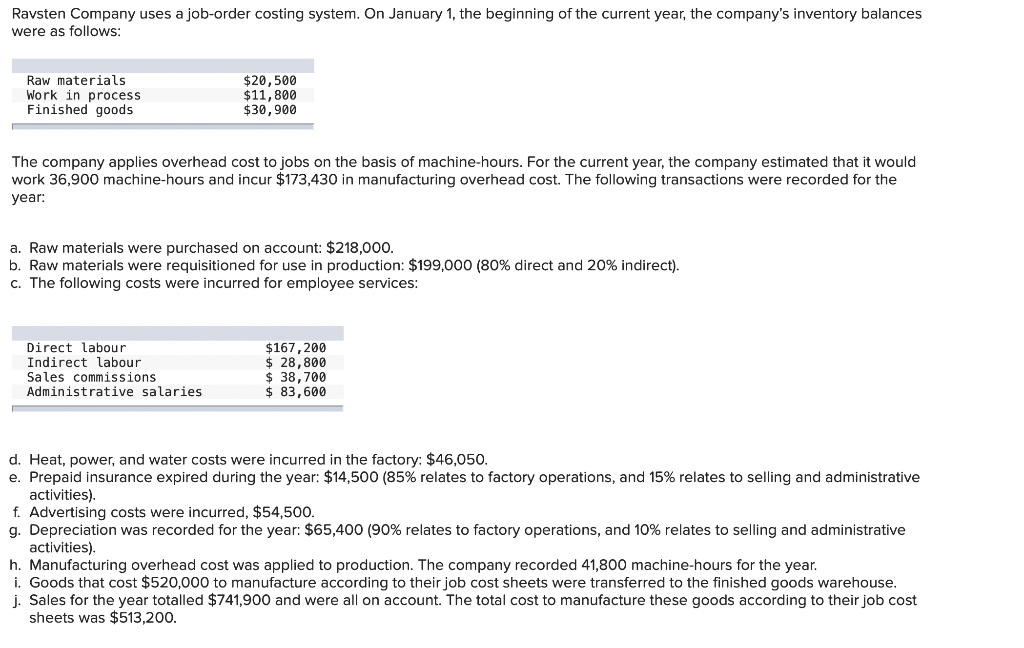

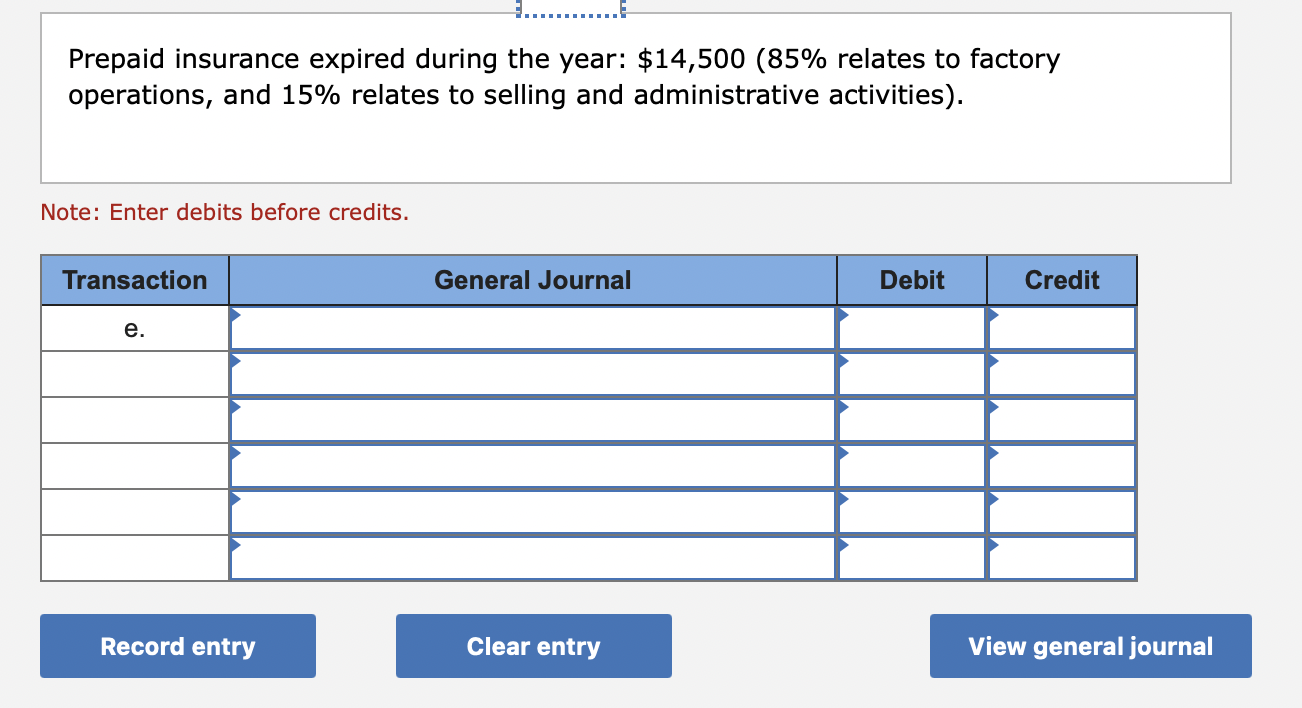

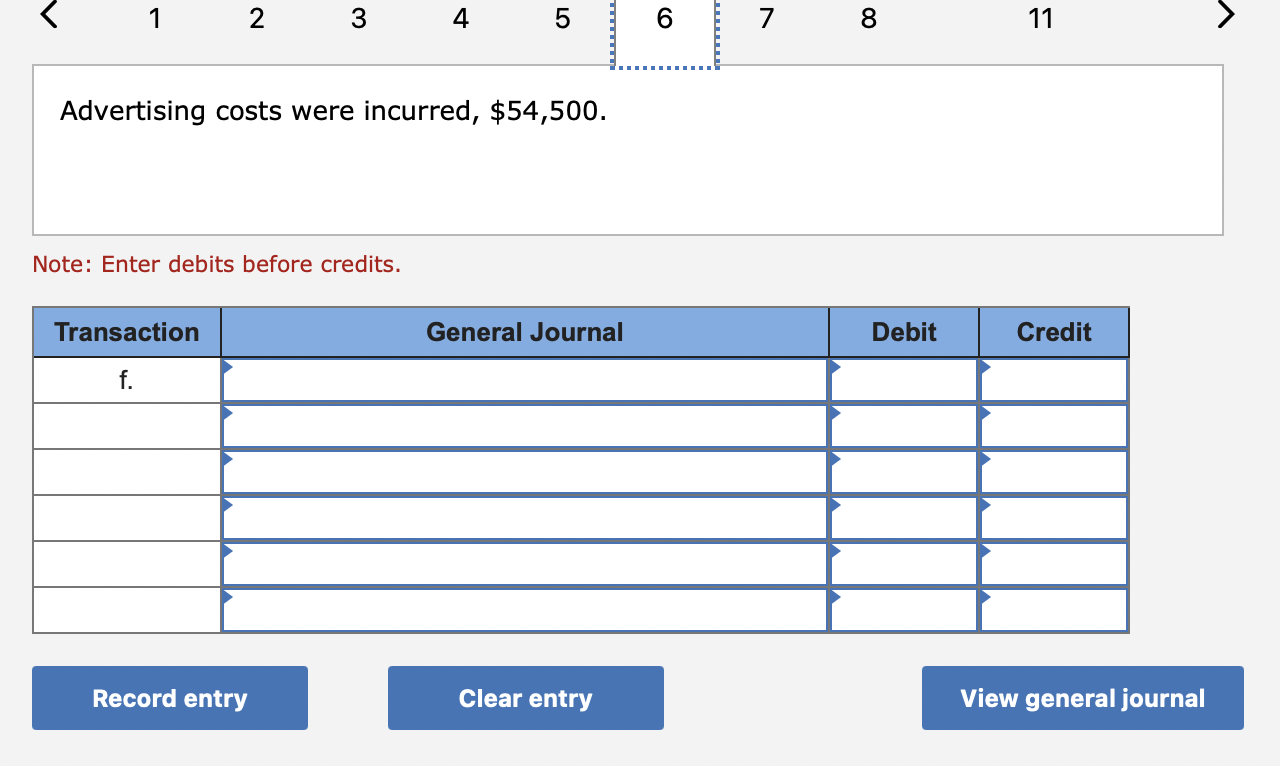

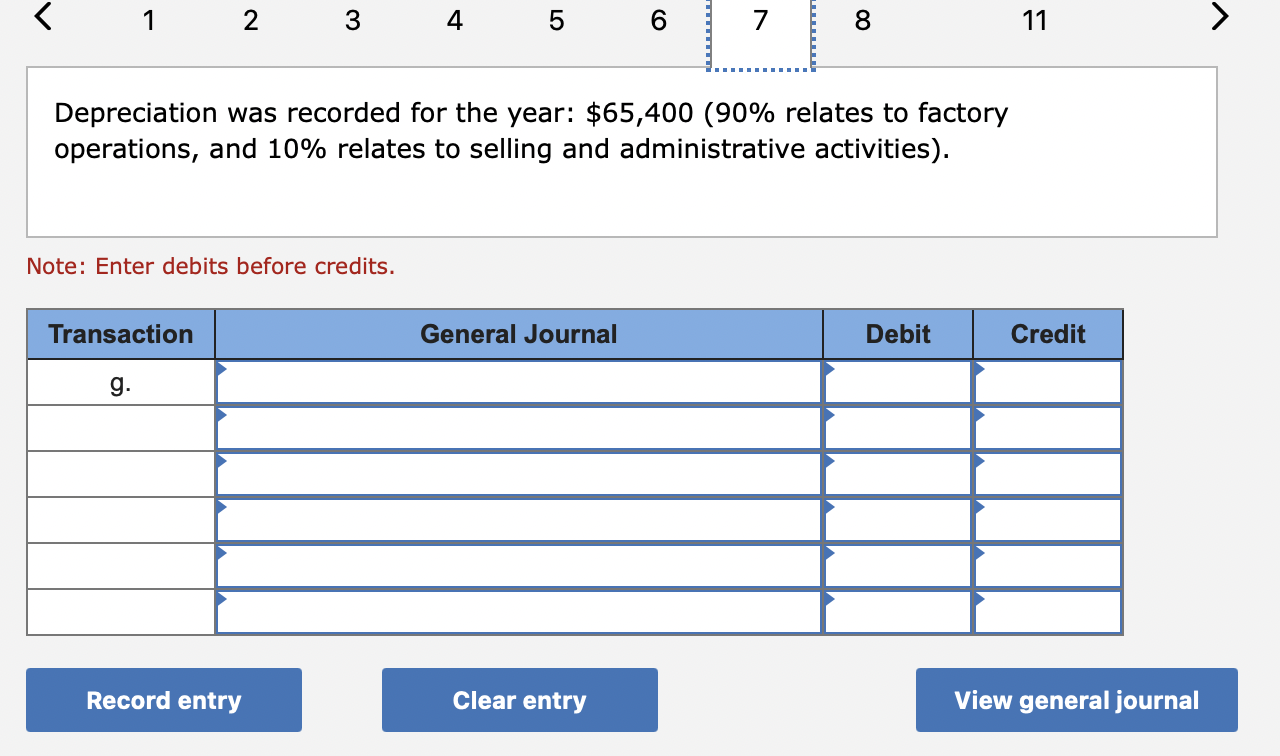

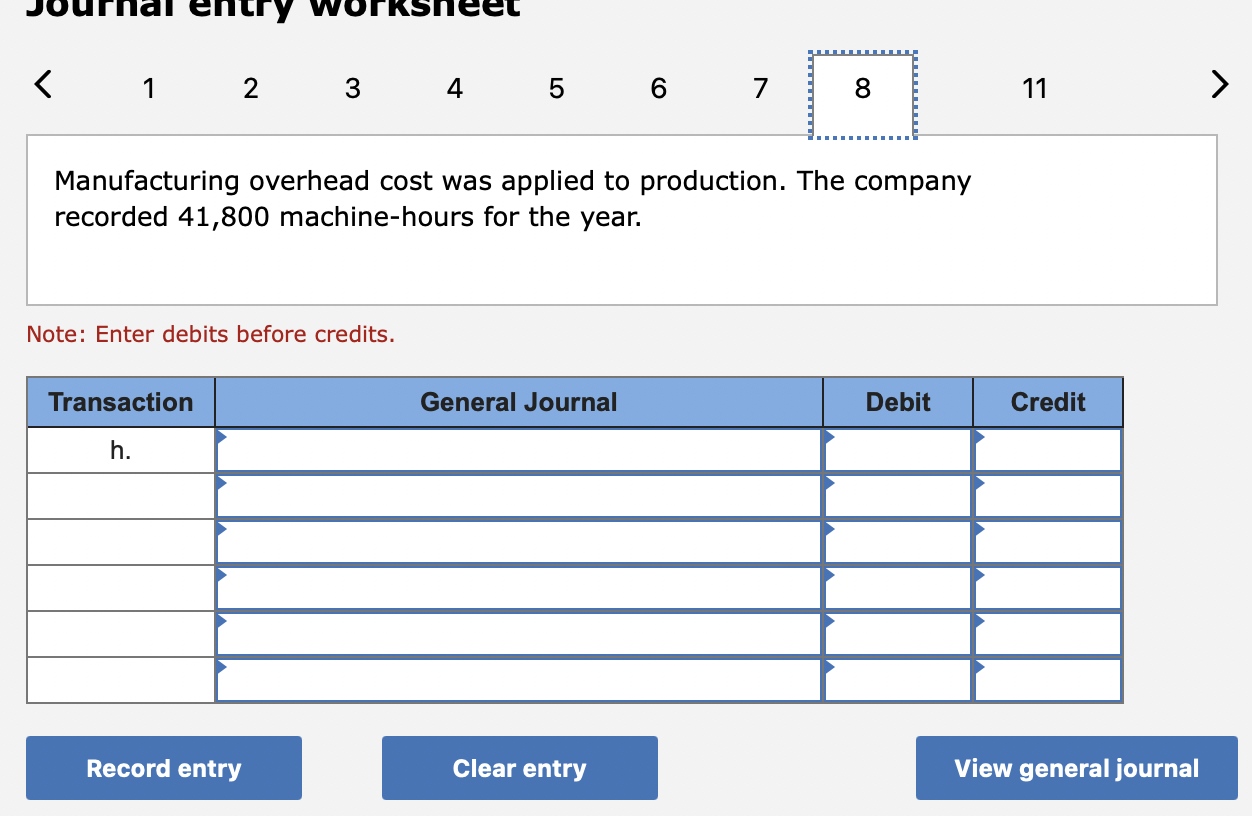

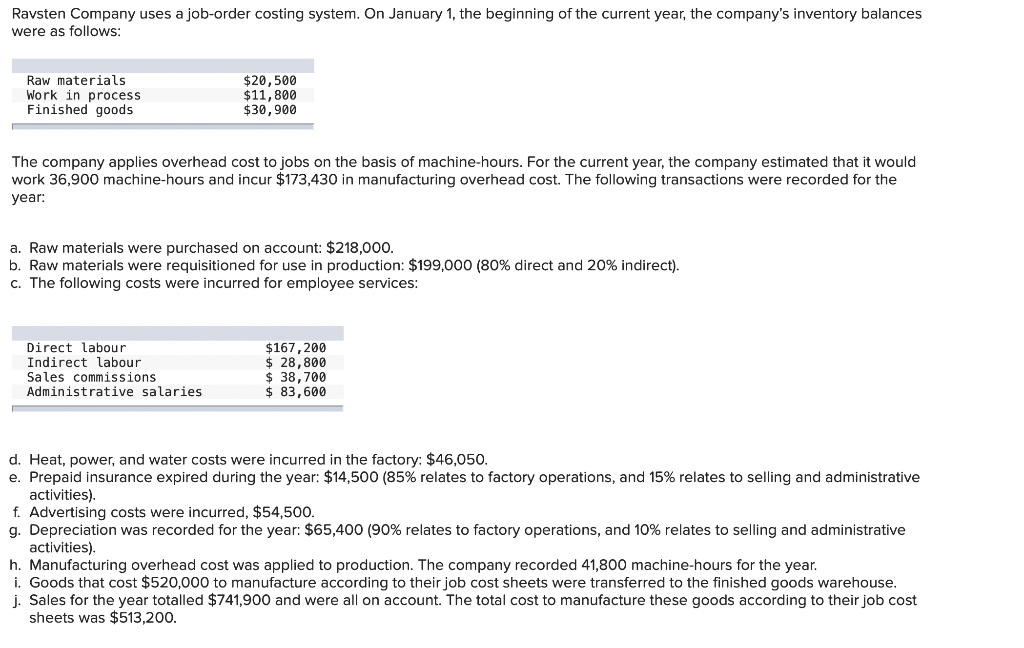

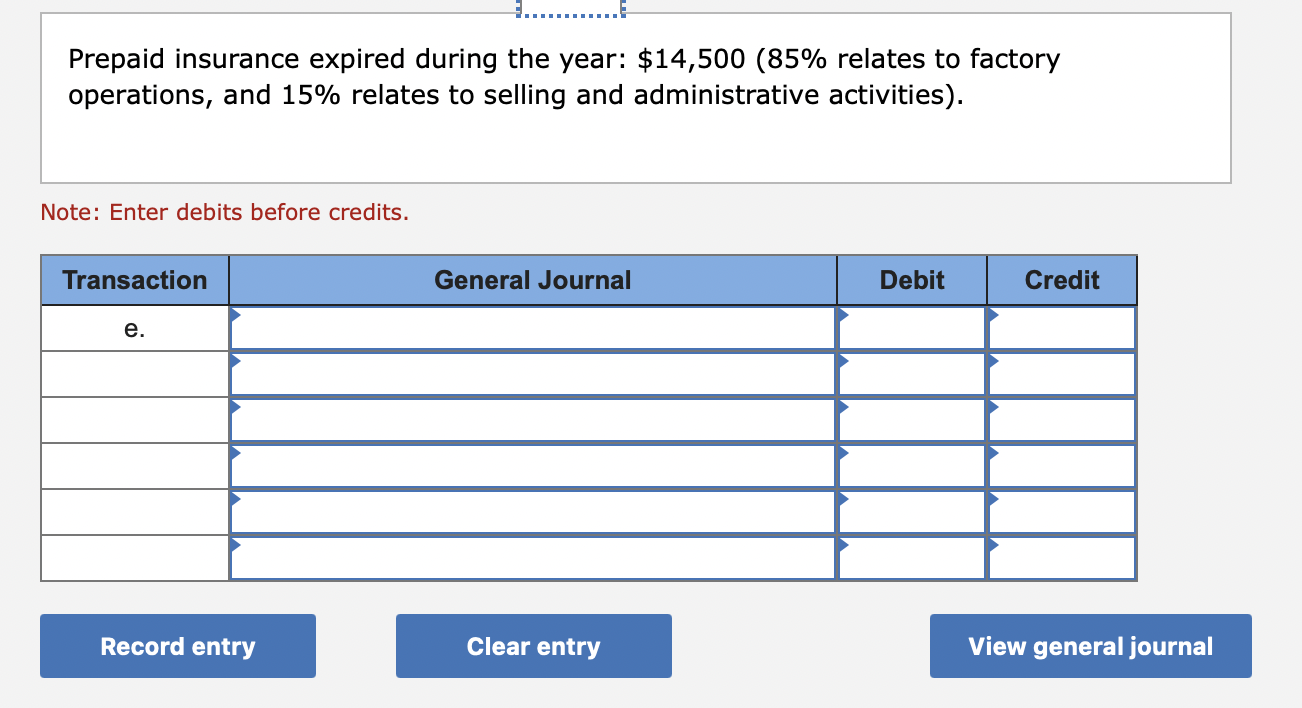

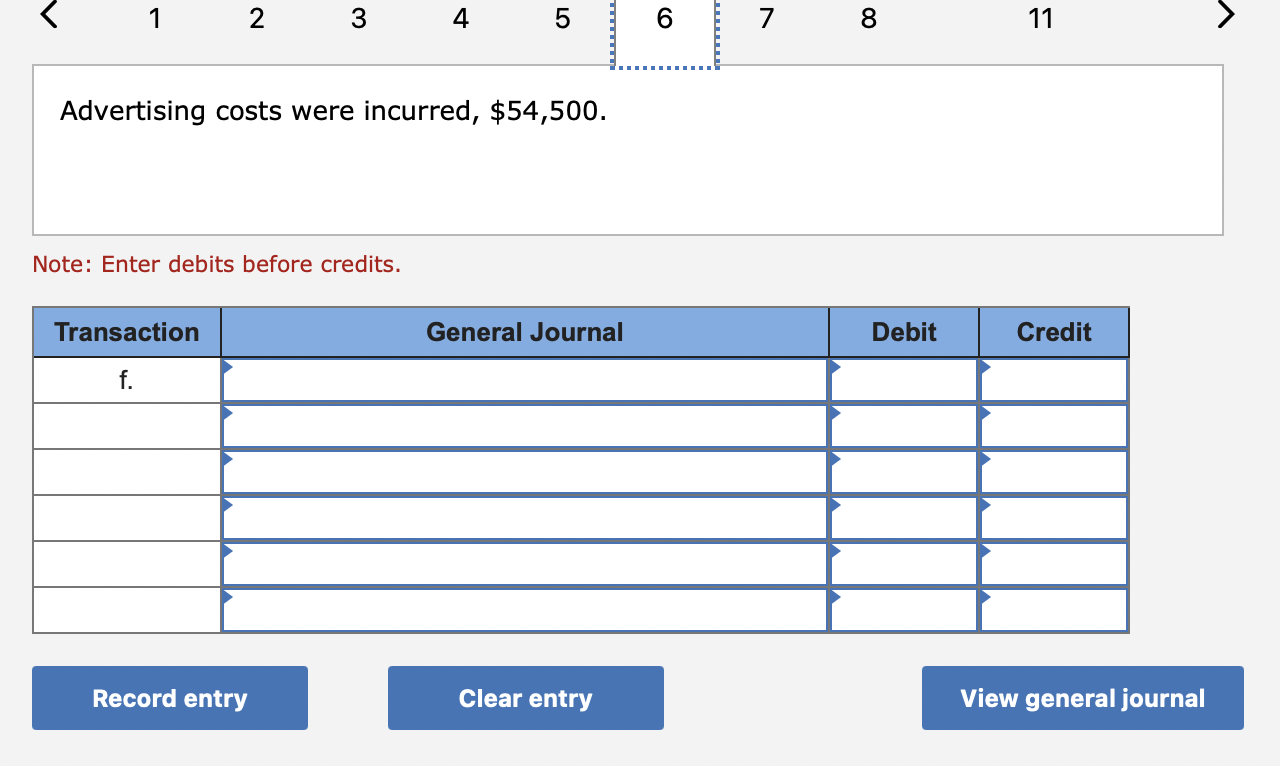

