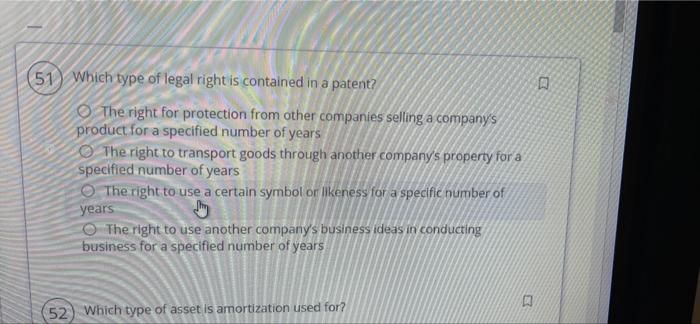

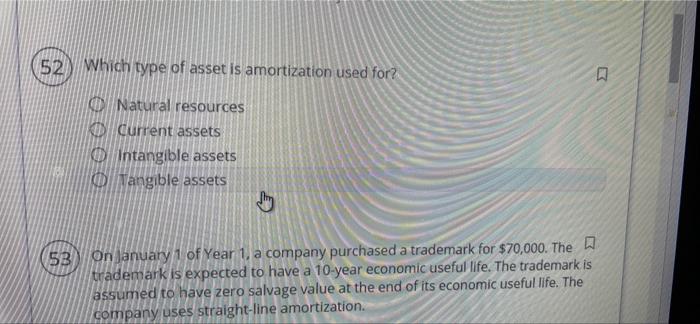

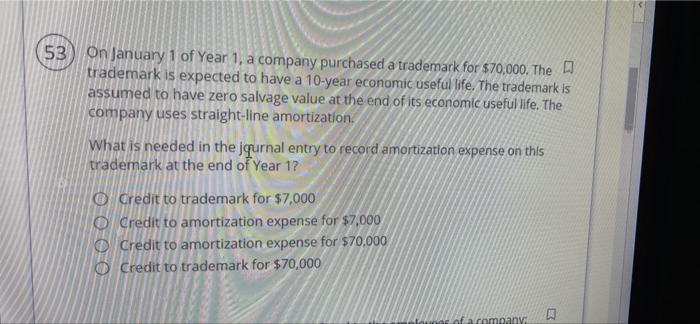

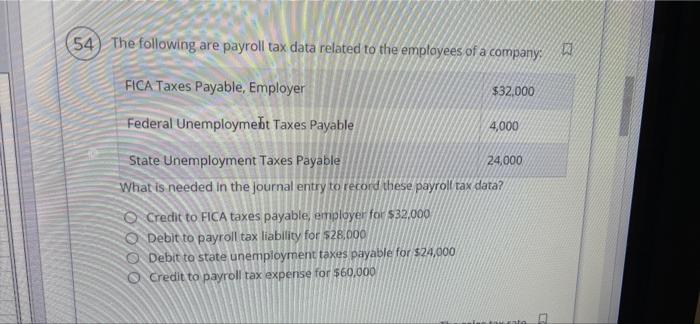

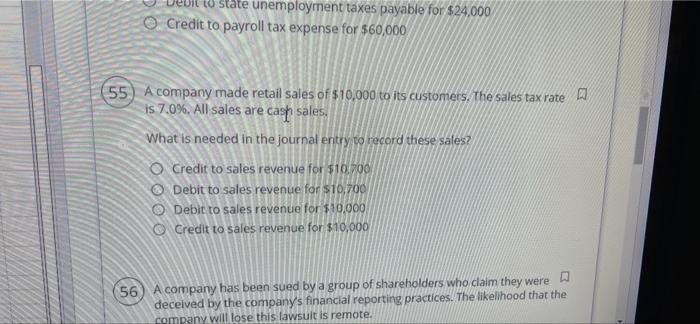

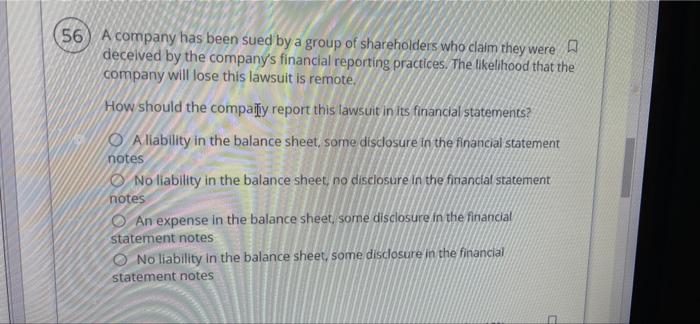

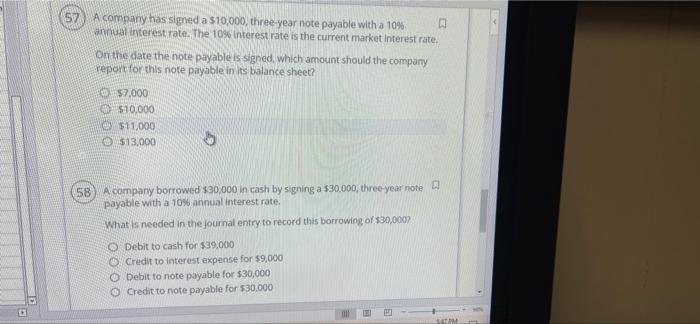

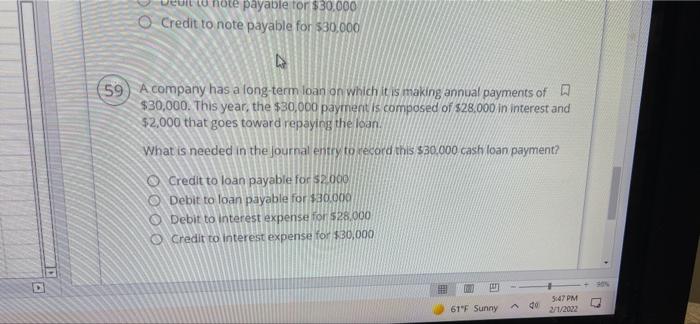

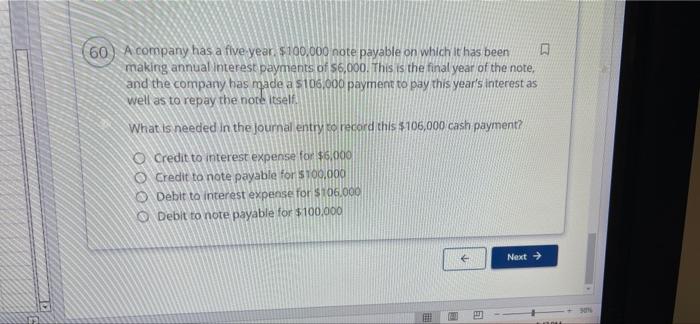

(51) Which type of legal right is contained in a patent? The right for protection from other companies selling a company's product for a specified number of years The right to transport goods through another company's property for a specified number of years The right to use a certain symbol or likeness for a specific number of years The right to use another company's business ideas in conducting business for a specified number of years (52) Which type of asset is amortization used for? (52 Which type of asset is amortization used for? Natural resources Current assets Intangible assets Tangible assets 5B On January 1 of Year 1, a company purchased a trademark for $70,000. The a trademark is expected to have a 10-year economic useful life. The trademark is assumed to have zero salvage value at the end of its economic useful life. The company uses straight-line amortization 53) On January 1 of Year 1, a company purchased a trademark for $70,000. The trademark is expected to have a 10-year economic useful life. The trademark is assumed to have zero salvage value at the end of its economic useful life. The company uses straight-line amortization. What is needed in the qurnal entry to record amortization expense on this trademark at the end of Year 1? O Credit to trademark for $7,000 Credit to amortization expense for $7,000 Credit to amortization expense for $70,000 o Credit to trademark for $70,000 of a company (54) The following are payroll tax data related to the employees of a company: $32,000 FICA Taxes Payable, Employer Federal Unemploymebt Taxes Payable 4,000 State Unemployment Taxes Payable 24,000 What is needed in the journal entry to record these payroll tax data? O Credit to FICA taxes payable, employer for $32,000 O Debit to payroll tax liability for $28.000 Debit to state unemployment taxes payable for $24,000 O Credit to payroll tax expense for $60,000 state unemployment taxes payable for $24,000 O Credit to payroll tax expense for 560,000 (55) A company made retail sales of $10,000 to its customers. The sales tax rate is 7.0%. All sales are cash sales. What is needed in the journal entry to record these sales? O Credit to sales revenue for $10.700 Debit to sales revenue for $10,700 O Debit to sales revenue for $10,000 Credit to sales revenue for $10,000 56) A company has been sued by a group of shareholders who claim they were deceived by the company's financial reporting practices. The likelihood that the company will lose this lawsuit is remote. 