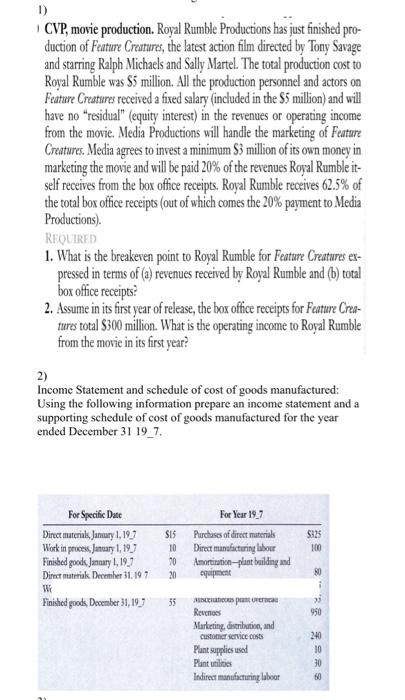

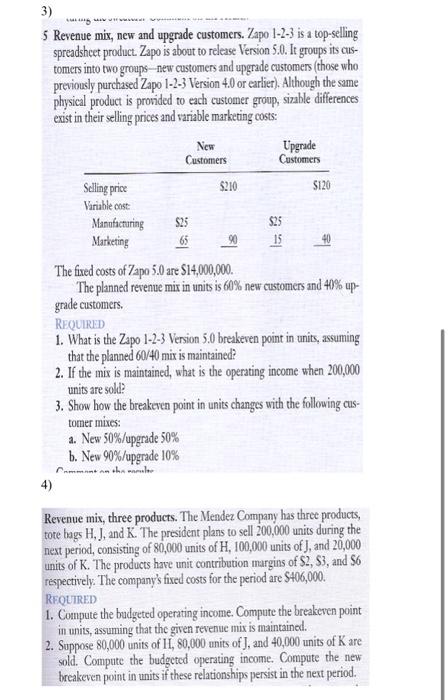

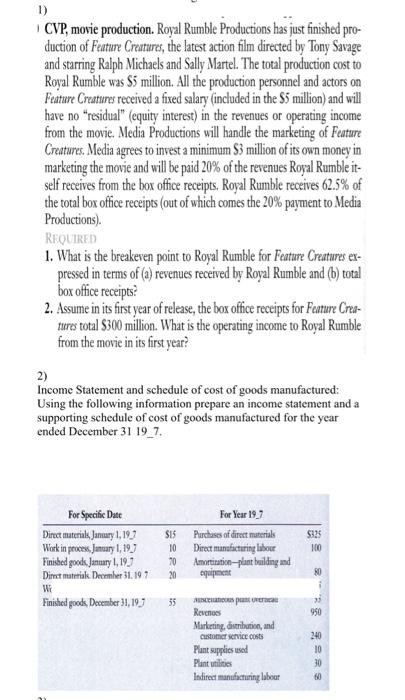

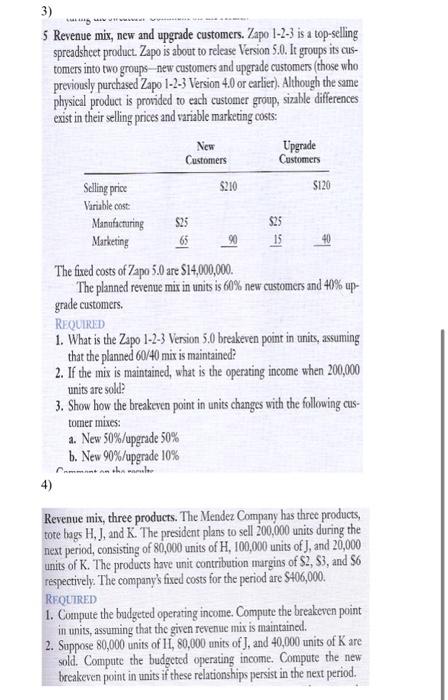

5 Revenue mix, new and upgrade customers. Zapo 1-2-3 is a top-selling spreadsheet product. Zapo is about to release Version 5.0. It groups its customers into two groups -new customers and upgrade customers (those who previously purchased Zapo 1-2-3 Version 4.0 or earlier). Although the same physical product is provided to each customer group, sizable differences exist in their selling prices and variable marketing costs: The fixed costs of 7apo5.0 are $14,000,000. The planned revenue mix in units is 60% new customers and 40% upgrade customers. REQUIRID 1. What is the Zapo 1-2-3 Version 5.0 breakeren point in units, assuming that the planned 60/40 mix is maintained? 2. If the mix is maintained, what is the operating income when 200,000 units are sold? 3. Show how the breakeren point in units changes with the following customer mixes: a. New 50% /upgrade 50% b. New 90% /upgrade 10% 4) Revenue mix, three products. The Mendez Company has three products, tote tags H,J, and K. The president plans to sell 200,000 units during the next period, consisting of 80,000 units of H,100,000 units of J, and 20,000 units of K. The products have unit contribution margins of $2,$3, and $6 respectively. The company's fixed costs for the period are $406,000. RFQtIRED 1. Compute the budgeted operating income. Compute the breakeren point in units, assuming that the given revenue mix is maintained. 2. Suppose 80,000 units of II,80,000 units of J, and 40,000 units of K are sold. Compute the budgeted operating inoome. Compute the new breakeven point in units if these relationships persist in the next period. 1) 1 CVP, movie production. Royal Rumble Productions has just finished production of Feature Crenturs, the latest action film directed by Tony Savage and starring Ralph Michaels and Sally Martel. The total production cost to Royal Rumble was $5 million. All the production personnel and actors on Feature Creatures received a fixed salary (included in the $5 million) and will have no "residual" (equity interest) in the revenues or operating income from the movie. Media Productions will handle the marketing of Feature Creatures. Media agrees to invest a minimum S3 million of its own money in marketing the movie and will be paid 20% of the revenues Royal Rumble itself receives from the box office receipts. Royal Rumble receives 62.5% of the total box office receipts (out of which comes the 20% payment to Media Productions). 1. What is the breakeren point to Royal Rumble for Feature Cratures erpressed in terms of (a) revenues received by Royal Rumble and (b) total box office receipts? 2. Assume in its first year of release, the box office receipts for Fanure Creatures total $300 million. What is the operating income to Royal Rumble from the movic in its first year? 2) Income Statement and schedule of cost of goods manufactured: Using the following information prepare an income statement and a supporting schedule of cost of goods manufactured for the year ended December 31 19_7. 