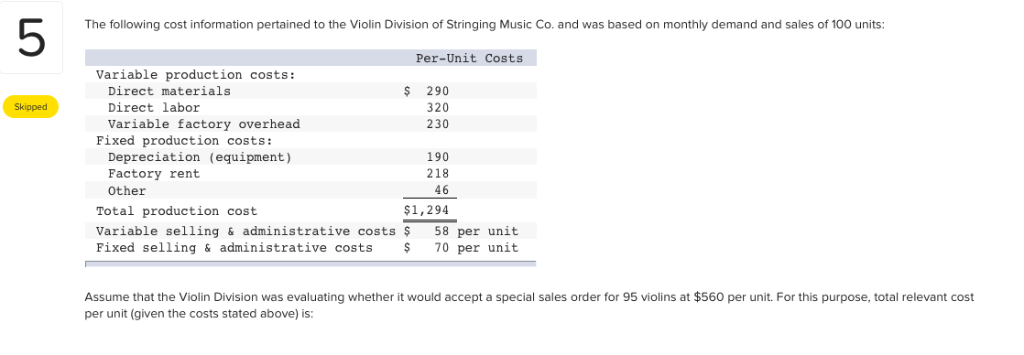

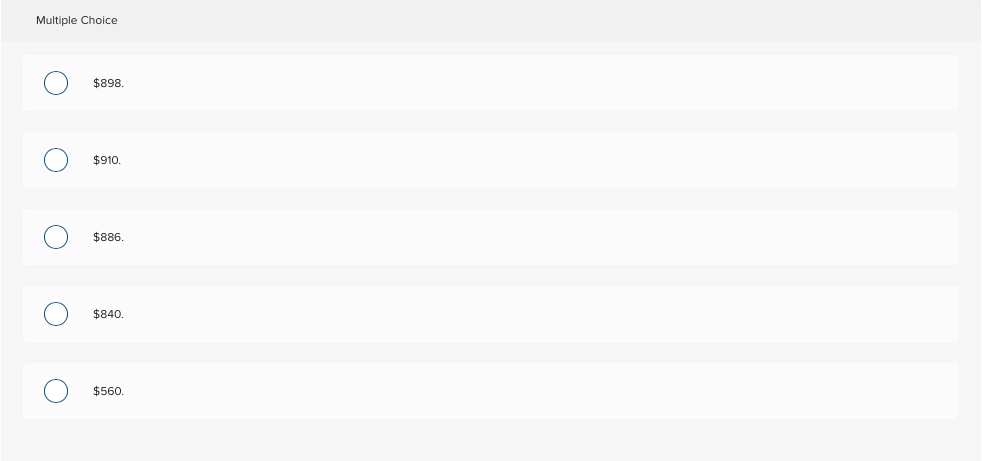

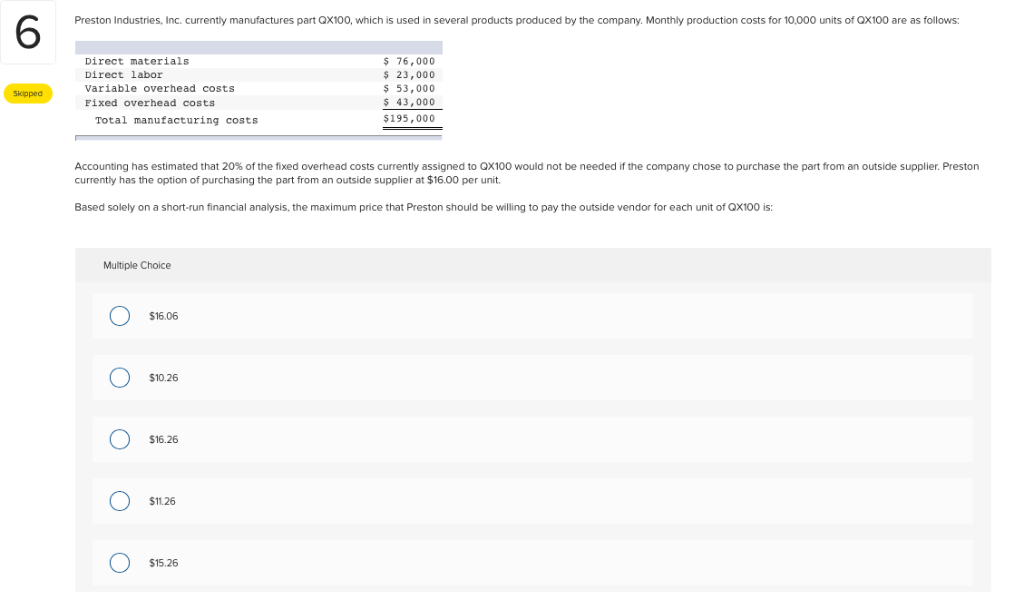

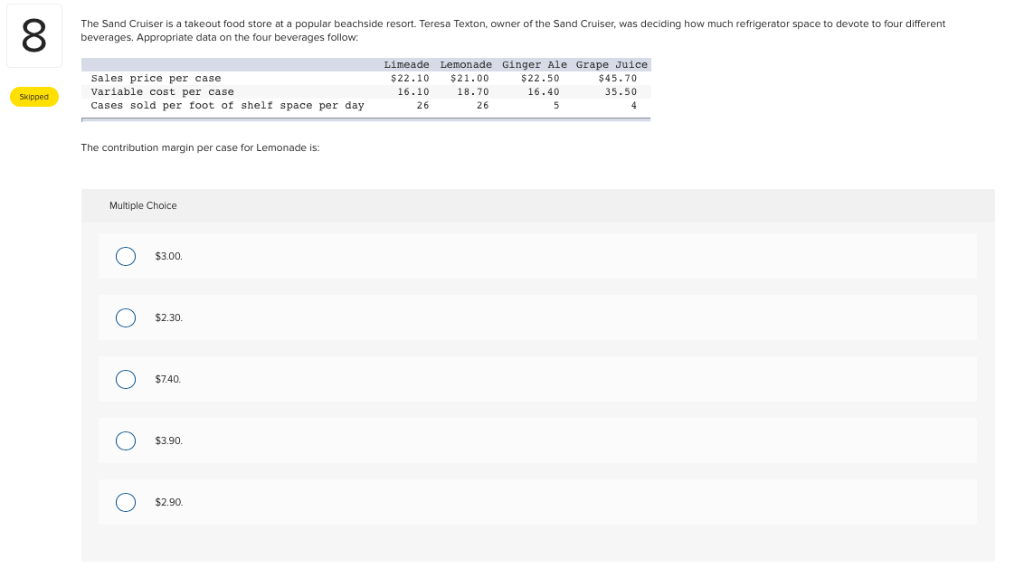

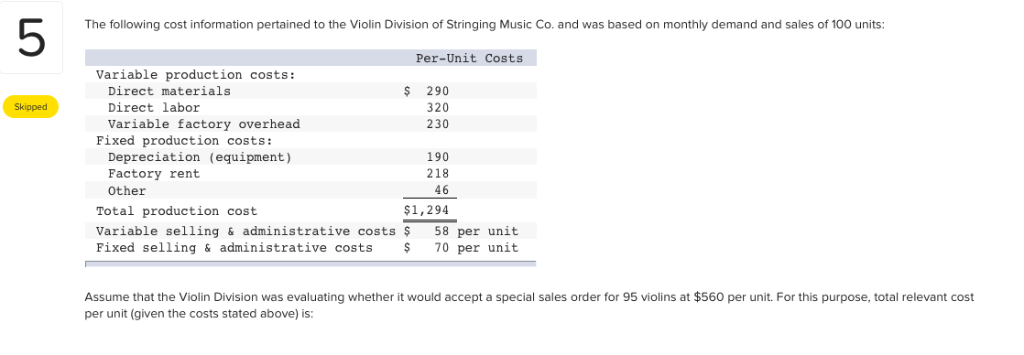

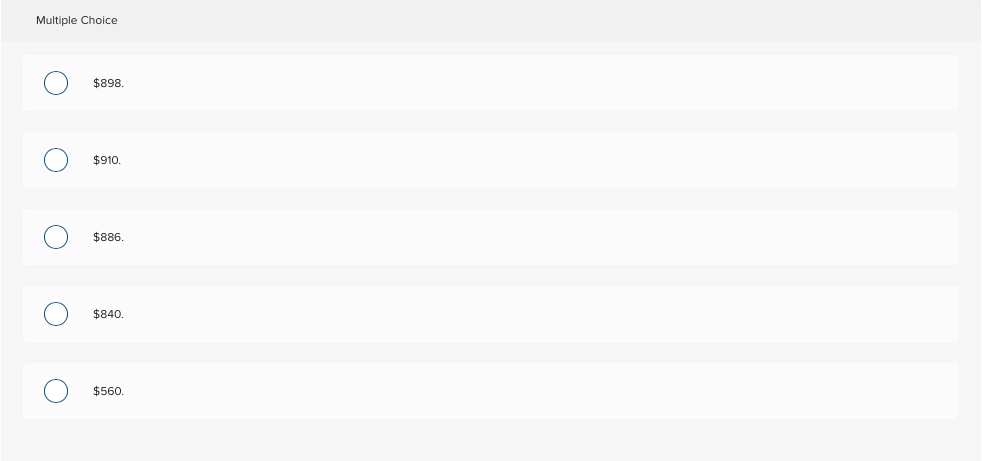

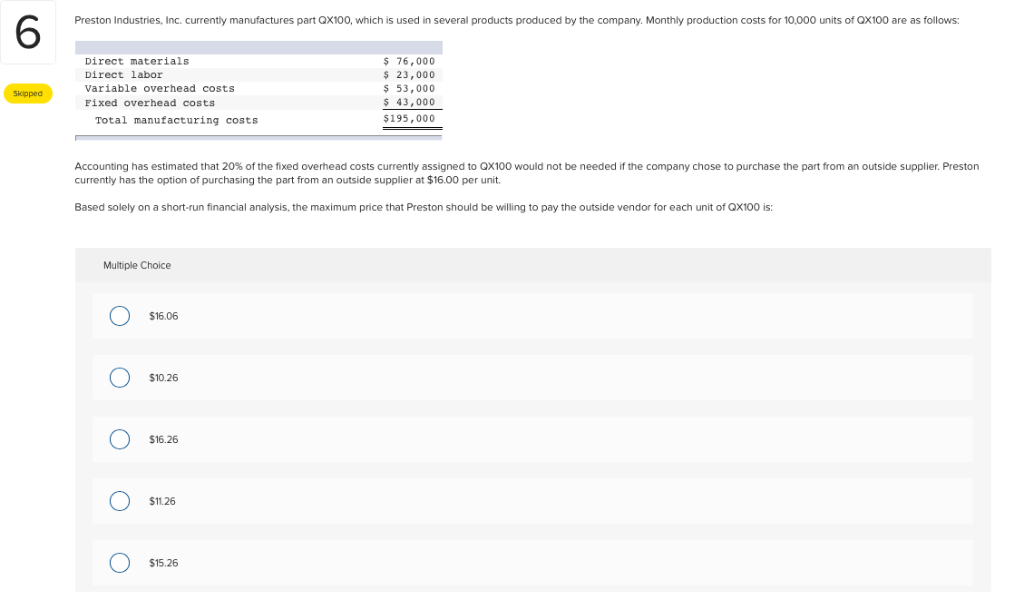

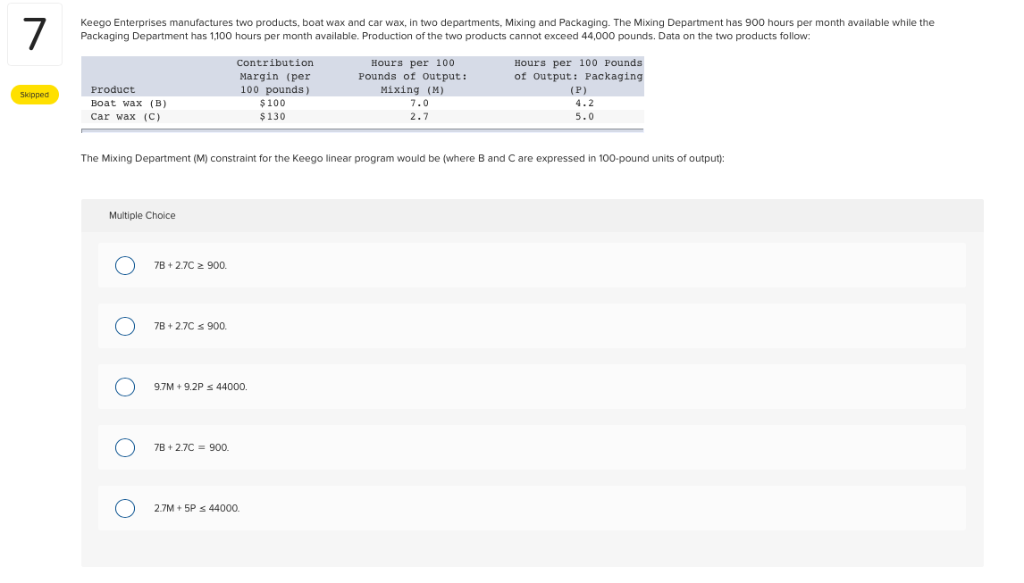

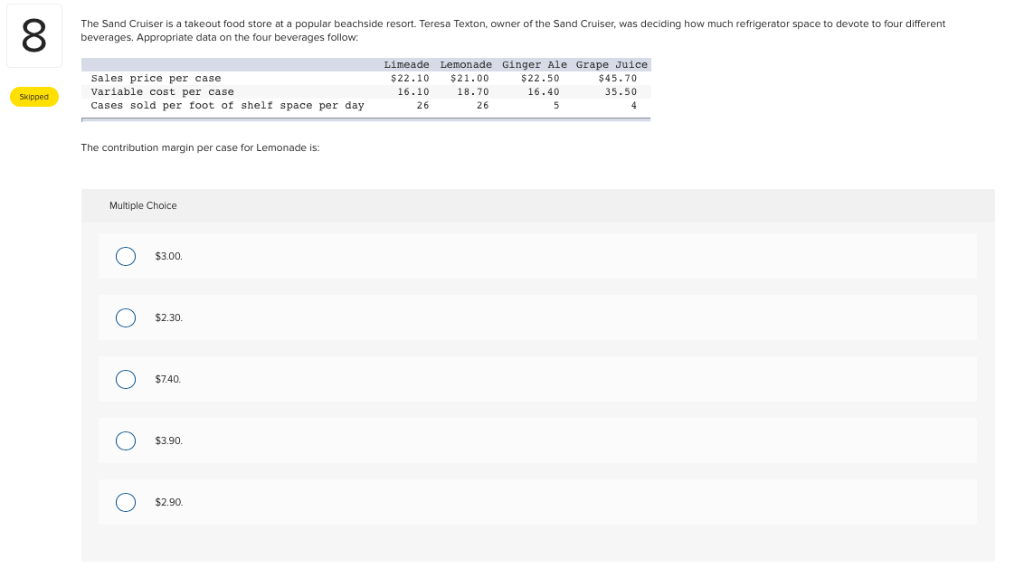

5 The following cost information pertained to the Violin Division of Stringing Music Co. and was based on monthly demand and sales of 100 units: Per-Unit Costs Variable production costs: Direct materials Direct labor Variable factory overhead $ 290 320 230 Fixed production costs: Depreciation (equipment) Factory rent Other 190 218 46 $1,294 Total production cost Variable selling & administrative costs $58 per