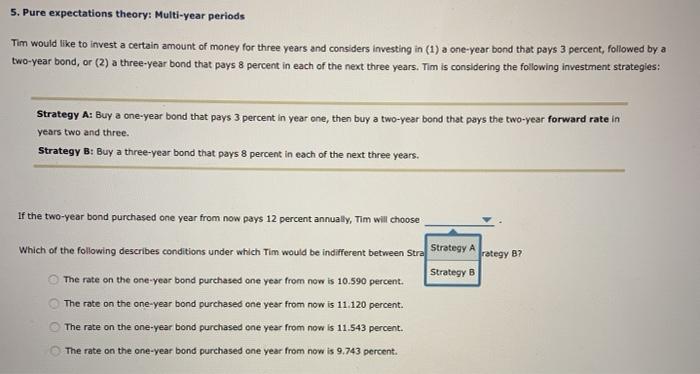

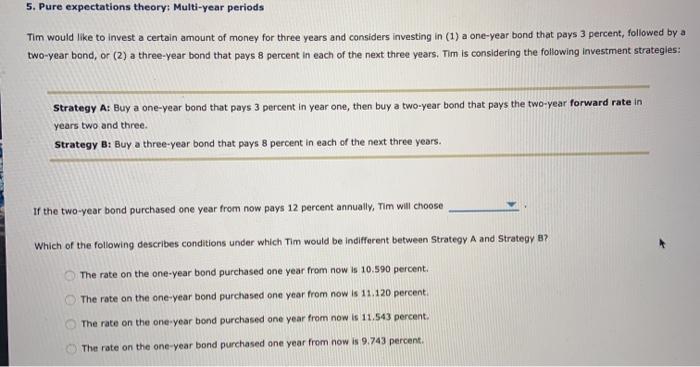

5. Pure expectations theory: Multi-year periods Tim would like to invest a certain amount of money for three years and considers investing in (1) a one-year bond that pays 3 percent, followed by a two-year bond, or (2) a three-year bond that pays 8 percent in each of the next three years. Tim is considering the following investment strategies: Strategy A: Buy a one-year bond that pays 3 percent in year one, then buy a two-year bond that pays the two-year forward rate in years two and three. Strategy B: Buy a three-year bond that pays 8 percent in each of the next three years. If the two-year bond purchased one year from now pays 12 percent annually, Tim will choose Which of the following describes conditions under which Tim would be indifferent between Stra Strategy A rategy B? The rate on the one-year bond purchased one year from now is 10.590 percent. Strategy B The rate on the one-year bond purchased one year from now is 11.120 percent. The rate on the one-year bond purchased one year from now is 11.543 percent. The rate on the one-year bond purchased one year from now is 9.743 percent. 5. Pure expectations theory: Multi-year periods Tim would like to invest a certain amount of money for three years and considers investing in (1) a one-year bond that pays 3 percent, followed by a two-year bond, or (2) a three-year bond that pays 8 percent in each of the next three years. Tim is considering the following investment strategies: Strategy A: Buy a one-year bond that pays 3 percent in year one, then buy a two-year bond that pays the two-year forward rate in years two and three. Strategy B: Buy a three-year bond that pays 8 percent in each of the next three years. of the two-year bond purchased one year from now pays 12 percent annually, Tim will choose Which of the following describes conditions under which Tim would be indifferent between Strategy A and Strategy B? The rate on the one-year bond purchased one year from now is 10.590 percent. The rate on the one-year bond purchased one year from now is 11.120 percent O O O O The rate on the one-year bond purchased one year from now is 11.543 percent. The rate on the one year bond purchased one year from now is 9.743 percent