Answered step by step

Verified Expert Solution

Question

1 Approved Answer

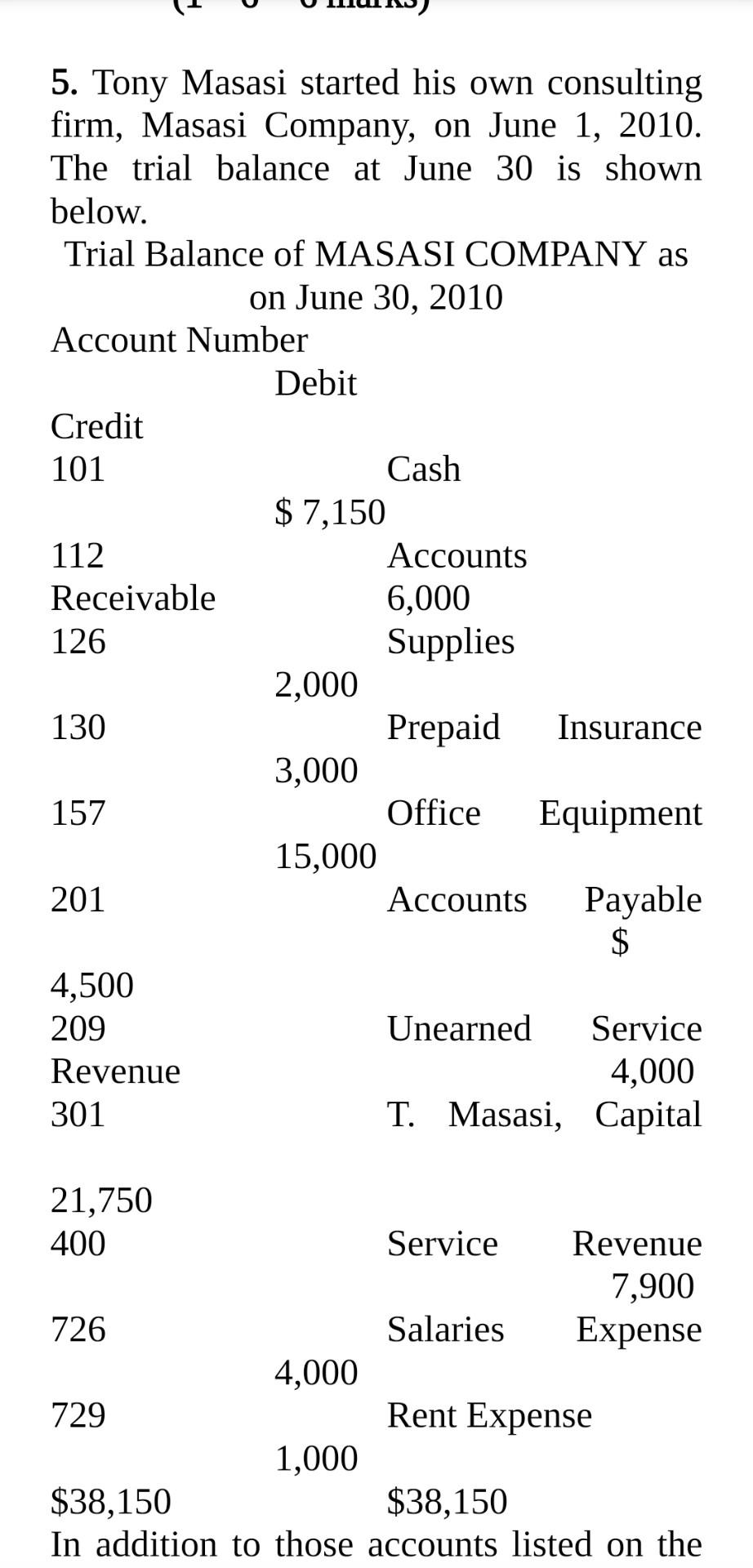

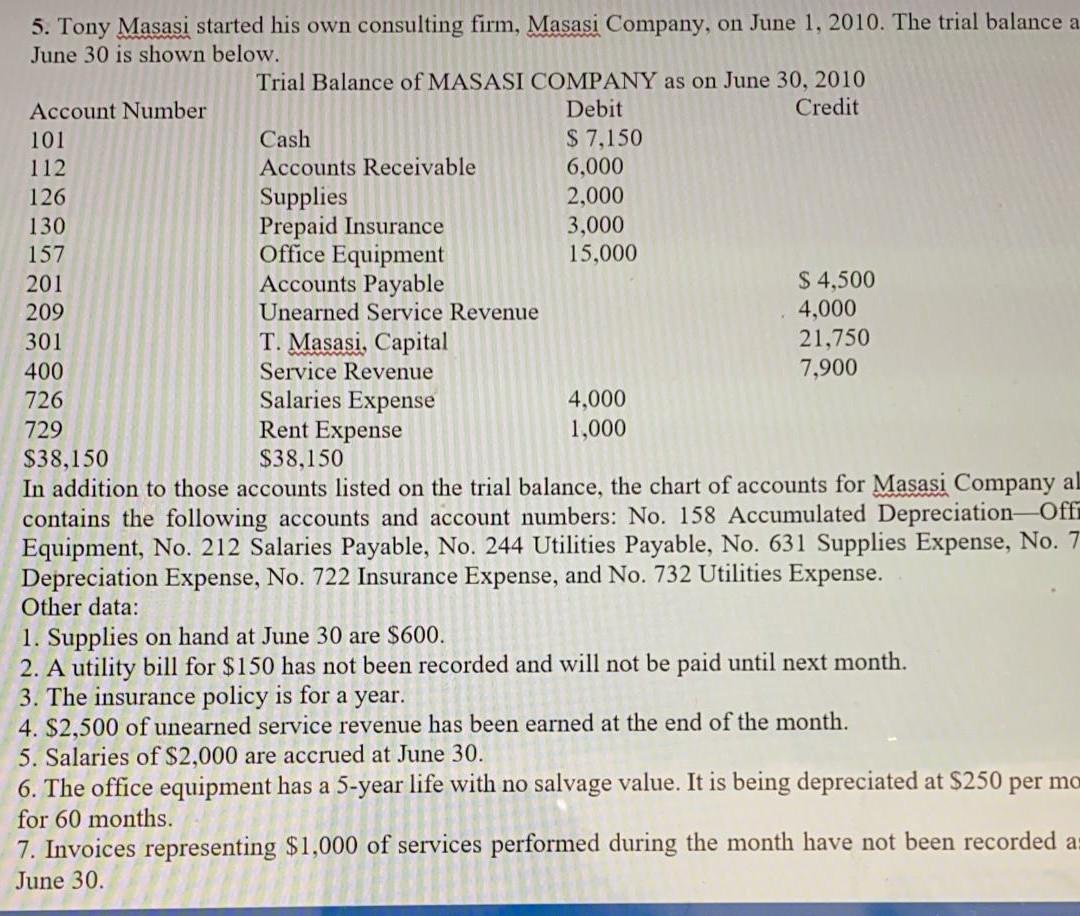

> 5. Tony Masasi started his own consulting firm, Masasi Company, on June 1, 2010. The trial balance at June 30 is shown below. Trial

