Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. Payroll Entries. Pasceri Products, Inc. operates on a six-day work week, Monday through Saturday, with paychecks being distributed on the following Wednesday. Examination

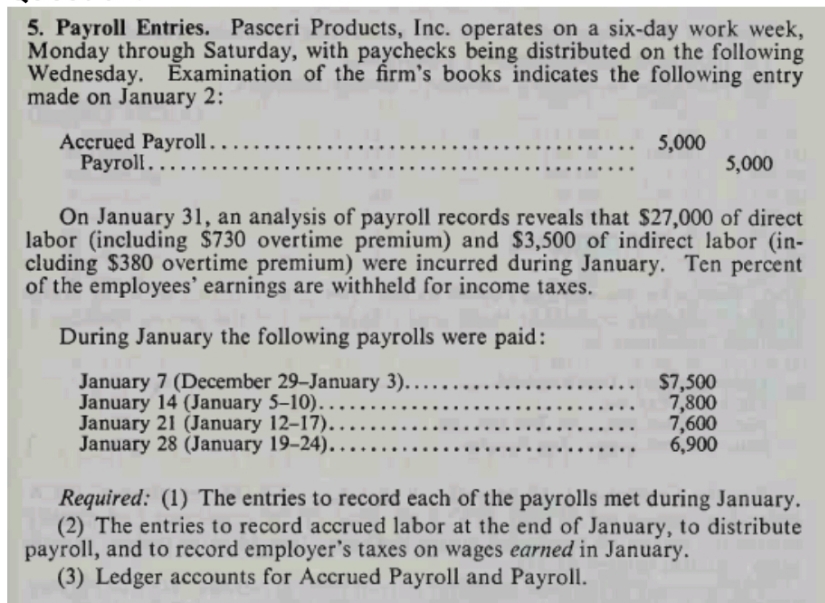

5. Payroll Entries. Pasceri Products, Inc. operates on a six-day work week, Monday through Saturday, with paychecks being distributed on the following Wednesday. Examination of the firm's books indicates the following entry made on January 2: Accrued Payroll.... Payroll.... 5,000 5,000 On January 31, an analysis of payroll records reveals that $27,000 of direct labor (including $730 overtime premium) and $3,500 of indirect labor (in- cluding $380 overtime premium) were incurred during January. Ten percent of the employees' earnings are withheld for income taxes. During January the following payrolls were paid: January 7 (December 29-January 3)..... January 14 (January 5-10)... January 21 (January 12-17).. January 28 (January 19-24). $7,500 7,800 7,600 6,900 Required: (1) The entries to record each of the payrolls met during January. (2) The entries to record accrued labor at the end of January, to distribute payroll, and to record employer's taxes on wages earned in January. (3) Ledger accounts for Accrued Payroll and Payroll.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started