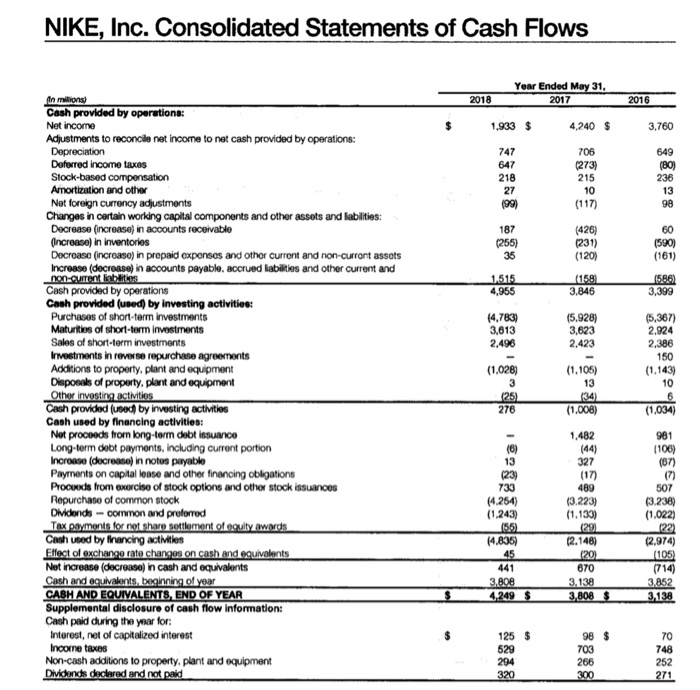

5. Review the Statement of Cash Flows. Provide a definition for each of the three sections of the statement. One of the largest uses of cash on this statement is for the Repurchase of common stock, why would NIKE be buying back its own common stock? Is there anything on the statement that appears to be out of proportion or inconsistent with previous years? NIKE, Inc. Consolidated Statements of Cash Flows Year Ended May 31, 2017 2018 2016 4,240 $ 3,760 1.933 $ 747 647 218 649 706 (273) 215 (80) 236 (117) (255) (426) (231) (120) 60 (590) (161) 35 1.515 4,955 (158 3.846 1586) 3,399 (4.783) 3,613 2.496 (5.928) 3,623 2,423 (5,367) 2.924 2,386 150 (1.143) 10 (1,028) In millions) Cash provided by operations: Net income Adjustments to reconcile net income to net cash provided by operations: Depreciation Deferred income taxes Stock-based compensation Amortization and other Not foreign currency adjustments Changes in certain working capital components and other assets and labilities: Decrease increase) in accounts receivable (ncrease) in inventories Decrease increaso) in prepaid expenses and other current and non-curront assots Increase (decrease) in accounts payable, accrued liabilities and other current and non quirent liabites Cash provided by operations Cash provided (used) by investing activities: Purchases of short-term investments Matunities of short-term investments Sales of short-term investments Investments in reverse repurchase agreements Additions to property, plant and equipment Disposals of property, plant and equipment Other investing activities Cash provided (used by investing activities Cash used by financing activities: Net proceeds from long-term debt issuance Long-term debt payments, including current portion Incrosso (decrease in notos payable Payments on capital lease and other financing obligations Procuxts from exercise of stock options and other stock issuances Repurchase of common stock Dividends common and preferred Tax payments for not share settlement of oculty awards Cash used by financing activities Effect of exchange rate changes on cash and equivalents Net increase (decrease) in cash and equivalents Cash and equivalents, beginning of year CASH AND EQUIVALENTS, END OF YEAR Supplemental disclosure of cash flow Information: Cash paid during the year for: Interest, net of capitalized interest Income taxes Non-cash additions to property, plant and equipment Dividends declared and not paid (1.105) (34) (1.008) (1,034) 730 (4.254) (1.243) (55) (4.835) 1.482 (44) 327 (17) 489 (3.223) (1.133) (291 (2.148) 1201 670 3,138 3.808 $ 981 (106) (87) (72 507 (3.238) (1.022) (22) (2.974) (105) (714) 3.852 3.138 441 3.808 4,249 $ $ 125 529 294 98 $ 703 748 266 252 320 271