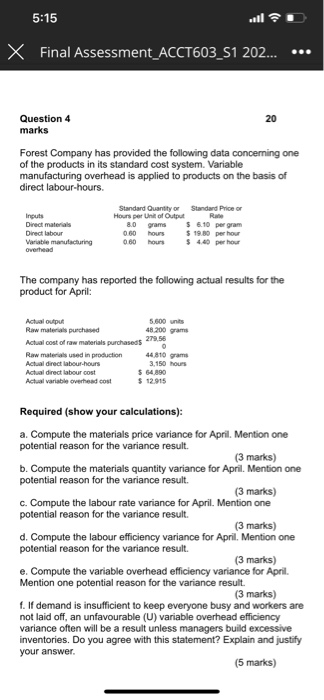

5:15 Final Assessment_ACCT603_51 202... Question 4 20 marks Forest Company has provided the following data concerning one of the products in its standard cost system. Variable manufacturing overhead is applied to products on the basis of direct labour-hours. Standard Quantity or Standard Price or Hours per Unit of Output Direct materials 80 grams $ 6.10 per gram Direct labour 0.00 hours $ 19.80 per hour Variable manufacturing 0.60 hours Overhead The company has reported the following actual results for the product for April: Actual output 5.600 unts Raw materials purchased 48.200 grams Actual cost of raw materials purchased 279.56 0 Raw materials used in production 44.10 game Actual direct labour-hours 3,150 hours Actual direct labour cost $ 64,890 Actual variable overhead cost $ 12.915 Required (show your calculations): a Compute the materials price variance for April. Mention one potential reason for the variance result. (3 marks) b. Compute the materials quantity variance for April. Mention one potential reason for the variance result. (3 marks) c. Compute the labour rate variance for April. Mention one potential reason for the variance result. (3 marks) d. Compute the labour efficiency variance for April. Mention one potential reason for the variance result. (3 marks) e. Compute the variable overhead efficiency variance for April. Mention one potential reason for the variance result. (3 marks) f. If demand is insufficient to keep everyone busy and workers are not laid off, an unfavourable (U) variable overhead efficiency variance often will be a result unless managers build excessive inventories. Do you agree with this statement? Explain and justify your answer. (5 marks) 5:15 Final Assessment_ACCT603_51 202... Question 4 20 marks Forest Company has provided the following data concerning one of the products in its standard cost system. Variable manufacturing overhead is applied to products on the basis of direct labour-hours. Standard Quantity or Standard Price or Hours per Unit of Output Direct materials 80 grams $ 6.10 per gram Direct labour 0.00 hours $ 19.80 per hour Variable manufacturing 0.60 hours Overhead The company has reported the following actual results for the product for April: Actual output 5.600 unts Raw materials purchased 48.200 grams Actual cost of raw materials purchased 279.56 0 Raw materials used in production 44.10 game Actual direct labour-hours 3,150 hours Actual direct labour cost $ 64,890 Actual variable overhead cost $ 12.915 Required (show your calculations): a Compute the materials price variance for April. Mention one potential reason for the variance result. (3 marks) b. Compute the materials quantity variance for April. Mention one potential reason for the variance result. (3 marks) c. Compute the labour rate variance for April. Mention one potential reason for the variance result. (3 marks) d. Compute the labour efficiency variance for April. Mention one potential reason for the variance result. (3 marks) e. Compute the variable overhead efficiency variance for April. Mention one potential reason for the variance result. (3 marks) f. If demand is insufficient to keep everyone busy and workers are not laid off, an unfavourable (U) variable overhead efficiency variance often will be a result unless managers build excessive inventories. Do you agree with this statement? Explain and justify your