Answered step by step

Verified Expert Solution

Question

1 Approved Answer

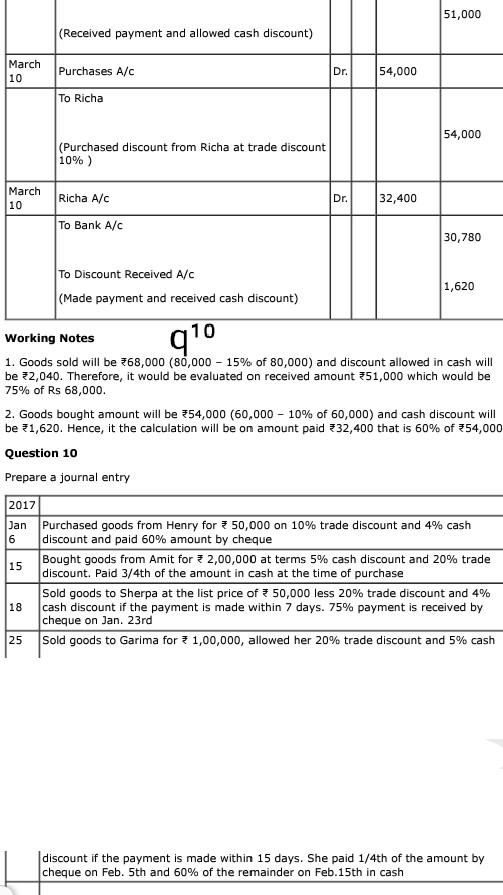

51,000 (Received payment and allowed cash discount) March 10 Dr. 54,000 Purchases A/C To Richa 54,000 (Purchased discount from Richa at trade discount 10% )

51,000 (Received payment and allowed cash discount) March 10 Dr. 54,000 Purchases A/C To Richa 54,000 (Purchased discount from Richa at trade discount 10% ) March 10 Richa A/C Dr. 32,400 To Bank A/C 30,780 To Discount Received A/C 1,620 (Made payment and received cash discount) 10 Working Notes 1. Goods sold will be 368,000 (80,000 - 15% of 80,000) and discount allowed in cash will be 72,040. Therefore, it would be evaluated on received amount *51,000 which would be 75% of Rs 68,000. 2. Goods bought amount will be 354,000 (60,000 - 10% of 60,000) and cash discount will be 21,620. Hence, it the calculation will be on amount paid 32,400 that is 60% of 54,000 Question 10 Prepare a journal entry 2017 Jan Purchased goods from Henry for 7 50,000 on 10% trade discount and 4% cash discount and paid 60% amount by cheque Bought goods from Amit for 7 2,00,000 at terms 5% cash discount and 20% trade discount. Paid 3/4th of the amount in cash at the time of purchase Sold goods to Sherpa at the list price of 50,000 less 20% trade discount and 4% cash discount if the payment is made within 7 days. 75% payment is received by cheque on Jan. 23rd Sold goods to Garima for 3 1,00,000, allowed her 20% trade discount and 5% cash 6 15 18 25 discount if the payment is made within 15 days. She paid 1/4th of the amount by cheque on Feb. 5th and 60% of the remainder on Feb. 15th in cash

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started