Question

5. Options and Futures a. Your employer is offering you stock options on the firm as part of your pay package. You know the following

5. Options and Futures

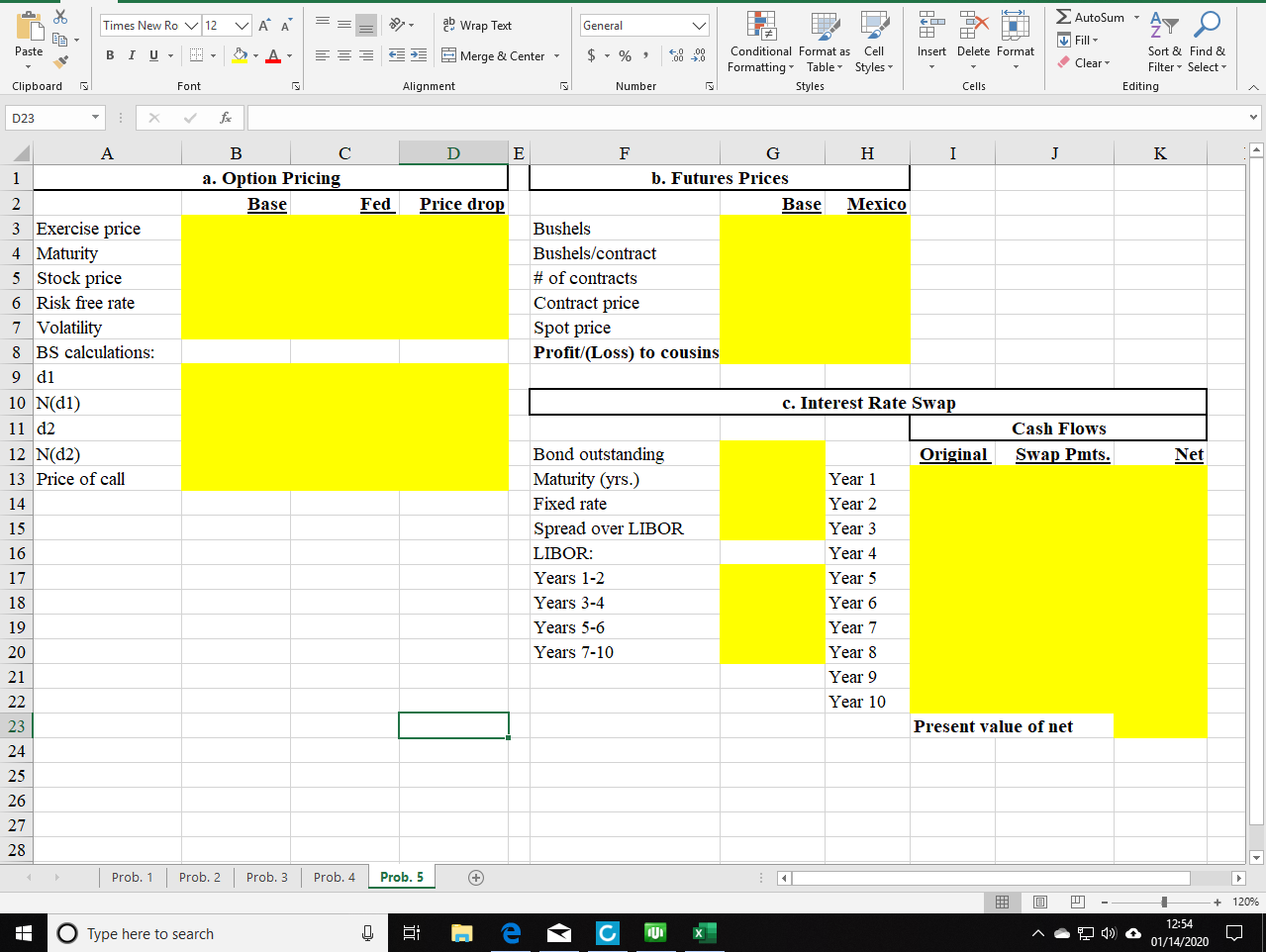

a. Your employer is offering you stock options on the firm as part of your pay package. You know the following about this offer:

Current stock price - $25

Exercise price - $35

Maturity (yrs. ) - 2

Risk-free rate - 4.5%

Stock volatility - 30%

What is the value of the option? Suppose the Fed reduces Treasury rates to 4.0%, what is the new price of the option? Your company's share price falls to $23, what is the new price of the option?

b. Your cousins grow corn in Iowa and plan to harvest 500,000 bushels at the end of the season. They are unsure whether to sell the futures contracts and lock the price in at $4.05/bushel or take a gamble and sell it all at the spot price at season's end. They think they can get $4.10/bushel based on historical prices and their own analysis. Assuming no transaction costs and each contract covers 5,000 bushels, what will the cousins' profit/loss be if they sell the contracts and the spot price is $4.10? Mexico had a bumper harvest and spot prices fall to $3.86/bushel, what will the cousins' profit/loss be now?

c. Because its financial position has strengthened considerably very recently, Apache Airlines is offered an interest rate swap - fixed to floating (LIBOR). The details are as follows:

Current Apache bond maturity - 10 years

Bond face value - $200M

Current bond rate - 6% per year, fixed

Floating rate - LIBOR + 100 basis points

Projected LIBOR rates: 4.5% (years 1-2), 5% (years 3-4), 5.5% (years 5-6), 5% (years 7-10)

Show the cash flows for Apache and the present value gain/loss of doing the swap.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started