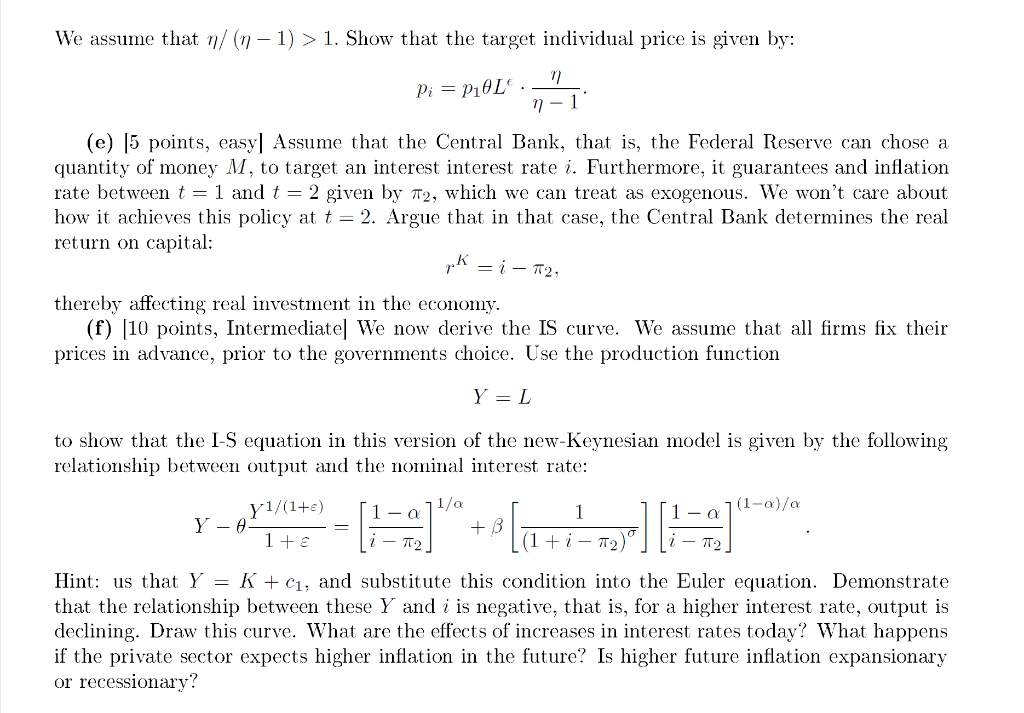

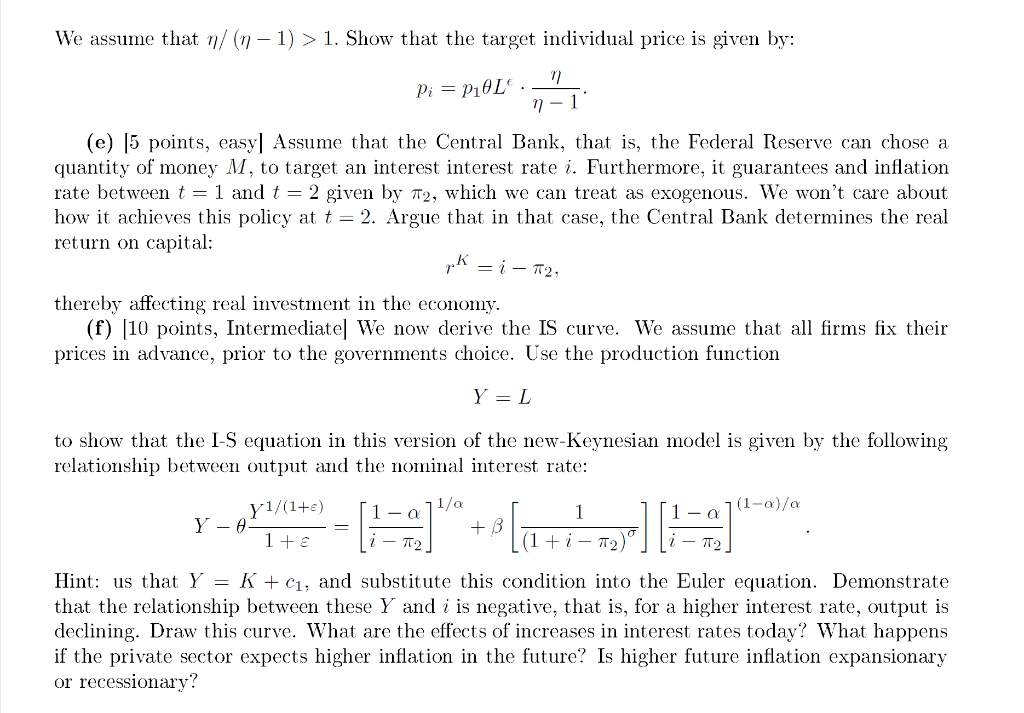

5. IS-LM model and the value of Commitment (30 Points) This question will help you understand the IS-LM model in great detail. We derive the IS-LM model. There is a single household that is alive for two periods: 1-o OL+ 1. Show that the target individual price is given by: 77 Pi = P0L. (e) [5 points, easy] Assume that the Central Bank, that is, the Federal Reserve can chose a quantity of money M, to target an interest interest rate i. Furthermore, it guarantees and inflation rate between t = 1 and t = 2 given by 72, which we can treat as exogenous. We won't care about how it achieves this policy at t = 2. Argue that in that case, the Central Bank determines the real return on capital: =i = , thereby affecting real investment in the economy. (f) [10 points, Intermediate] We now derive the IS curve. We assume that all firms fix their prices in advance, prior to the governments choice. Use the production function Y = L to show that the I-S equation in this version of the new-Keynesian model is given by the following relationship between output and the nominal interest rate: 1/a 7 (1-x)/x 1 Y-0- Y1/(1+e) 1 + + B 72 (1 + i - ) Hint: us that Y = K + c, and substitute this condition into the Euler equation. Demonstrate that the relationship between these Y and i is negative, that is, for a higher interest rate, output is declining. Draw this curve. What are the effects of increases in interest rates today? What happens if the private sector expects higher inflation in the future? Is higher future inflation expansionary or recessionary? 5. IS-LM model and the value of Commitment (30 Points) This question will help you understand the IS-LM model in great detail. We derive the IS-LM model. There is a single household that is alive for two periods: 1-o OL+ 1. Show that the target individual price is given by: 77 Pi = P0L. (e) [5 points, easy] Assume that the Central Bank, that is, the Federal Reserve can chose a quantity of money M, to target an interest interest rate i. Furthermore, it guarantees and inflation rate between t = 1 and t = 2 given by 72, which we can treat as exogenous. We won't care about how it achieves this policy at t = 2. Argue that in that case, the Central Bank determines the real return on capital: =i = , thereby affecting real investment in the economy. (f) [10 points, Intermediate] We now derive the IS curve. We assume that all firms fix their prices in advance, prior to the governments choice. Use the production function Y = L to show that the I-S equation in this version of the new-Keynesian model is given by the following relationship between output and the nominal interest rate: 1/a 7 (1-x)/x 1 Y-0- Y1/(1+e) 1 + + B 72 (1 + i - ) Hint: us that Y = K + c, and substitute this condition into the Euler equation. Demonstrate that the relationship between these Y and i is negative, that is, for a higher interest rate, output is declining. Draw this curve. What are the effects of increases in interest rates today? What happens if the private sector expects higher inflation in the future? Is higher future inflation expansionary or recessionary