Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. Keep 100 percent of business interests in the family. GOALS: PREPARE A PROPER ESTATE PLAN 1. Minimize estate 2. Fund college education for the

5. Keep 100 percent of business interests in the family.

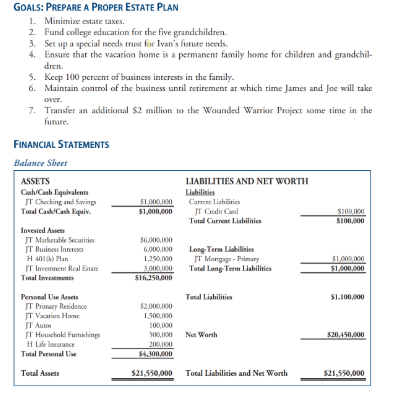

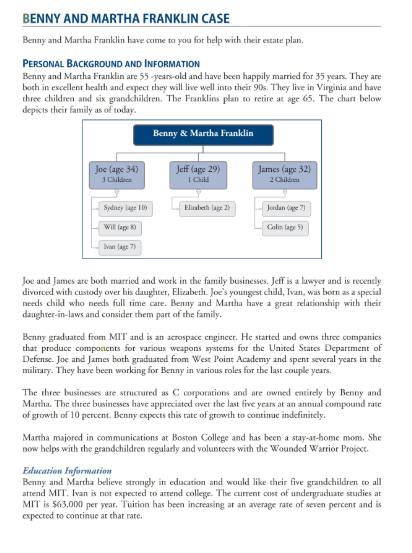

GOALS: PREPARE A PROPER ESTATE PLAN 1. Minimize estate 2. Fund college education for the five grandchildren. 3. Set up a special needs trust for Ivan's future needs. 4. Ensure that the vacation home is a permanent family home for children and grandchil dren 5. Keep 100 percent of business interests in the family. 6. Maintain control of the business until retirement at which time James and Joe will take over. 7. Transfer an additional $2 million to the Wounded Warrior Project some time in the future FINANCIAL STATEMENTS Balance Sheet ASSETS Cash Cash Equivalents IT Checking and Swing Total Cacahui $100,000 $1,000,000 LIABILITIES AND NET WORTH Liabilities Cum liahilities IT Credit Card Total Current Liabilities Invested Act JT Market Securities IT Business Interese H4015) Man IT in Real Estate Talle $600.000 6.000.000 1.250,000 3.000.000 S162500D Long Term L ilities IT Morge Primary Total Long-Term Liabilities $1.000000 $1.000.000 Toual Liabilities SL.100.000 $200000 1.500.000 Penal Us IT Primary Residence IT Van Home ITA TT HP HLE Total P al Net Worth 500.000 200.000 Tous $21.550,000 Total Liabilities and Net Worth BENNY AND MARTHA FRANKLIN CASE Benny and Martha Franklin have come to you for help with their estate plan. PERSONAL BACKGROUND AND INFORMATION Benny and Martha Franklin are 55 years old and have been happily married for 35 years. They are boch in excellent health and expect they will live well into their 90s. They live in Virginia and have three children and six grandchildren. The Franklins plan to retire at age 65. The chart below depicts their family as of today. Benny & Martha Franklin loc (age 3) Clic Jeff (age 29) I Child James (age 32 Sydney 100 Elizabeth Cage 2) Willage Colin ay 5) Joe and James are both married and work in the family businesses. Jeff is a lawyer and is recently divorced with custody over his daughter, ElizabethJoe's youngest child, Ivan, was born as a special needs child who needs full time care. Benny and Martha have a great relationship with their daughter-in-laws and consider them part of the family. Benny graduated from MIT and is an acrospace engineer. He started and owns three companies that produce components for various weapons systems for the United States Department of Defense Joe and James both graduated from West Point Academy and spent several years in the military. They have been working for Benny in various roles for the last couple years. The three businesses are structured as C corporations and are owned entirely by Benny and Martha. The three businesses have appreciated over the last five years at an annual compound rate of growth of 10 percent. Benny expects this rate of growth to continue indefinitely Martha majored in communications at Boston College and has been a stay-at-home mom. She now helps with the grandchildren regularly and volunteers with the Wounded Warrior Project Education Information Benny and Martha believe strongly in education and would like their five grandchildren to all attend MIT. Ivan is not expected to attend college. The current cost of undergraduate studies at MIT is $63,000 per year. Tuition has been increasing at an average rate of seven percent and is expected to continue at that rate. GOALS: PREPARE A PROPER ESTATE PLAN 1. Minimize estate 2. Fund college education for the five grandchildren. 3. Set up a special needs trust for Ivan's future needs. 4. Ensure that the vacation home is a permanent family home for children and grandchil dren 5. Keep 100 percent of business interests in the family. 6. Maintain control of the business until retirement at which time James and Joe will take over. 7. Transfer an additional $2 million to the Wounded Warrior Project some time in the future FINANCIAL STATEMENTS Balance Sheet ASSETS Cash Cash Equivalents IT Checking and Swing Total Cacahui $100,000 $1,000,000 LIABILITIES AND NET WORTH Liabilities Cum liahilities IT Credit Card Total Current Liabilities Invested Act JT Market Securities IT Business Interese H4015) Man IT in Real Estate Talle $600.000 6.000.000 1.250,000 3.000.000 S162500D Long Term L ilities IT Morge Primary Total Long-Term Liabilities $1.000000 $1.000.000 Toual Liabilities SL.100.000 $200000 1.500.000 Penal Us IT Primary Residence IT Van Home ITA TT HP HLE Total P al Net Worth 500.000 200.000 Tous $21.550,000 Total Liabilities and Net Worth BENNY AND MARTHA FRANKLIN CASE Benny and Martha Franklin have come to you for help with their estate plan. PERSONAL BACKGROUND AND INFORMATION Benny and Martha Franklin are 55 years old and have been happily married for 35 years. They are boch in excellent health and expect they will live well into their 90s. They live in Virginia and have three children and six grandchildren. The Franklins plan to retire at age 65. The chart below depicts their family as of today. Benny & Martha Franklin loc (age 3) Clic Jeff (age 29) I Child James (age 32 Sydney 100 Elizabeth Cage 2) Willage Colin ay 5) Joe and James are both married and work in the family businesses. Jeff is a lawyer and is recently divorced with custody over his daughter, ElizabethJoe's youngest child, Ivan, was born as a special needs child who needs full time care. Benny and Martha have a great relationship with their daughter-in-laws and consider them part of the family. Benny graduated from MIT and is an acrospace engineer. He started and owns three companies that produce components for various weapons systems for the United States Department of Defense Joe and James both graduated from West Point Academy and spent several years in the military. They have been working for Benny in various roles for the last couple years. The three businesses are structured as C corporations and are owned entirely by Benny and Martha. The three businesses have appreciated over the last five years at an annual compound rate of growth of 10 percent. Benny expects this rate of growth to continue indefinitely Martha majored in communications at Boston College and has been a stay-at-home mom. She now helps with the grandchildren regularly and volunteers with the Wounded Warrior Project Education Information Benny and Martha believe strongly in education and would like their five grandchildren to all attend MIT. Ivan is not expected to attend college. The current cost of undergraduate studies at MIT is $63,000 per year. Tuition has been increasing at an average rate of seven percent and is expected to continue at that rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started