tax rte in Argentina and in the U.S. s 40%. terms. As a result of its analysis, Hermosa wishes to explore the implications of being able to grow sales volume by 4% per year. Argentine inflation is expected to average 5%, per year, so sales price per year, respectively, are thought reasonable. Although and material cost increases of 7% and 6% material costs in Argentina are expected to rise, US-based the five year period. One of your analyst colleagues has already begun working on the task from the project standpoint and has computed annual project cash flows as follows: $512,000; $574,208; $644,159; $722,775, and $811,085 for years 1-5, respectively. costs are not expected to change over Below you will find a summary of selected information. Growth Value o8 24,000 Selected key variables Light bulb export or producion volume to Argentina, per year Sales price per set in Argentina Material costs per set in Argentina Material and shipping costs of imported U.S components per set Direct & indirect cost per set for U.S. parent per set 4.00% 7.00% 6.00% 0.00% 0.00% 60.00 20.00 s 10.00 Depreciable investment (buildings & equipment) Initial investment in net working capital Discount rate in Argentina 5.00 S 1,000,000 S 1,000,000 15.00% ur job is to develop an analysis from the parent viewpoint and compute NPV. he project acceptable? (20 points)