Answered step by step

Verified Expert Solution

Question

1 Approved Answer

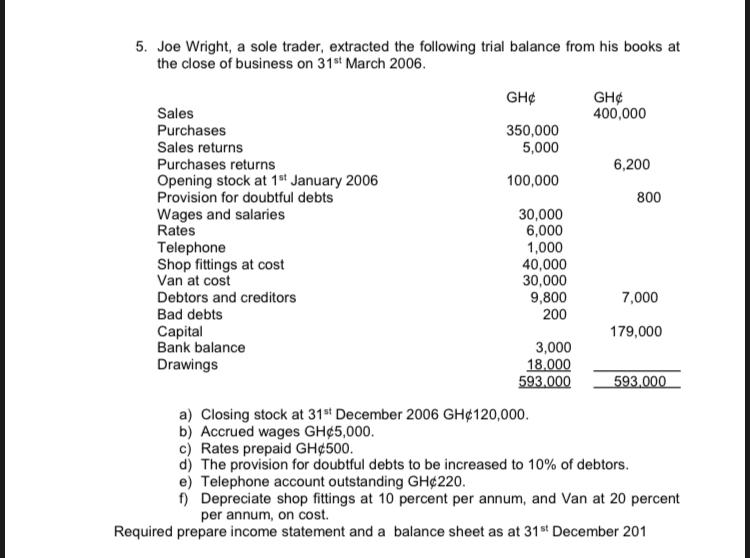

5. Joe Wright, a sole trader, extracted the following trial balance from his books at the close of business on 31st March 2006. GH

5. Joe Wright, a sole trader, extracted the following trial balance from his books at the close of business on 31st March 2006. GH GH 400,000 Sales Purchases 350,000 5,000 Sales returns Purchases returns Opening stock at 1 January 2006 Provision for doubtful debts Wages and salaries Rates Telephone Shop fittings at cost Van at cost 6,200 100,000 800 30,000 6,000 1,000 40,000 30,000 9,800 Debtors and creditors 7,000 Bad debts Capital Bank balance Drawings 200 179,000 3,000 18.000 593.000 593.000 a) Closing stock at 31st December 2006 GH120,000. b) Accrued wages GH5,000. c) Rates prepaid GH500. d) The provision for doubtful debts to be increased to 10% of debtors. e) Telephone account outstanding GH220. f) Depreciate shop fittings at 10 percent per annum, and Van at 20 percent per annum, on cost. Required prepare income statement and a balance sheet as at 31st December 201

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer INCOME STATEMENT Revenue Sales Revenue 400000 Less Sales return 5000 Net Sales Revenue 395000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started