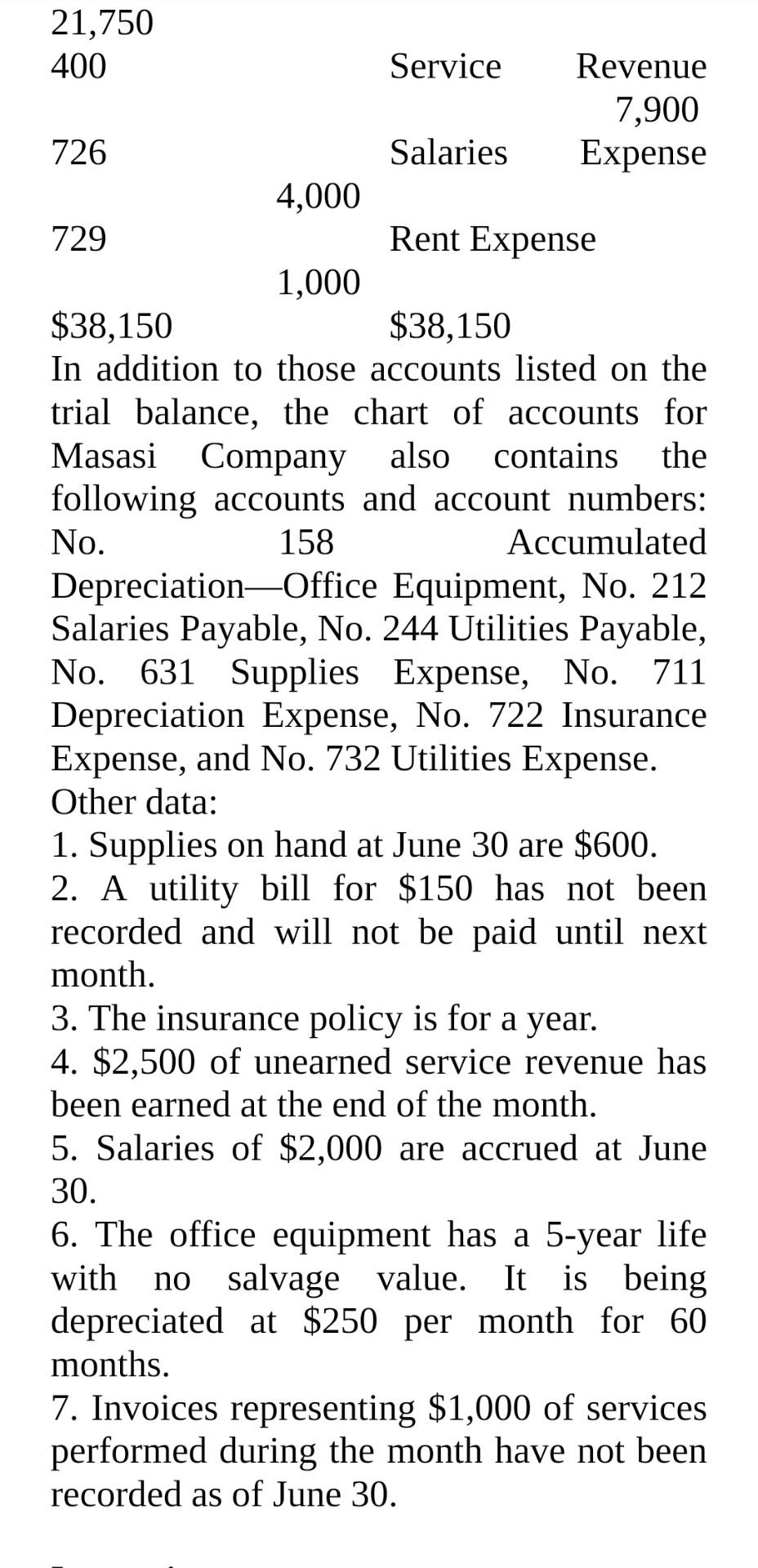

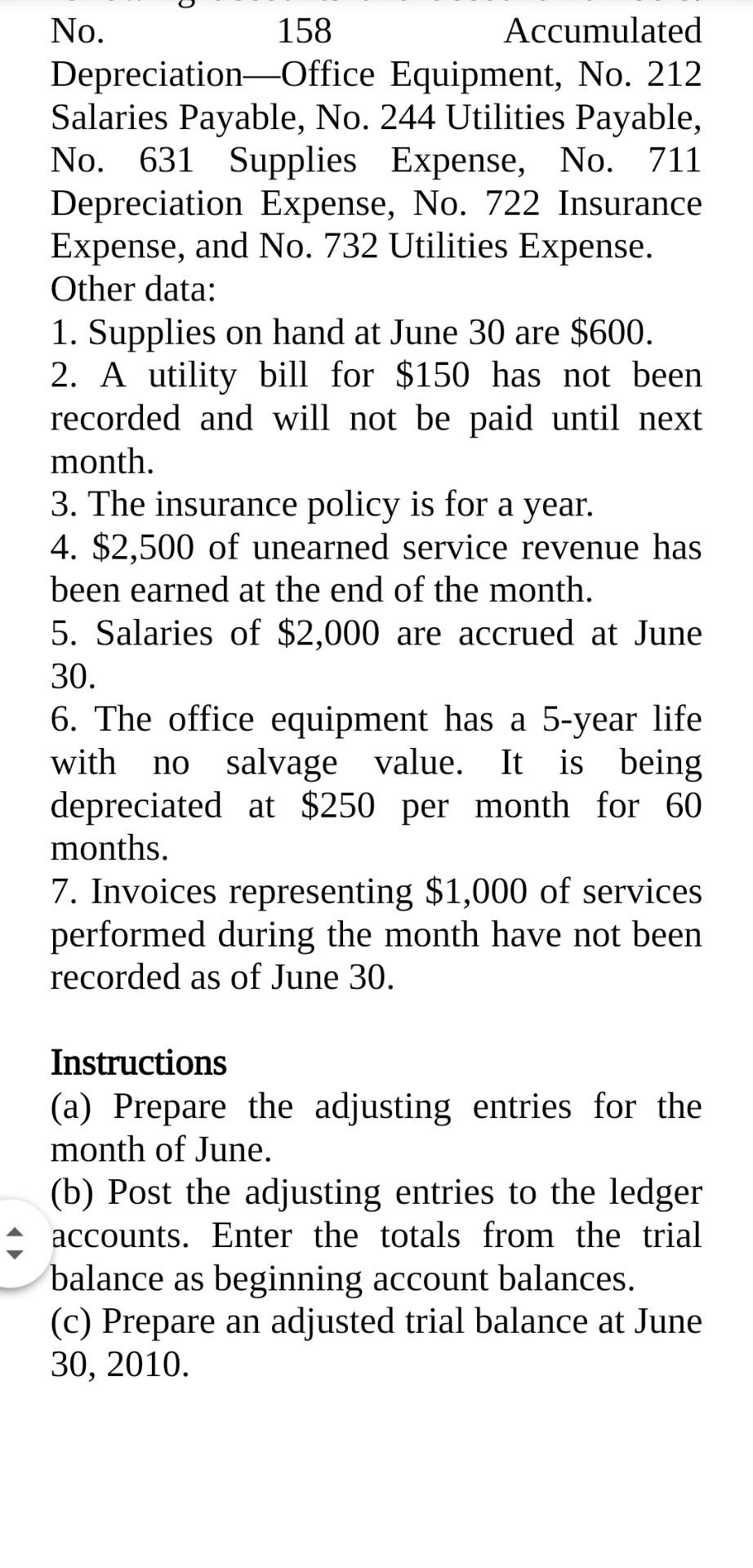

> 5. Tony Masasi started his own consulting firm, Masasi Company, on June 1, 2010. The trial balance at June 30 is shown below. Trial Balance of MASASI COMPANY as on June 30, 2010 Account Number Debit Credit 101 Cash $ 7,150 112 Accounts Receivable 6,000 126 Supplies 2,000 130 Prepaid Insurance 3,000 157 Office Equipment 15,000 201 Accounts Payable $ 4,500 209 Unearned Service Revenue 4,000 301 T. Masasi, Capital 21,750 400 Service Revenue 7,900 726 Salaries Expense 4,000 729 Rent Expense 1,000 $38,150 $38,150 In addition to those accounts listed on the 21,750 400 Service Revenue 7,900 726 Salaries Expense 4,000 729 Rent Expense 1,000 $38,150 $38,150 In addition to those accounts listed on the trial balance, the chart of accounts for Masasi Company also contains the following accounts and account numbers: No. 158 Accumulated DepreciationOffice Equipment, No. 212 Salaries Payable, No. 244 Utilities Payable, No. 631 Supplies Expense, No. 711 Depreciation Expense, No. 722 Insurance Expense, and No. 732 Utilities Expense. Other data: 1. Supplies on hand at June 30 are $600. 2. A utility bill for $150 has not been recorded and will not be paid until next month. 3. The insurance policy is for a year. 4. $2,500 of unearned service revenue has been earned at the end of the month. 5. Salaries of $2,000 are accrued at June 30. 6. The office equipment has a 5-year life with no salvage value. It is being depreciated at $250 per month for 60 months. 7. Invoices representing $1,000 of services performed during the month have not been recorded as of June 30. No. 158 Accumulated DepreciationOffice Equipment, No. 212 Salaries Payable, No. 244 Utilities Payable, No. 631 Supplies Expense, No. 711 Depreciation Expense, No. 722 Insurance Expense, and No. 732 Utilities Expense. Other data: 1. Supplies on hand at June 30 are $600. 2. A utility bill for $150 has not been recorded and will not be paid until next month. 3. The insurance policy is for a year. 4. $2,500 of unearned service revenue has been earned at the end of the month. 