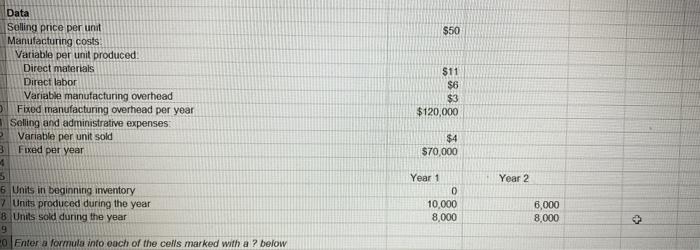

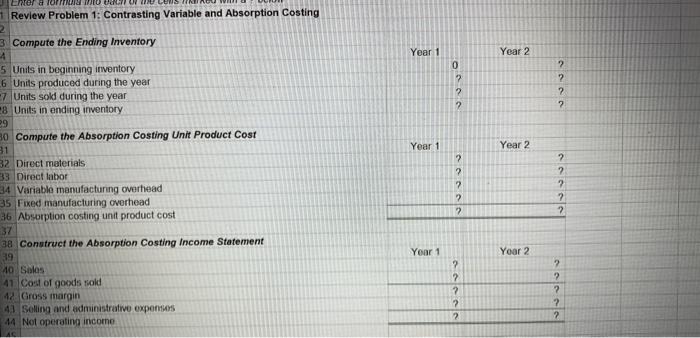

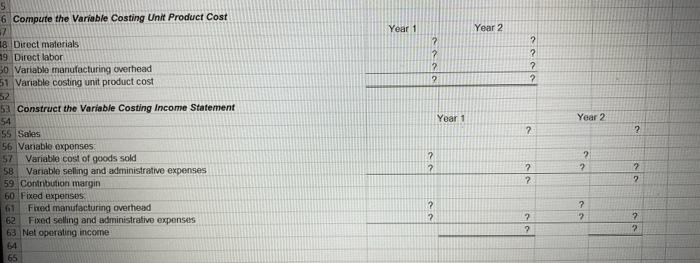

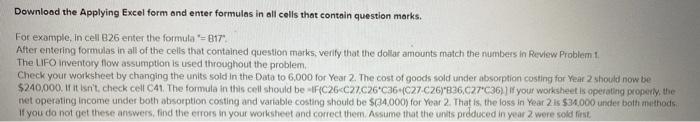

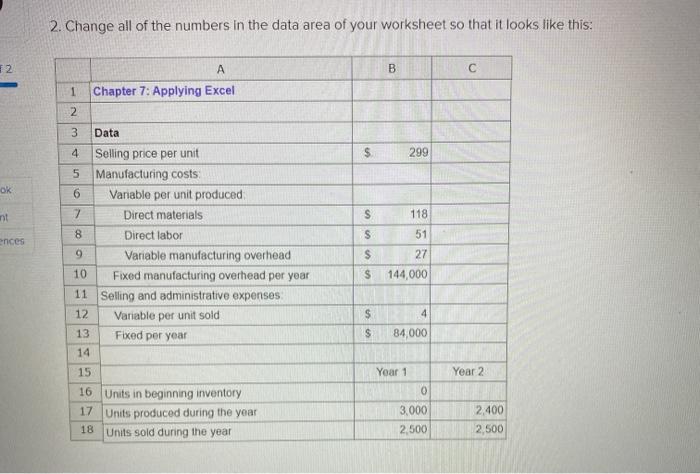

$50 Data Selling price per unit Manufacturing costs Variable per unit produced Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead per year Selling and administrative expenses Variable per unit sold 3 Fixed per year 4 $11 $6 $3 $120,000 $4 $70,000 Year 2 6 Units in beginning inventory 7 Units produced during the year 8 Units sold during the year 9 Enter a formula into each of the cells marked with a ? below Year 1 0 10.000 8,000 6,000 8,000 Year Year 1 Year 2 0 2 2 2 2 2 2 2 Year 1 Year 2 Enter a forma Review Problem 1: Contrasting Variable and Absorption Costing 2 3 Compute the Ending Inventory 4 5 Units in beginning inventory 6 Units produced during the year 7 Units sold during the year 8 Units in ending inventory 29 30 Compute the Absorption Costing Unit Product Cost 31 32 Direct materials 33 Direct labor 34 Variable manufacturing overhead 35 Fixed manufacturing overhead 36 Absorption costing unit product cost 37 38 Conutruct the Absorption Costing Income Statement 39 40 Sales 41 Cost of goods sold 42. Cross margin 41 Soling and administrative expenses 44 Not operating income ? 2 2 2 2 7 2 2 2 2 Year 1 Yoar 2 ? 2 2 ? 2 ? ? ? ? 2 Year 1 Year 2 6 Compute the Variable Costing Unit Product Cost 7 18 Direct materials 19 Direct labor 30 Variable manufacturing overhead 51 Variable costing unit product cost ? ? 2 ? 2 2 ? ? Year 1 Year 2 2 2 53 Construct the Variable Costing Income Statement 54 55 Sales 56 Variable expenses -57 Variable cost of goods sold 58 Variable selling and administrative expenses 59. Contribution margin 60 Fixed expenses 61 Fred manufacturing overhead 62 Fixed selling and administrative expenses 63 Net operating income 7 7 ?? 2 2 2 ? ? 2 ? 2 ? ? 2 ? 65 Download the Applying Excel form and enter formules in all cells that contain question marks. For example, in cell 826 enter the formula = 817" After entering formulas in all of the cells that contained question marks, verify that the dollar amounts match the numbers in Review Problem 1. The UFO inventory flow assumption is used throughout the problem Check your worksheet by changing the units sold in the Data to 6,000 for Year 2. The cost of goods sold under absorption costing for Year 2 should now be $240,000. If it isn't check cell C41. The formula in this cell should be 1FC26C27026C36C27.026)*836.027C36)) if your worksheet is operating properly, the net operating Income under both absorption costing and variable costing should be $34.000) for Year 2. That is the loss in Year 2 is $34.000 under both methods If you do not get these answers, find the errors in your worksheet and correct them. Assume that the units produced in year 2 were sold first 2. Change all of the numbers in the data area of your worksheet so that it looks like this: 2 A B 1 Chapter 7: Applying Excel 2 3 Data $ 299 ok s nt S 118 s ences 4 Selling price per unit 5 Manufacturing costs 6 Variable per unit produced 7 Direct materials 8 Direct labor 9 Variable manufacturing overhead 10 Fixed manufacturing overhead per year 11 Selling and administrative expenses 12 Variable per unit sold 13 Fixed per year 14 $ $ 51 27 144,000 S os 4 84,000 15 Year 2 16 Units in beginning inventory 17 Units produced during the year 18 Units sold during the year Year 1 0 3,000 2.500 2,400 2,500 If your formulas are correct, you should get the correct answers to the following questions. (a) What is the net operating income (loss) in Year 1 under absorption costing