Question

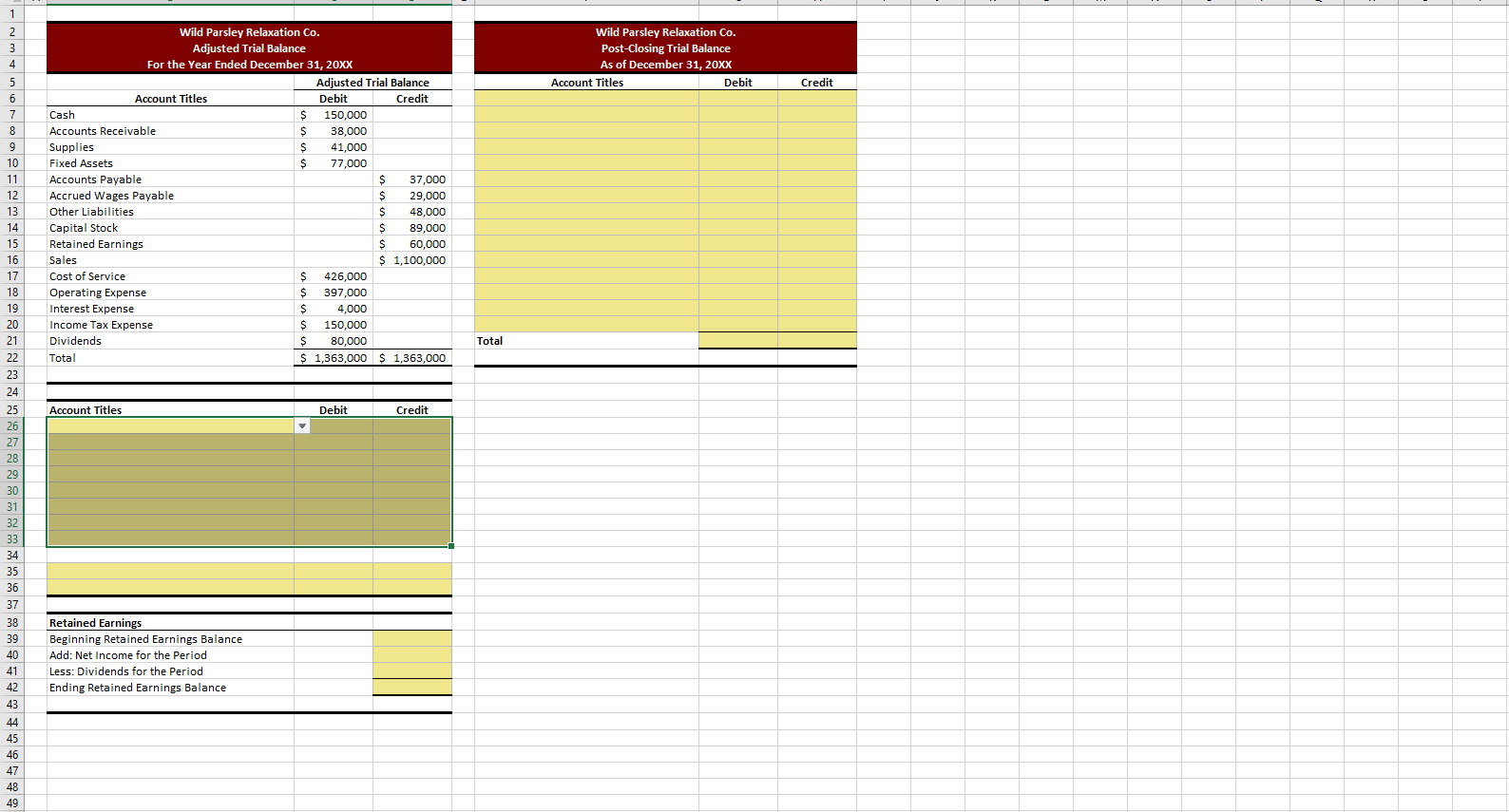

Financial accounting The income statement of Wild Parsley Relaxation Co. is given in the spreadsheet. Leila is asked to prepare journal entries to close revenues

Financial accounting

The income statement of Wild Parsley Relaxation Co. is given in the spreadsheet. Leila is asked to prepare journal entries to close revenues and expenses to retained earnings and to close dividends to retained earnings, and then to create the post-closing trial balance. Complete the following tasks.

In cells B26:D33, prepare the journal entries to close revenues and expenses to retained earnings.

- Debit entries go first followed by credit entries.

- Use the Increase Indent button in the Alignment group of the Home menu tab to indent account titles of credited accounts.

- Choose an appropriate account title in column B from the drop-down list.

- In columns C or D reference the appropriate debit or credit amount for the item from the income statement.

- For the retained earnings account, reference cells in column C and D to calculate the debited or credited amount.

- If any rows are not necessary, leave them blank.

In the table in cells B35:D36, prepare the journal entries to close dividends to retained earnings.

- Debit entries go first followed by credit entries.

- Use the Increase Indent button in the Alignment group of the Home menu tab to indent account titles of credited accounts.

- Choose appropriate account titles in column B from the drop-down list.

- In columns C or D reference appropriate debit or credit amounts for the items from the income statement.

Using the table in cells B38:D43, calculate the ending retained earnings balance.

- In cell D39, reference the appropriate cell from the trial balance above.

- In cells D39:D40, reference appropriate cells from the closing journal entries above before calculating the ending retained earnings amount.

- Calculate the ending retained earning balance in cell D42.

Complete the post-closing trial balance in cells F6:H20.

- In column F, choose appropriate account from the drop-down lists in column F.

- Enter appropriate debit and credit amounts in columns G and H.

- The debit or credit amounts for each account should be referenced in the adjusted trial balance (B2:D23), the closing journal entries (B26:D36) or the retained earnings calculation (B38:D43).

- If any rows are not necessary, leave them blank.

Calculate the total debits and credits.

- In cell G21, use the SUM function to calculate the total of all the debit accounts.

- Use copy and paste to calculate the total of all the credit accounts.

Drop down menu titles:

Cash

Accounts receivable

Supplies

Fixed assets

Accounts payable

Accrued wages payable

Other liabilities

Capital stock

Retained earnings

Sales

Cost of service

Operating expense

Interest expense

Income tax expense

Dividends

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started