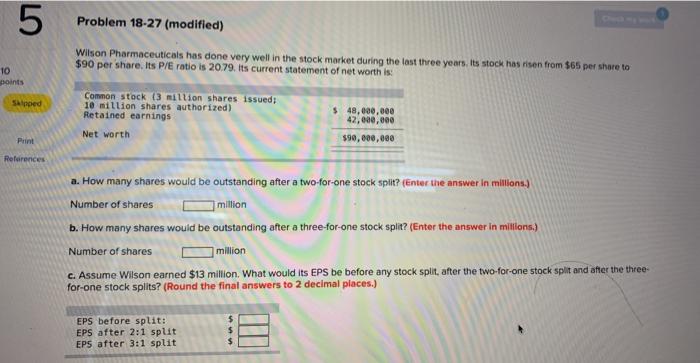

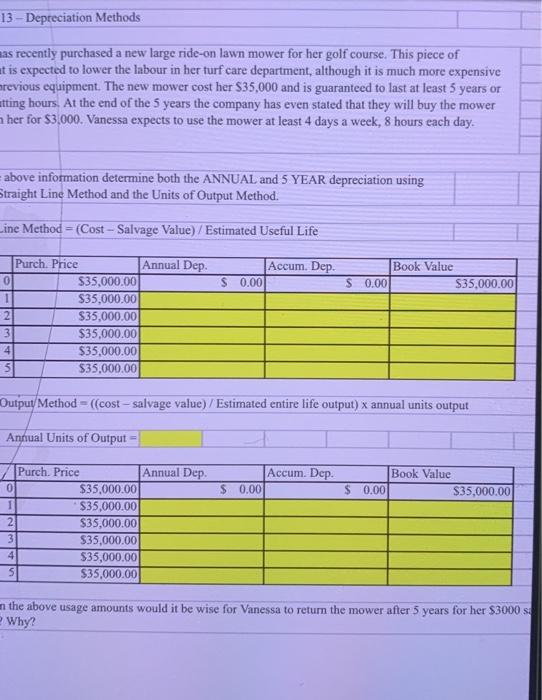

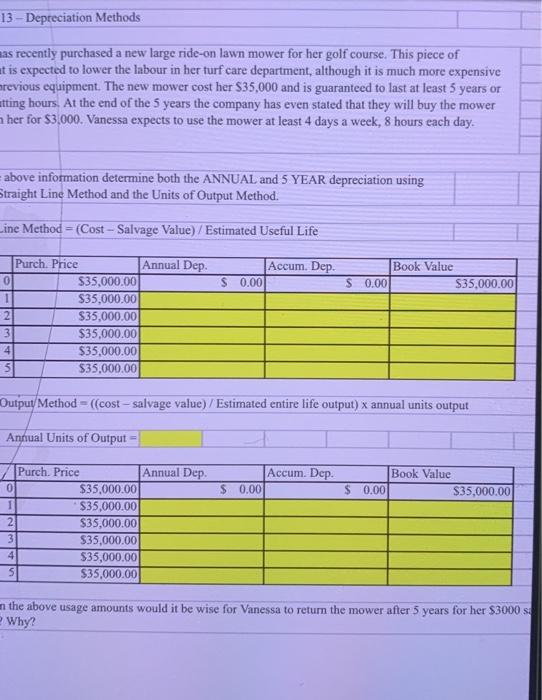

5 Problem 18-27 (modified) Wilson Pharmaceuticals has done very well in the stock market during the last three years. Its stock has risen from $65 per share to $90 per share. Its P/E ratio is 20.79. Its current statement of net worth is: 10 points Sipped Common stock (3 million shares issued; 10 million shares authorized) Retained earnings $ 48,000,000 42,000,000 $90,000,000 Net worth References a. How many shares would be outstanding after a two-for-one stock split? (Enter the answer in millions.) Number of shares million b. How many shares would be outstanding after a three-for-one stock split? (Enter the answer in millions.) Number of shares million c. Assume Wilson earned $13 million. What would its EPS be before any stock split, after the two-for-one stock split and after the three for-one stock splits? (Round the final answers to 2 decimal places.) EPS before split: EPS after 2:1 split EPS after 3:1 split $ 13 - Depreciation Methods as recently purchased a new large ride-on lawn mower for her golf course. This piece of at is expected to lower the labour in her turf care department, although it is much more expensive revious equipment. The new mower cost her $35,000 and is guaranteed to last at least 5 years or atting hours. At the end of the 5 years the company has even stated that they will buy the mower her for $3.000. Vanessa expects to use the mower at least 4 days a week, 8 hours each day. above information determine both the ANNUAL and 5 YEAR depreciation using Straight Line Method and the Units of Output Method. Line Method = (Cost - Salvage Value) / Estimated Useful Life Accum. Dep $ 0.00 Book Value S 0.00 S35,000.00 Purch. Price Annual Dep O $35,000.00 1 $35,000.00 2 $35,000.00 3 $35,000.00 4 $35,000.00 5 $35,000.00 Output Method - ((cost - salvage value) / Estimated entire life output) x annual units output Annual Units of Output Accum. Dep. $ 0.00 Book Value $ 0.00 $35,000.00 Purch. Price Annual Dep. 0 $35,000.00 $35,000.00 2 $35,000.00 3 $35,000.00 4 $35,000.00 5 $35,000.00 in the above usage amounts would it be wise for Vanessa to return the mower after 5 years for her $3000 S Why