Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. Refer to Hello Goodbye Ltd.'s cumulative redeemable preference shares option. Assist Hello Goodbye Ltd. in determining the current value of each preference share at

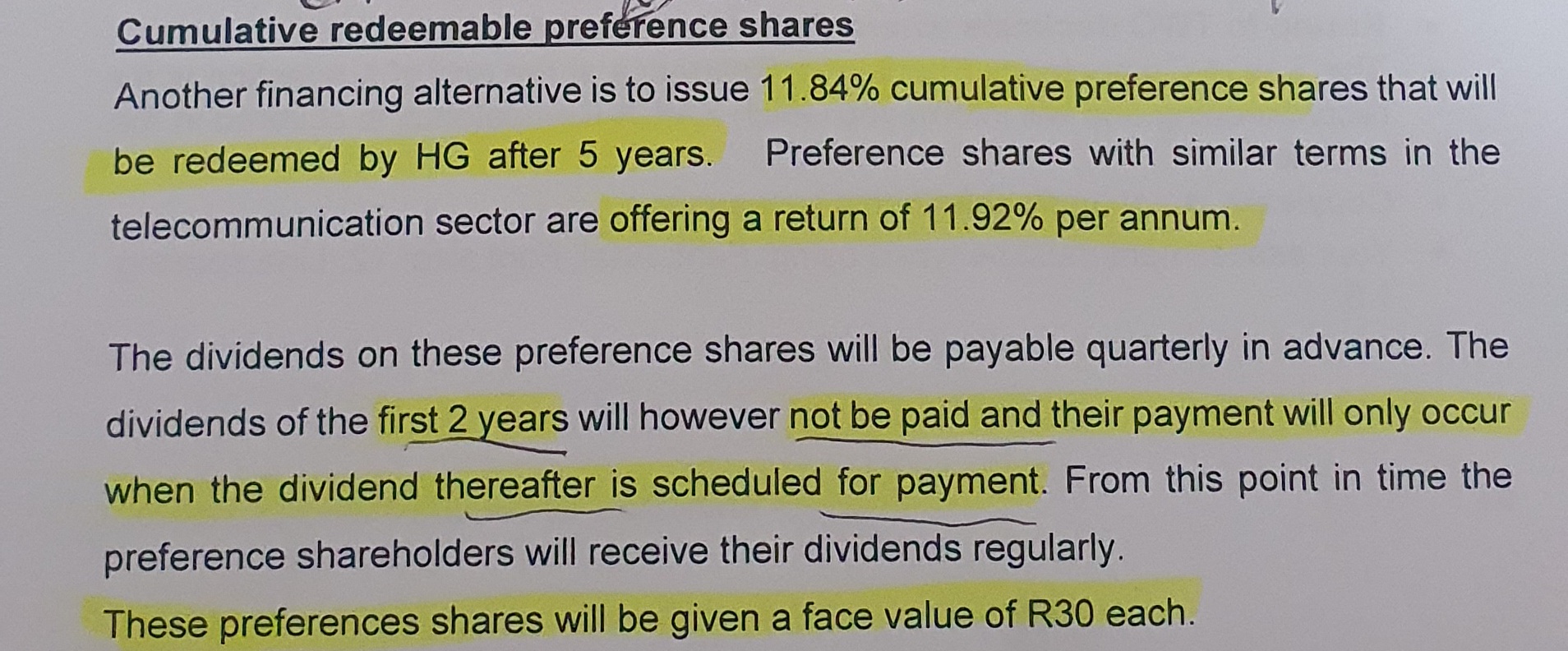

5. Refer to Hello Goodbye Ltd.'s cumulative redeemable preference shares option. Assist Hello Goodbye Ltd. in determining the current value of each preference share at the time of issue. Cumulative redeemable preference shares Another financing alternative is to issue 11.84% cumulative preference shares that will be redeemed by HG after 5 years. Preference shares with similar terms in the telecommunication sector are offering a return of 11.92% per annum. The dividends on these preference shares will be payable quarterly in advance. The dividends of the first 2 years will however not be paid and their payment will only occur when the dividend thereafter is scheduled for payment. From this point in time the preference shareholders will receive their dividends regularly. These preferences shares will be given a face value of R30 each

5. Refer to Hello Goodbye Ltd.'s cumulative redeemable preference shares option. Assist Hello Goodbye Ltd. in determining the current value of each preference share at the time of issue. Cumulative redeemable preference shares Another financing alternative is to issue 11.84% cumulative preference shares that will be redeemed by HG after 5 years. Preference shares with similar terms in the telecommunication sector are offering a return of 11.92% per annum. The dividends on these preference shares will be payable quarterly in advance. The dividends of the first 2 years will however not be paid and their payment will only occur when the dividend thereafter is scheduled for payment. From this point in time the preference shareholders will receive their dividends regularly. These preferences shares will be given a face value of R30 each Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started