unit Fixed selling & administrative costs70 per unit Assume that the Violin Division was evaluating whether it would accept a special sales order for 95 violins at $560 per unit. For this purpose, total relevant cost per unit (given the costs stated above) is Multiple Choice $898. $910. $886 $840. $560 6 Preston Industries, Inc. currently manufactures part QX100, which is used in several products produced by the company. Monthly production costs for 10,000 units of QX100 are as follows: Direct materials Direct labor Variable overhead costs Fixed overhead costs $ 76,000 $ 23,000 $ 53,000 43,000 $195,000 Siopped Total manufacturing costs Accounting has estimated that 20% of the fixed overhead costs currently assigned to QX100 would not be needed if the company chose to purchase the part from an outside supplier. Preston currently has the option of purchasing the part from an outside supplier at $16.00 per unit Based solely on a short-run financial analysis, the maximum price that Preston should be willing to pay the outside vendor for each unit of QX100 is: Multiple Choice $16.06 $10.26 $16.26 $11.26 $15.26 Keego Enterprises manufactures two products, boat wax and car wax, in two departments, Mixing and Packaging. The Mixing Department has 900 hours per month available while the Packaging Department has 1,100 hours per month available. Production of the two products cannot exceed 44,000 pounds. Data on the two products follow Contribution Margin (per 100 pounds) $100 $130 Hours per 100 Pounds of output: Mixing (M) Hours per 100 Pounds of output: Packaging Product Boat wax (B) Car wax (C) 7.0 2.7 4.2 The Mixing Department (M) constraint for the Keego linear program would be (where B and C are expressed in 100-pound units of output): Multiple Choice 7B +2.7C 2 900. 7B+2.7C s 900 9.7M +9.2P s 44000 B+2.7C 900. 27M5P s 44000 The Sand Cruiser is a takeout food store at a popular beachside resort. Teresa Texton, owner of the Sand Cruiser, was deciding how much refrigerator space to devote to four different beverages. Appropriate data on the four beverages follow Limeade Lemonade Ginger Ale Grape Juice Sales price per case Variable cost per case Cases sold per foot of shelf space per day $22.10 $21.00 18.70 26 16.10 26 $22.50 16.40 $45.70 35.50 Skipped The contribution margin per case for Lemonade is: Multiple Choice $3.00. $2.30 $7.40 $3.90. $2.90