5 Revenue mix, new and upgrade customers. Zapo 1-2-3 is a top-selling spreadsheet product. Zapo is about to release Version 5.0. It groups its customers into two groups -new customers and upgrade customers (those who previously purchased Zapo 1-2-3 Version 4.0 or earlier). Although the same physical product is provided to each customer group, sizable differences exist in their selling prices and variable marketing costs: The fixed costs of 7apo5.0 are $14,000,000. The planned revenue mix in units is 60% new customers and 40% upgrade customers. REQUIRID 1. What is the Zapo 1-2-3 Version 5.0 breakeren point in units, assuming that the planned 60/40 mix is maintained? 2. If the mix is maintained, what is the operating income when 200,000 units are sold? 3. Show how the breakeren point in units changes with the following customer mixes: a. New 50% /upgrade 50% b. New 90% /upgrade 10% 4) Revenue mix, three products. The Mendez Company has three products, tote tags H,J, and K. The president plans to sell 200,000 units during the next period, consisting of 80,000 units of H,100,000 units of J, and 20,000 units of K. The products have unit contribution margins of $2,$3, and $6 respectively. The company's fixed costs for the period are $406,000. RFQtIRED 1. Compute the budgeted operating income. Compute the breakeren point in units, assuming that the given revenue mix is maintained. 2. Suppose 80,000 units of II,80,000 units of J, and 40,000 units of K are sold. Compute the budgeted operating inoome. Compute the new breakeven point in units if these relationships persist in the next period. 1) 1 CVP, movie production. Royal Rumble Productions has just finished production of Feature Crenturs, the latest action film directed by Tony Savage and starring Ralph Michaels and Sally Martel. The total production cost to Royal Rumble was $5 million. All the production personnel and actors on Feature Creatures received a fixed salary (included in the $5 million) and will have no "residual" (equity interest) in the revenues or operating income from the movie. Media Productions will handle the marketing of Feature Creatures. Media agrees to invest a minimum S3 million of its own money in marketing the movie and will be paid 20% of the revenues Royal Rumble itself receives from the box office receipts. Royal Rumble receives 62.5% of the total box office receipts (out of which comes the 20% payment to Media Productions). 1. What is the breakeren point to Royal Rumble for Feature Cratures erpressed in terms of (a) revenues received by Royal Rumble and (b) total box office receipts? 2. Assume in its first year of release, the box office receipts for Fanure Creatures total $300 million. What is the operating income to Royal Rumble from the movic in its first year? 2) Income Statement and schedule of cost of goods manufactured: Using the following information prepare an income statement and a supporting schedule of cost of goods manufactured for the year ended December 31 19_7