Question: 5. MO Ltd. is considering a five-year project to expand its production efficiency. Building a new plant for $1,000,000 at the beginning of the project

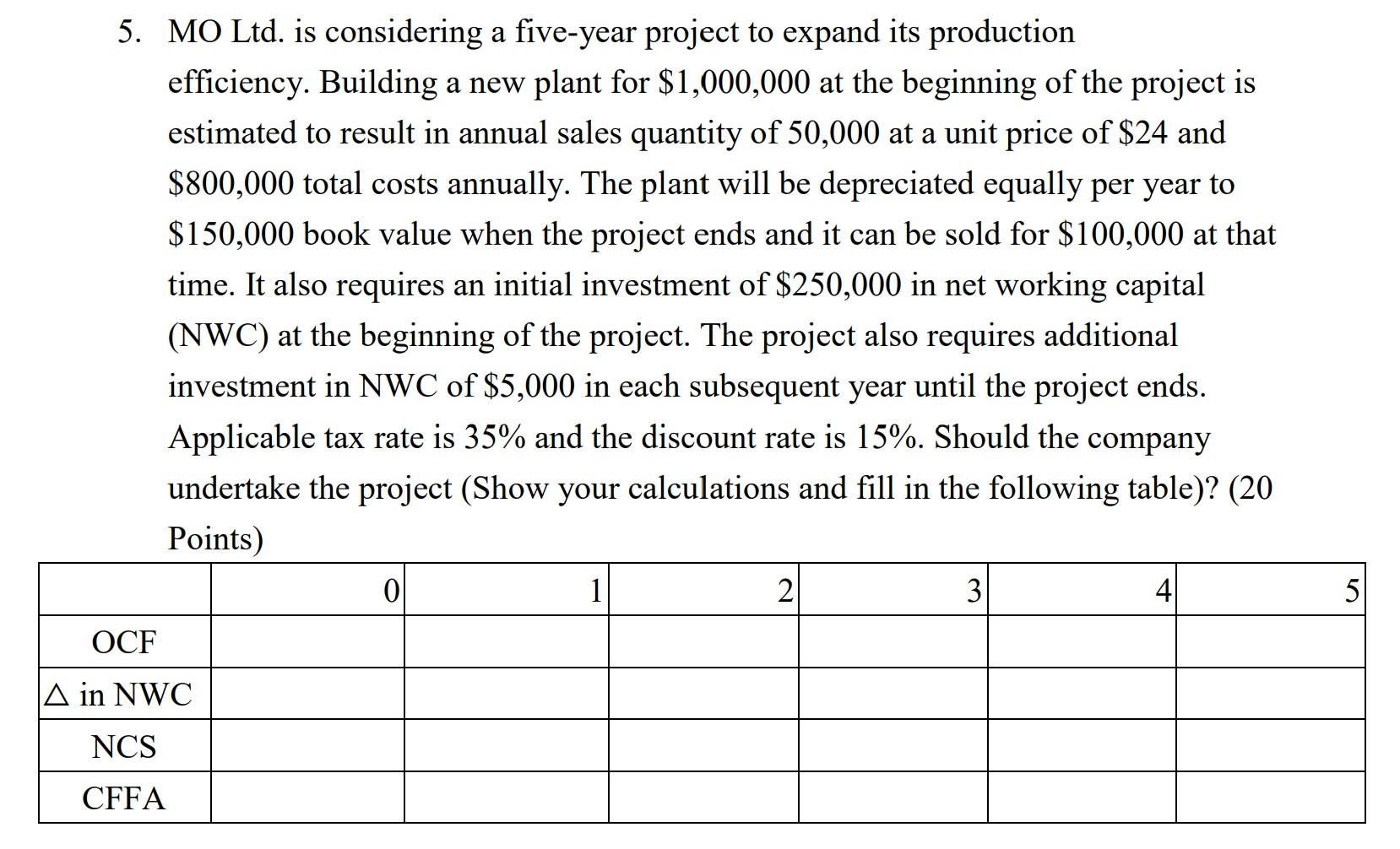

5. MO Ltd. is considering a five-year project to expand its production efficiency. Building a new plant for $1,000,000 at the beginning of the project is estimated to result in annual sales quantity of 50,000 at a unit price of $24 and $800,000 total costs annually. The plant will be depreciated equally per year to $150,000 book value when the project ends and it can be sold for $100,000 at that time. It also requires an initial investment of $250,000 in net working capital (NWC) at the beginning of the project. The project also requires additional investment in NWC of $5,000 in each subsequent year until the project ends. Applicable tax rate is 35% and the discount rate is 15%. Should the company undertake the project (Show your calculations and fill in the following table)? (20 Points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts