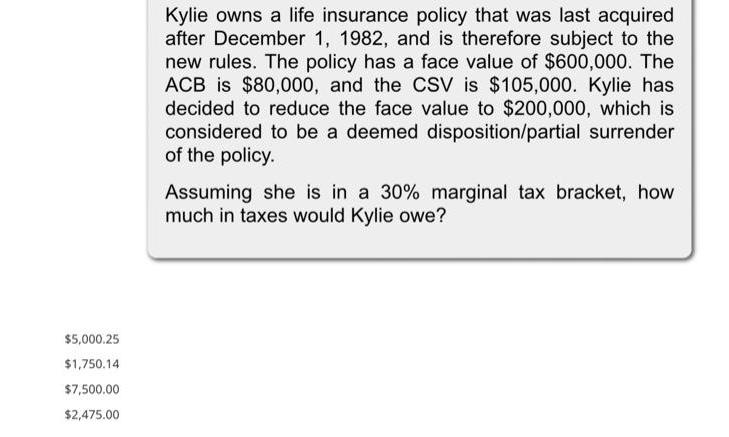

$5,000.25 $1,750.14 $7,500.00 $2,475.00 Kylie owns a life insurance policy that was last acquired after December 1, 1982, and is therefore subject to the

$5,000.25 $1,750.14 $7,500.00 $2,475.00 Kylie owns a life insurance policy that was last acquired after December 1, 1982, and is therefore subject to the new rules. The policy has a face value of $600,000. The ACB is $80,000, and the CSV is $105,000. Kylie has decided to reduce the face value to $200,000, which is considered to be a deemed disposition/partial surrender of the policy. Assuming she is in a 30% marginal tax bracket, how much in taxes would Kylie owe?

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below PARTICULARS AMOUNT Cash Surrender Value ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started