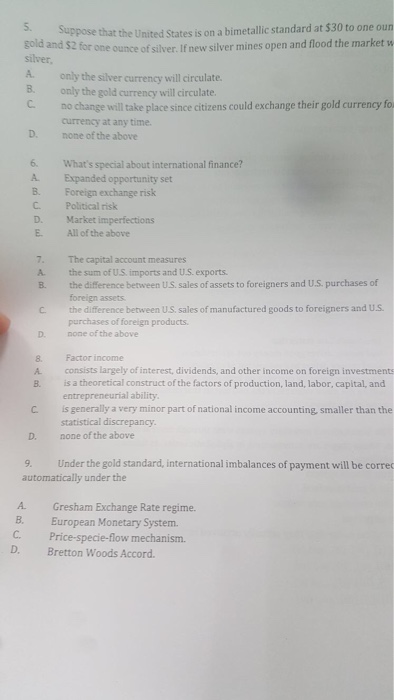

5. suppose that the United States is on a bimetallic standard at $30 to one oun for one ounce of silver.If new silver mines open and flood the market w silver, A. onlythe siver currency will crailate. B only the gold currency will circulate C no change will take place since citizens could exchange their gold currency fo currency at any time none of the above D. 6. What's special about international finance? A Expanded opportunity set B. Foreign exchange risk C. Political risk D. Market imperfections E All of the above 7. The capital account measures A the sum of U.S. imports and U.S. exports B. the difference between U.S sales of assets to foreigners and U.S. purchases of foreign assets C the difference between U.S sales of manufactured goods to foreigners and U.S purchases of foreign products. D. one of the above 8. Factor income A consists largely of interest, dividends, and other income on foreign investments B. is a theoretical construct of the factors of production, land, labor, capital, and entrepreneurial ability C is generally a very minor part of national income accounting, smaller than the D. oe of the above 9. Under the gold standard, international imbalances of payment will be corred automatically under the A. Gresham Exchange Rate regime. B. European Monetary System D. Bretton Woods Accord. 5. suppose that the United States is on a bimetallic standard at $30 to one oun for one ounce of silver.If new silver mines open and flood the market w silver, A. onlythe siver currency will crailate. B only the gold currency will circulate C no change will take place since citizens could exchange their gold currency fo currency at any time none of the above D. 6. What's special about international finance? A Expanded opportunity set B. Foreign exchange risk C. Political risk D. Market imperfections E All of the above 7. The capital account measures A the sum of U.S. imports and U.S. exports B. the difference between U.S sales of assets to foreigners and U.S. purchases of foreign assets C the difference between U.S sales of manufactured goods to foreigners and U.S purchases of foreign products. D. one of the above 8. Factor income A consists largely of interest, dividends, and other income on foreign investments B. is a theoretical construct of the factors of production, land, labor, capital, and entrepreneurial ability C is generally a very minor part of national income accounting, smaller than the D. oe of the above 9. Under the gold standard, international imbalances of payment will be corred automatically under the A. Gresham Exchange Rate regime. B. European Monetary System D. Bretton Woods Accord