Answered step by step

Verified Expert Solution

Question

1 Approved Answer

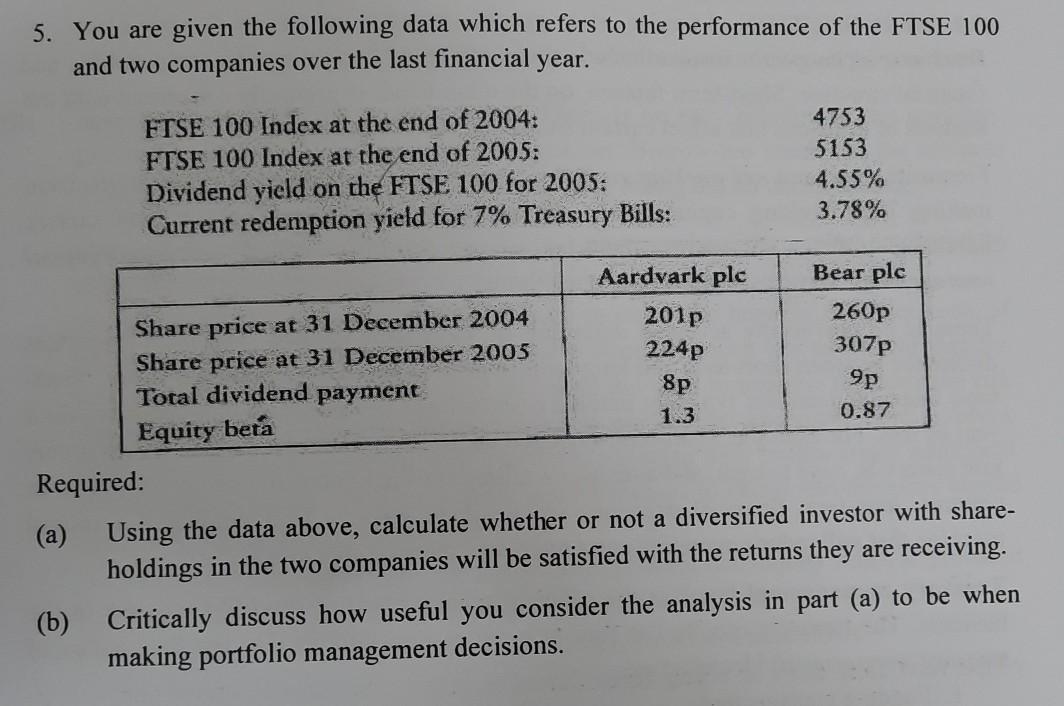

5. You are given the following data which refers to the performance of the FTSE 100 and two companies over the last financial year. FTSE

5. You are given the following data which refers to the performance of the FTSE 100 and two companies over the last financial year. FTSE 100 Index at the end of 2004: FTSE 100 Index at the end of 2005: Dividend yield on the FTSE 100 for 2005: Current redemption yield for 7% Treasury Bills: 4753 5153 4.55% 3.78% Aardvark plc Bear plc Share price at 31 December 2004 2017 260p Share price at 31 December 2005 224p 307p Total dividend payment 8p 9p 1.3 0.87 Equity beta Required: (a) Using the data above, calculate whether or not a diversified investor with share- holdings in the two companies will be satisfied with the returns they are receiving. (b) Critically discuss how useful you consider the analysis in part (a) to be when making portfolio management decisions. 5. You are given the following data which refers to the performance of the FTSE 100 and two companies over the last financial year. FTSE 100 Index at the end of 2004: FTSE 100 Index at the end of 2005: Dividend yield on the FTSE 100 for 2005: Current redemption yield for 7% Treasury Bills: 4753 5153 4.55% 3.78% Aardvark plc Bear plc Share price at 31 December 2004 2017 260p Share price at 31 December 2005 224p 307p Total dividend payment 8p 9p 1.3 0.87 Equity beta Required: (a) Using the data above, calculate whether or not a diversified investor with share- holdings in the two companies will be satisfied with the returns they are receiving. (b) Critically discuss how useful you consider the analysis in part (a) to be when making portfolio management decisions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started