Question

5. Mr. Forthcoming will only use the ITA 85 provisions to transfer a specific asset if there is a tax advantage in doing so. 6.

5. Mr. Forthcoming will only use the ITA 85 provisions to transfer a specific asset if there is a tax advantage in doing so.

6. On October 1, 2021, Mr. Forthcoming sells the shares that he received in this rollover for $208,000. Forthcoming Inc. is a qualified small business corporation. Mr. Forthcoming has never used his lifetime capital gains deduction and he has no Cumulative Net Investment Loss

Required:

A. Determine if it is possible to elect under section 85 (i.e. are the conditions for S85 met?)

B. Advise Mr. Forthcoming with respect to which assets should be transferred under the provisions of ITA 85(1), and the values that should be elected in order to minimize his current Tax Payable. Indicate the appropriate alternative treatment for any assets that you do not recommend transferring with the use of ITA 85(1).

C. Assume that Mr. Forthcoming only uses ITA 85(1) for those assets you have indicated should be transferred under this provision. What are the PUC and ACB of the shares received by Mr. Forthcoming?

D. Calculate Mr. Forthcoming’s taxable capital gain on the sale of the shares and indicate the effect of the current year sale of shares on his Taxable Income.

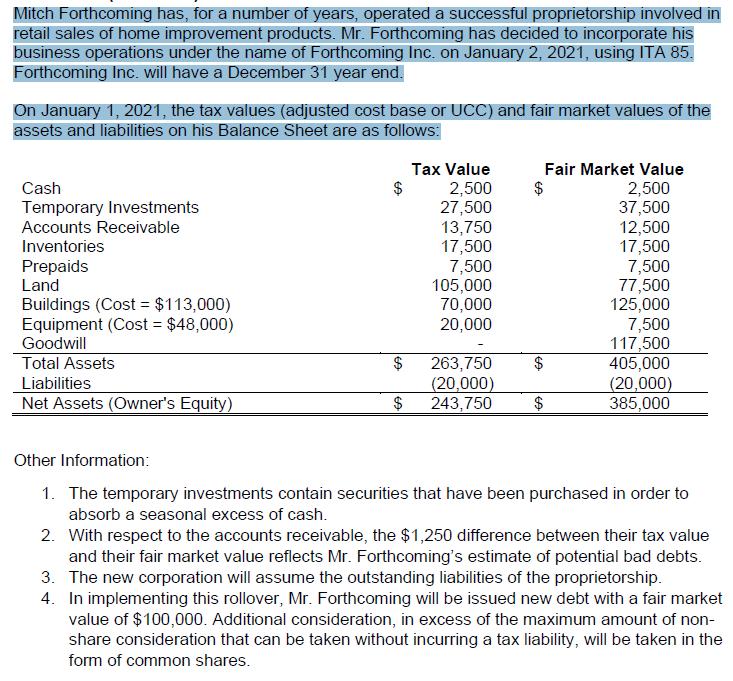

Mitch Forthcoming has, for a number of years, operated a successful proprietorship involved in retail sales of home improvement products. Mr. Forthcoming has decided to incorporate his business operations under the name of Forthcoming Inc. on January 2, 2021, using ITA 85. Forthcoming Inc. will have a December 31 year end. On January 1, 2021, the tax values (adjusted cost base or UCC) and fair market values of the assets and liabilities on his Balance Sheet are as follows: Cash Temporary Investments Accounts Receivable Inventories Prepaids Land Buildings (Cost = $113,000) Equipment (Cost = $48,000) Goodwill Total Assets Liabilities Net Assets (Owner's Equity) $ $ Tax Value 2,500 27,500 13,750 17,500 7,500 105,000 70,000 20,000 263,750 (20,000) 243,750 Fair Market Value $ 2,500 37,500 $ 12,500 17,500 7,500 77,500 125,000 7,500 117,500 405,000 (20,000) 385,000 Other Information: 1. The temporary investments contain securities that have been purchased in order to absorb a seasonal excess of cash. 2. With respect to the accounts receivable, the $1,250 difference between their tax value and their fair market value reflects Mr. Forthcoming's estimate of potential bad debts. 3. The new corporation will assume the outstanding liabilities of the proprietorship. 4. In implementing this rollover, Mr. Forthcoming will be issued new debt with a fair market value of $100,000. Additional consideration, in excess of the maximum amount of non- share consideration that can be taken without incurring a tax liability, will be taken in the form of common shares. Mitch Forthcoming has, for a number of years, operated a successful proprietorship involved in retail sales of home improvement products. Mr. Forthcoming has decided to incorporate his business operations under the name of Forthcoming Inc. on January 2, 2021, using ITA 85. Forthcoming Inc. will have a December 31 year end. On January 1, 2021, the tax values (adjusted cost base or UCC) and fair market values of the assets and liabilities on his Balance Sheet are as follows: Cash Temporary Investments Accounts Receivable Inventories Prepaids Land Buildings (Cost = $113,000) Equipment (Cost = $48,000) Goodwill Total Assets Liabilities Net Assets (Owner's Equity) $ $ Tax Value 2,500 27,500 13,750 17,500 7,500 105,000 70,000 20,000 263,750 (20,000) 243,750 Fair Market Value $ 2,500 37,500 $ 12,500 17,500 7,500 77,500 125,000 7,500 117,500 405,000 (20,000) 385,000 Other Information: 1. The temporary investments contain securities that have been purchased in order to absorb a seasonal excess of cash. 2. With respect to the accounts receivable, the $1,250 difference between their tax value and their fair market value reflects Mr. Forthcoming's estimate of potential bad debts. 3. The new corporation will assume the outstanding liabilities of the proprietorship. 4. In implementing this rollover, Mr. Forthcoming will be issued new debt with a fair market value of $100,000. Additional consideration, in excess of the maximum amount of non- share consideration that can be taken without incurring a tax liability, will be taken in the form of common shares.

Step by Step Solution

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

A Yes it is possible to elect under section 85 The conditions for S85 are met because ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started