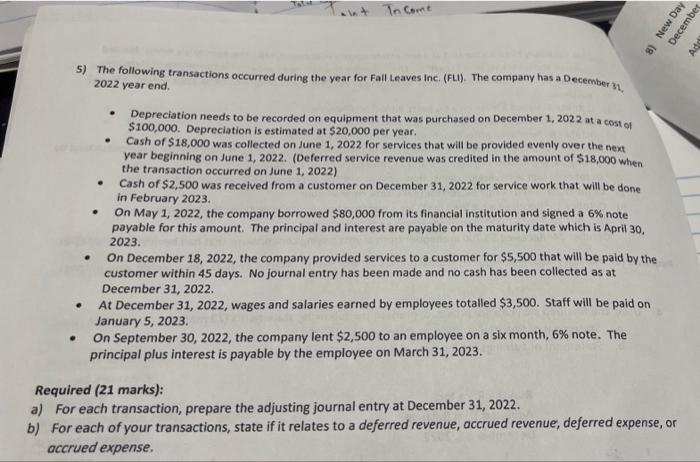

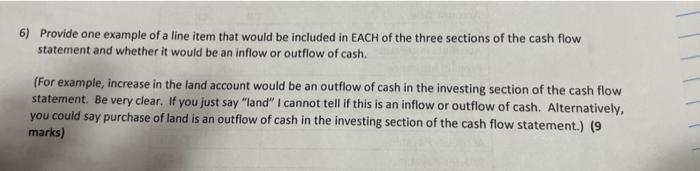

5) The following transactions occurred during the year for Fall Leaves inc. (FUL). The company has a December 31 . 2022 year end. - Depreciation needs to be recorded on equipment that was purchased on December 1,2022 at a cost of $100,000. Depreciation is estimated at $20,000 per year. - Cash of $18,000 was collected on June 1,2022 for services that will be provided evenly over the next year beginning on June 1,2022 . (Deferred service revenue was credited in the amount of $18,000 when the transaction occurred on June 1,2022) - Cash of $2,500 was received from a customer on December 31, 2022 for service work that will be done in February 2023. - On May 1, 2022, the company borrowed $80,000 from its financial institution and signed a 6% note payable for this amount. The principal and interest are payable on the maturity date which is April 30 . 2023. - On December 18, 2022, the company provided services to a customer for $5,500 that will be paid by the customer within 45 days. No journal entry has been made and no cash has been collected as at December 31, 2022. - At December 31, 2022, wages and salaries earned by employees totalled $3,500. Staff will be paid on January 5, 2023. - On September 30, 2022, the company lent $2,500 to an employee on a six month, 6% note. The principal plus interest is payable by the employee on March 31, 2023. Required (21 marks): a) For each transaction, prepare the adjusting journal entry at December 31,2022. b) For each of your transactions, state if it relates to a deferred revenue, accrued revenue, deferred expense, or accrued expense. 6) Provide one example of a line item that would be included in EACH of the three sections of the cash flow statement and whether it would be an inflow or outflow of cash. (For example, increase in the land account would be an outflow of cash in the investing section of the cash flow statement. Be very clear. If you just say "land" I cannot tell if this is an inflow or outflow of cash. Alternatively, you could say purchase of land is an outfiow of cash in the investing section of the cash flow statement.) ( 9 marks)