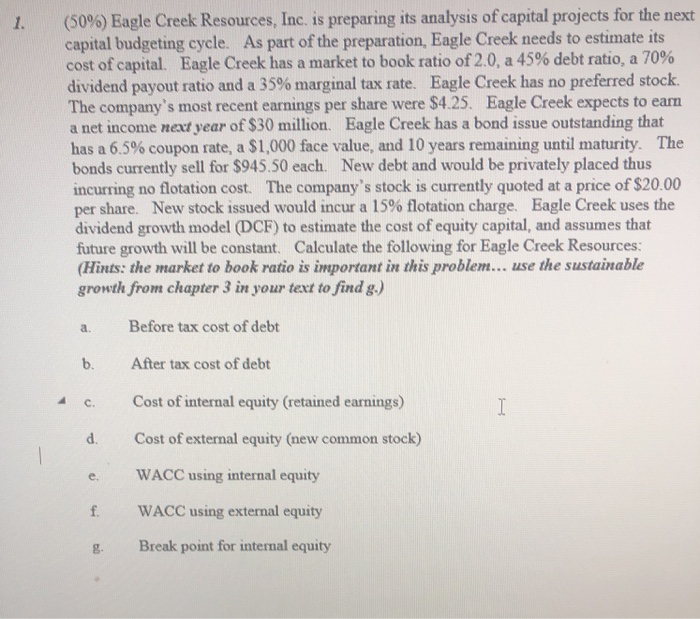

(50%) Eagle Creek Resources, Inc. is preparing its analysis of capital projects for the next capital budgeting cycle. As part of the preparation, Eagle Creek needs to estimate its cost of capital. Eagle Creek has a market to book ratio of 2.0, a 45% debt ratio, a 70% dividend payout ratio and a 35% marginal tax rate. Eagle Creek has no preferred stock. The company's most recent earnings per share were $4.25. Eagle Creek expects to earm a net income next year of $30 million. Eagle Creek has a bond issue outstanding that has a 65% coupon rate, a $1,000 face value, and 10 years remaining until maturity. The bonds currently sell for $945.50 each. New debt and would be privately placed thus incurring no flotation cost. The company's stock is currently quoted at a price of $20.00 per share. New stock issued would incur a 15% flotation charge. Eagle Creek uses the dividend growth model (DCF) to estimate the cost of equity capital, and assumes that future growth will be constant. Calculate the following for Eagle Creek Resources Hints: the market to book ratio is important in this problem... use the sustainable growth from chapter 3 in your text to find g.) Before tax cost of debt After tax cost of debt Cost of internal equity (retained earnings) a. b. 4 C. d. Cost of external equity (new common stock) e. WACC using internal equity f WACC using external equity g. Break point for internal equity (50%) Eagle Creek Resources, Inc. is preparing its analysis of capital projects for the next capital budgeting cycle. As part of the preparation, Eagle Creek needs to estimate its cost of capital. Eagle Creek has a market to book ratio of 2.0, a 45% debt ratio, a 70% dividend payout ratio and a 35% marginal tax rate. Eagle Creek has no preferred stock. The company's most recent earnings per share were $4.25. Eagle Creek expects to earm a net income next year of $30 million. Eagle Creek has a bond issue outstanding that has a 65% coupon rate, a $1,000 face value, and 10 years remaining until maturity. The bonds currently sell for $945.50 each. New debt and would be privately placed thus incurring no flotation cost. The company's stock is currently quoted at a price of $20.00 per share. New stock issued would incur a 15% flotation charge. Eagle Creek uses the dividend growth model (DCF) to estimate the cost of equity capital, and assumes that future growth will be constant. Calculate the following for Eagle Creek Resources Hints: the market to book ratio is important in this problem... use the sustainable growth from chapter 3 in your text to find g.) Before tax cost of debt After tax cost of debt Cost of internal equity (retained earnings) a. b. 4 C. d. Cost of external equity (new common stock) e. WACC using internal equity f WACC using external equity g. Break point for internal equity