5. Salaries of $2,000 are accrued at June 30. 6. The office equipment has a 5-year life with no salvage value. It is being depreciated at $250 per month for 60 months. 7. Invoices representing $1,000 of services performed during the month have not been recorded as of June 30. Instructions (a) Prepare the adjusting entries for the month of June. (b) Post the adjusting entries to the ledger accounts. Enter the totals from the trial balance as beginning account balances. (C) Prepare an adjusted trial balance at June 30, 2010. 5. Tony Masasi started his own consulting firm, Masasi Company, on June 1, 2010. The trial balance a June 30 is shown below. Trial Balance of MASASI COMPANY as on June 30, 2010 Account Number Debit Credit 101 Cash $ 7,150 112 Accounts Receivable 6,000 126 Supplies 2,000 130 Prepaid Insurance 3,000 157 Office Equipment 15,000 201 Accounts Payable $ 4,500 209 Unearned Service Revenue 4,000 301 T. Masasi, Capital 21,750 400 Service Revenue 7,900 726 Salaries Expense 4,000 729 Rent Expense 1,000 $38,150 $38,150 In addition to those accounts listed on the trial balance, the chart of accounts for Masasi Company al contains the following accounts and account numbers: No. 158 Accumulated Depreciation Offi Equipment, No. 212 Salaries Payable, No. 244 Utilities Payable, No. 631 Supplies Expense, No. 7 Depreciation Expense, No. 722 Insurance Expense, and No. 732 Utilities Expense. Other data: 1. Supplies on hand at June 30 are $600. 2. A utility bill for $150 has not been recorded and will not be paid until next month. 3. The insurance policy is for a year. 4. $2,500 of unearned service revenue has been earned at the end of the month. 5. Salaries of $2,000 are accrued at June 30. 6. The office equipment has a 5-year life with no salvage value. It is being depreciated at $250 per mo for 60 months. 7. Invoices representing $1,000 of services performed during the month have not been recorded a: June 30. No. 122. basura

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started