56 A company has been sued by a group of shareholders who claim they were 0 deceived by the company's financial reporting practices. The likelihood that the company will lose this lawsuit is remote. How should the compailly report this lawsuit in its financial statements? A liability in the balance sheet, some disclosure in the financial statement notes O No liability in the balance sheet, no disclosure in the financial statement notes O An expense in the balance sheet, some disclosure in the financial statement notes O No liability in the balance sheet some disclosure in the financial statement notes 57 A company has signed a $10,000, three year note payable with a 10% annual interest rate. The 10% interest rate is the current market interest rate. On the date the note payable is signed, which amount should the company report for this note payable in its balance sheet? 57,000 $10.000 $11,000 $13,000 58 A company borrowed $30,000 in cash by signing a $30,000, three-year note payable with a 10% annual interest rate What is needed in the journal entry to record this borrowing of $30,000 O Debit to cash for $39.000 Credit to interest expense for $9,000 O Debit to note payable for $30,000 Credit to note payable for 530,000 SEM to note payable for $30,000 Credit to note payable for $30,000 AN (59) A company has a long term loan on which it is making annual payments of a $30,000. This year, the $30,000 payment is composed of $28.000 in interest and $2,000 that goes toward repaying the loan What is needed in the journal entry to record this $30.000 cash loan payment? Credit to loan payable for 2000 Debit to loan payable for $30.000 O Debit to interest expense for $28.000 o Credit to interest expense for $30,000 D 51 61"F Sunny A 5:47 PM 71/2002 do 60) A company has a five year $100,000 note payable on which it has been D making annual interest payments of $6,000. This is the final year of the note, and the company has made a $106.000 payment to pay this year's interest as well as to repay the note itself What is needed in the journal entry to record this $106,000 cash payment? o Credit to interest expense for $6,000 O Credit to note payable for $700.000 O Debit to interest expense for $106.000 O Debit to note payable for $100.000 Next