Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5 On 1 April 2020 , Cheery Berhad purchased 100,000 equity shares securities at a cost of RM5 per share. When the securities were purchased,

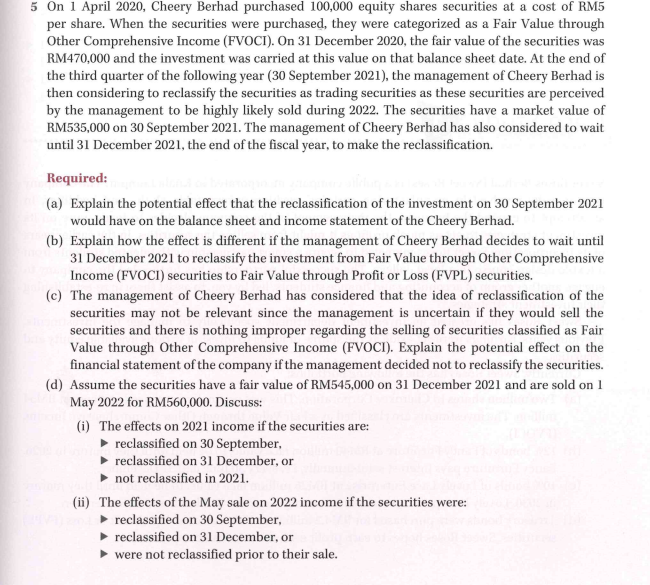

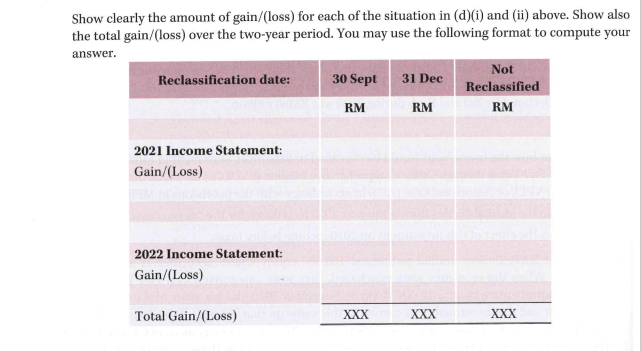

5 On 1 April 2020 , Cheery Berhad purchased 100,000 equity shares securities at a cost of RM5 per share. When the securities were purchased, they were categorized as a Fair Value through Other Comprehensive Income (FVOCI). On 31 December 2020, the fair value of the securities was RM470,000 and the investment was carried at this value on that balance sheet date. At the end of the third quarter of the following year (30 September 2021), the management of Cheery Berhad is then considering to reclassify the securities as trading securities as these securities are perceived by the management to be highly likely sold during 2022 . The securities have a market value of RM535,000 on 30 September 2021. The management of Cheery Berhad has also considered to wait until 31 December 2021, the end of the fiscal year, to make the reclassification. Required: (a) Explain the potential effect that the reclassification of the investment on 30 September 2021 would have on the balance sheet and income statement of the Cheery Berhad. (b) Explain how the effect is different if the management of Cheery Berhad decides to wait until 31 December 2021 to reclassify the investment from Fair Value through Other Comprehensive Income (FVOCI) securities to Fair Value through Profit or Loss (FVPL) securities. (c) The management of Cheery Berhad has considered that the idea of reclassification of the securities may not be relevant since the management is uncertain if they would sell the securities and there is nothing improper regarding the selling of securities classified as Fair Value through Other Comprehensive Income (FVOCI). Explain the potential effect on the financial statement of the company if the management decided not to reclassify the securities. (d) Assume the securities have a fair value of RM545,000 on 31 December 2021 and are sold on 1 May 2022 for RM560,000. Discuss: (i) The effects on 2021 income if the securities are: - reclassified on 30 September, - reclassified on 31 December, or - not reclassified in 2021. (ii) The effects of the May sale on 2022 income if the securities were: - reclassified on 30 September, - reclassified on 31 December, or - were not reclassified prior to their sale. Show clearly the amount of gain/(loss) for each of the situation in (d)(i) and (ii) above. Show also he total gain/(loss) over the two-year period. You may use the following format to compute your

5 On 1 April 2020 , Cheery Berhad purchased 100,000 equity shares securities at a cost of RM5 per share. When the securities were purchased, they were categorized as a Fair Value through Other Comprehensive Income (FVOCI). On 31 December 2020, the fair value of the securities was RM470,000 and the investment was carried at this value on that balance sheet date. At the end of the third quarter of the following year (30 September 2021), the management of Cheery Berhad is then considering to reclassify the securities as trading securities as these securities are perceived by the management to be highly likely sold during 2022 . The securities have a market value of RM535,000 on 30 September 2021. The management of Cheery Berhad has also considered to wait until 31 December 2021, the end of the fiscal year, to make the reclassification. Required: (a) Explain the potential effect that the reclassification of the investment on 30 September 2021 would have on the balance sheet and income statement of the Cheery Berhad. (b) Explain how the effect is different if the management of Cheery Berhad decides to wait until 31 December 2021 to reclassify the investment from Fair Value through Other Comprehensive Income (FVOCI) securities to Fair Value through Profit or Loss (FVPL) securities. (c) The management of Cheery Berhad has considered that the idea of reclassification of the securities may not be relevant since the management is uncertain if they would sell the securities and there is nothing improper regarding the selling of securities classified as Fair Value through Other Comprehensive Income (FVOCI). Explain the potential effect on the financial statement of the company if the management decided not to reclassify the securities. (d) Assume the securities have a fair value of RM545,000 on 31 December 2021 and are sold on 1 May 2022 for RM560,000. Discuss: (i) The effects on 2021 income if the securities are: - reclassified on 30 September, - reclassified on 31 December, or - not reclassified in 2021. (ii) The effects of the May sale on 2022 income if the securities were: - reclassified on 30 September, - reclassified on 31 December, or - were not reclassified prior to their sale. Show clearly the amount of gain/(loss) for each of the situation in (d)(i) and (ii) above. Show also he total gain/(loss) over the two-year period. You may use the following format to compute your Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started