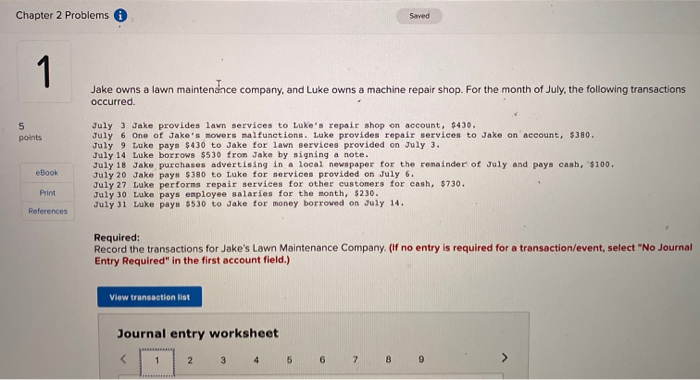

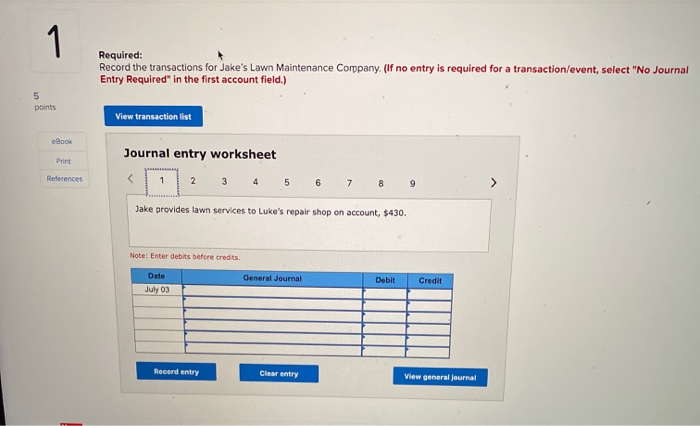

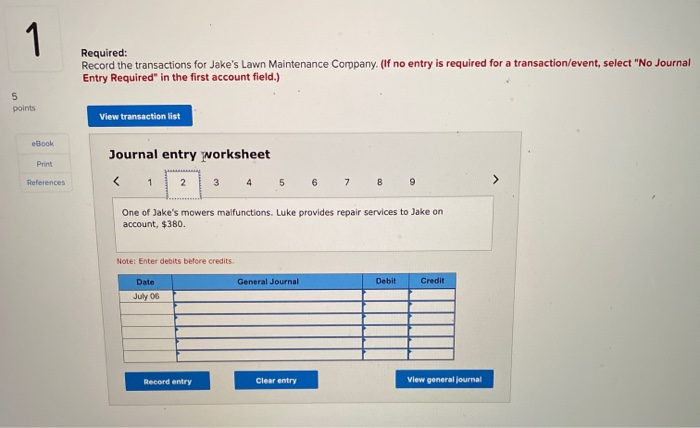

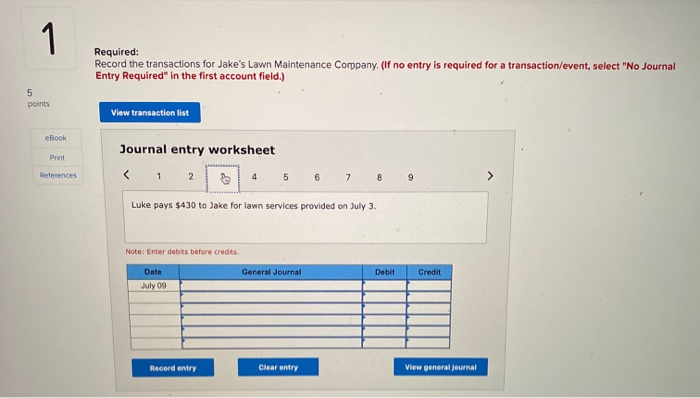

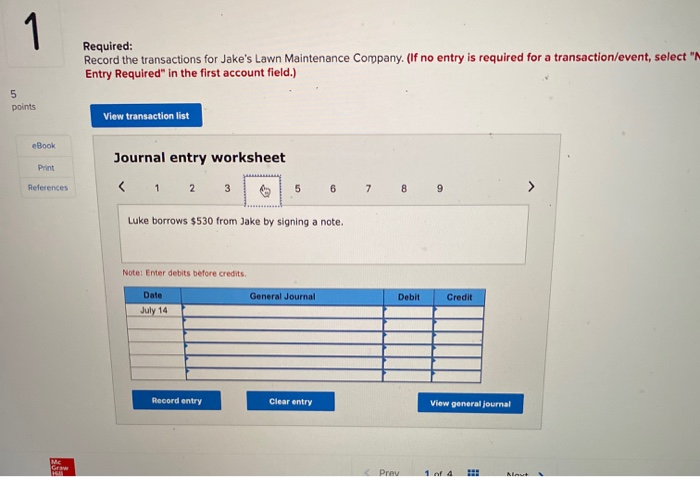

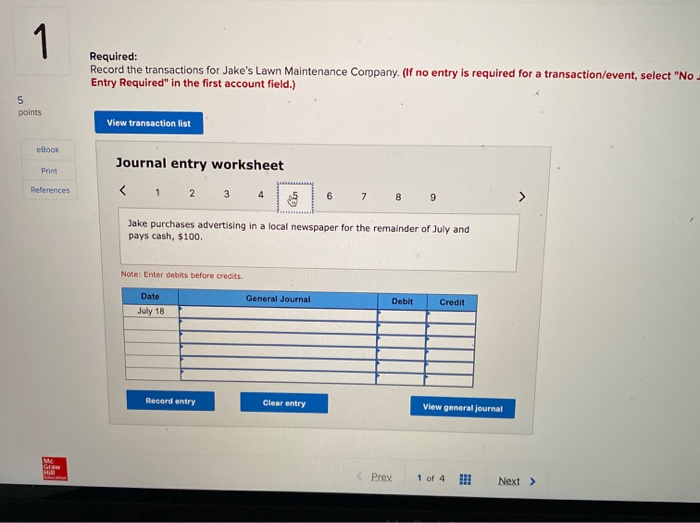

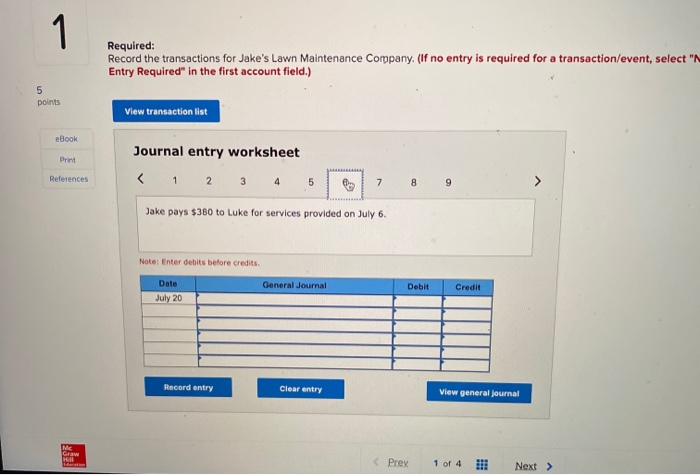

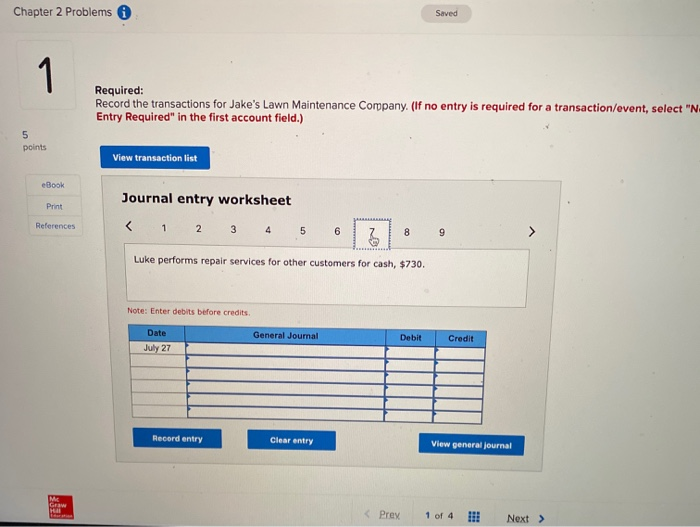

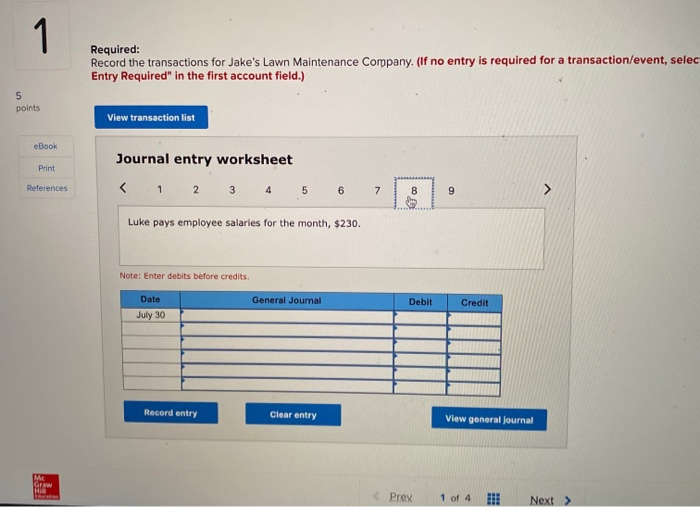

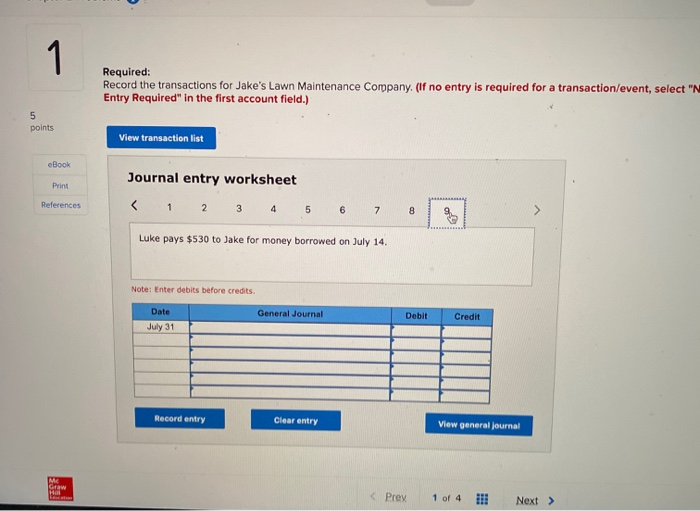

Chapter 2 Problems Saved 1 Jake owns a lawn maintenance company, and Luke owns a machine repair shop. For the month of July, the following transactions occurred. 5 points July 3 Jake provides lawn services to Luke's repair shop on account, $430. July 6 One of Jake's movers malfunctions. Luke provides repair services to Jake on account, $380. July 9 Luke pays $430 to Jake for lawn services provided on July 3. July 14 Luke borrows $530 from Jake by signing a note. July 18 Jake purchases advertising in a local newspaper for the remainder of July and pays cash, $100. July 20 Jake pays $380 to Luke for services provided on July 6. July 27 Luke performs repair services for other customers for cash, $730. July 30 Luke pays employee salaries for the month, $230. July 31 Luke pays $530 to Jake for money borrowed on July 14. eBook Print References Required: Record the transactions for Jake's Lawn Maintenance Company. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 2 4 5 6 7 8 9 1 Required: Record the transactions for Jake's Lawn Maintenance Company. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) 5 points View transaction list eBook Journal entry worksheet Print References 1 2 3 4 5 6 7 8 9 > Jake provides lawn services to Luke's repair shop on account, $430. Note: Enter debits before credits General Journal Debit Date July 03 Credit Record entry Clear entry View general Journal 1 Required: Record the transactions for Jake's Lawn Maintenance Company. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) 5 points View transaction list eBook Journal entry worksheet Print References 1 2 3 4 5 6 7 B > One of Jake's mowers malfunctions. Luke provides repair services to Jake on account, $380. Note: Enter debits before credits General Journal Debit Credit Date July 06 Record entry Clear entry View general Journal 1 Required: Record the transactions for Jake's Lawn Maintenance Company. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) 5 points View transaction list eBook Print Journal entry worksheet Luke pays $430 to Jake for lawn services provided on July 3. Note: Enter debits before credits General Journal Debit Credit Date July 09 Record entry Clear entry View general Journal 1 Required: Record the transactions for Jake's Lawn Maintenance Company. (If no entry is required for a transaction/event, select " Entry Required" in the first account field.) 5 points View transaction list eBook Journal entry worksheet Print References 3 5 6 7 Luke borrows $530 from Jake by signing a note. Note: Enter debits before credits Date General Journal Debit Credit July 14 Record entry Clear entry View general journal ME GE Preu 1 of 4 Naut 1 Required: Record the transactions for Jake's Lawn Maintenance Company. (If no entry is required for a transaction/event, select "No. Entry Required" in the first account field.) 5 points View transaction list eBook Journal entry worksheet Print References 1 Required: Record the transactions for Jake's Lawn Maintenance Company. (If no entry is required for a transaction/event, select "N Entry Required" in the first account field.) 5 points View transaction list eBook Print Journal entry worksheet Chapter 2 Problems Saved 1 Required: Record the transactions for Jake's Lawn Maintenance Company. (If no entry is required for a transaction/event, select "N- Entry Required" in the first account field.) 5 points View transaction list eBook Journal entry worksheet Print References 2 3 4 5 6 ND 8 9 Luke performs repair services for other customers for cash, $730. Note: Enter debits before credits General Journal Date July 27 Debit Credit Record entry Clear entry View general Journal ME GW HI Prey 1 of 4 !!! Next > 1 Required: Record the transactions for Jake's Lawn Maintenance Company. (If no entry is required for a transaction/event, selec Entry Required" in the first account field.) 5 points View transaction list eBook Print Journal entry worksheet Luke pays employee salaries for the month, $230. Note: Enter debits before credits. General Journal Debit Credit Date July 30 Record entry Clear entry View general Journal ME Graw HA Prey 1 of 4 Next > 1 Required: Record the transactions for Jake's Lawn Maintenance Company. (If no entry is required for a transaction/event, select "N Entry Required" in the first account field.) 5 points View transaction list eBook Print References Journal entry worksheet