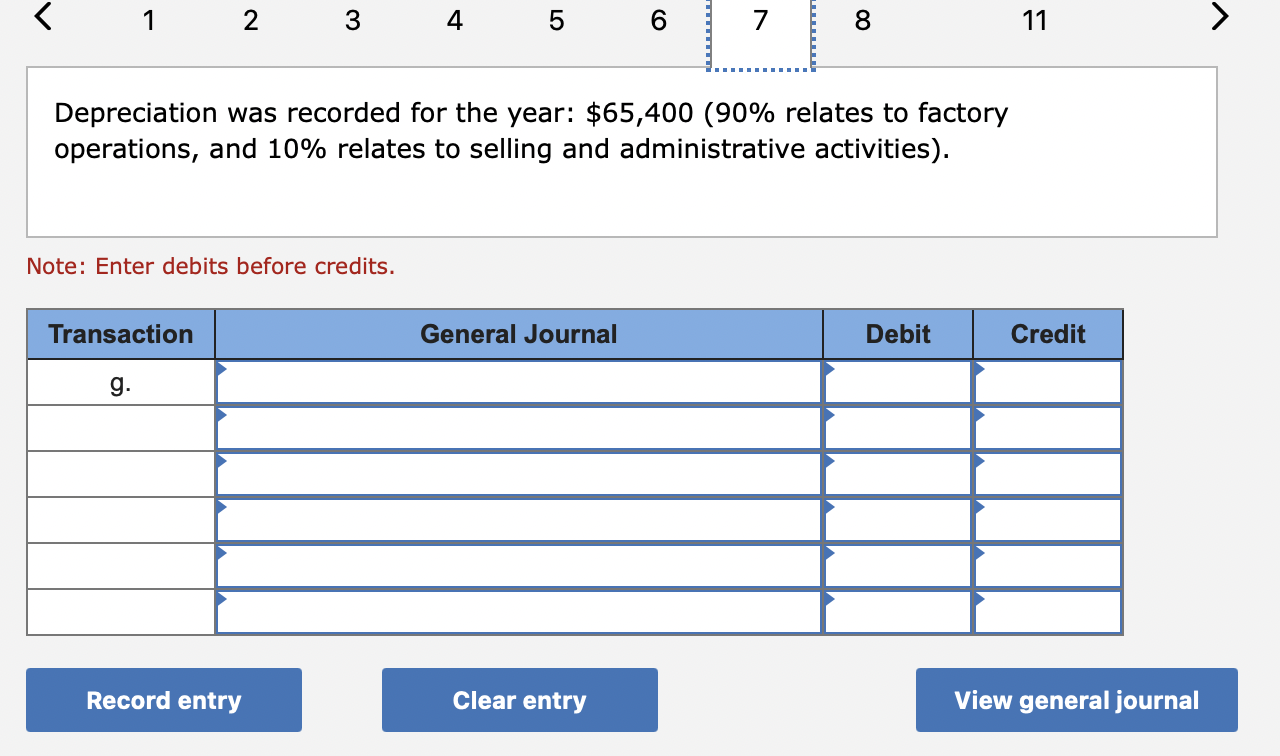

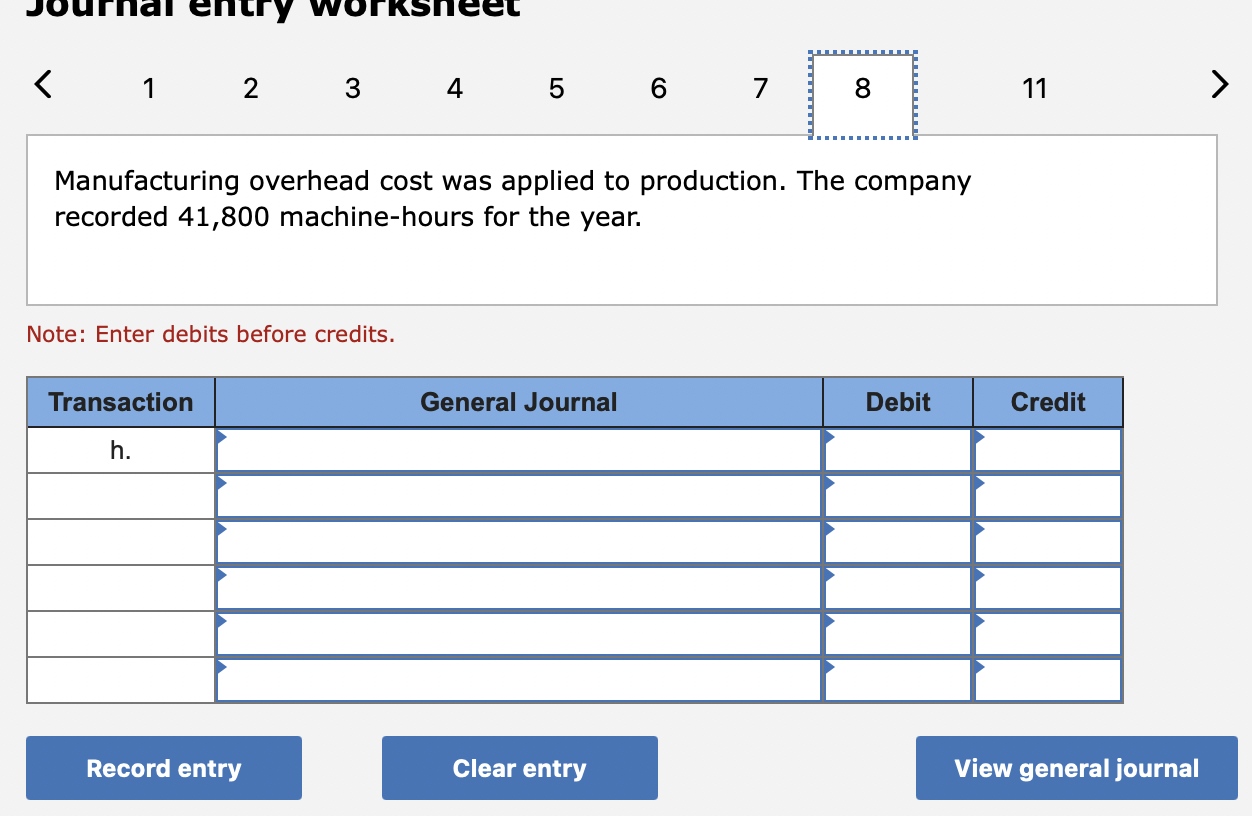

Ravsten Company uses a job-order costing system. On January 1, the beginning of the current year, the company's inventory balances were as follows: Raw materials Work in process Finished goods $20,500 $11,800 $30,900 The company applies overhead cost to jobs on the basis of machine-hours. For the current year, the company estimated that it would work 36,900 machine-hours and incur $173,430 in manufacturing overhead cost. The following transactions were recorded for the year: a. Raw materials were purchased on account: $218,000. b. Raw materials were requisitioned for use in production: $199,000 (80% direct and 20% indirect). c. The following costs were incurred for employee services: Direct labour Indirect labour Sales commissions Administrative salaries $167,200 $ 28,800 $ 38,700 $ 83,600 d. Heat, power, and water costs were incurred in the factory: $46,050. e. Prepaid insurance expired during the year: $14,500 (85% relates to factory operations, and 15% relates to selling and administrative activities). f. Advertising costs were incurred, $54,500. g. Depreciation was recorded for the year: $65,400 (90% relates to factory operations, and 10% relates to selling and administrative activities). h. Manufacturing overhead cost was applied to production. The company recorded 41,800 machine-hours for the year. i. Goods that cost $520,000 to manufacture according to their job cost sheets were transferred to the finished goods warehouse. j. Sales for the year totalled $741,900 and were all on account. The total cost to manufacture these goods according to their job cost sheets was $513,200. Prepaid insurance expired during the year: $14,500 (85% relates to factory operations, and 15% relates to selling and administrative activities). Note: Enter debits before credits. Transaction General Journal Debit Credit e. Record entry Clear entry View general journal 2 3 4 5 6 7 8 11 Advertising costs were incurred, $54,500. Note: Enter debits before credits. Transaction General Journal Debit Credit f. Record entry Clear entry View general journal 1 2. 3 4 5 6 7 8 11 > Depreciation was recorded for the year: $65,400 (90% relates to factory operations, and 10% relates to selling and administrative activities). Note: Enter debits before credits. Transaction General Journal Debit Credit g. Record entry Clear entry View general journal