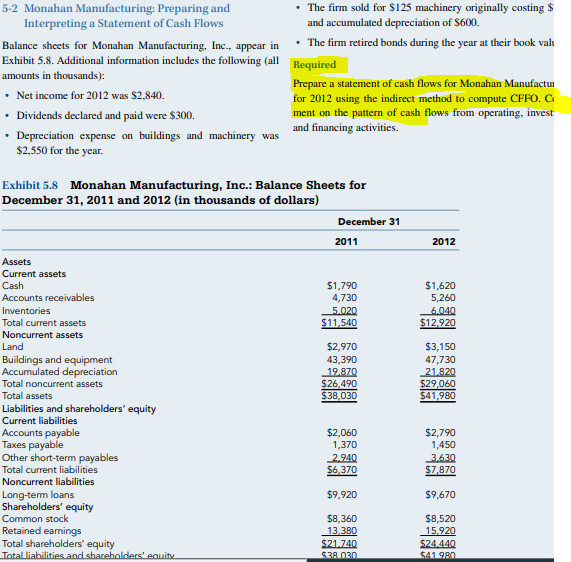

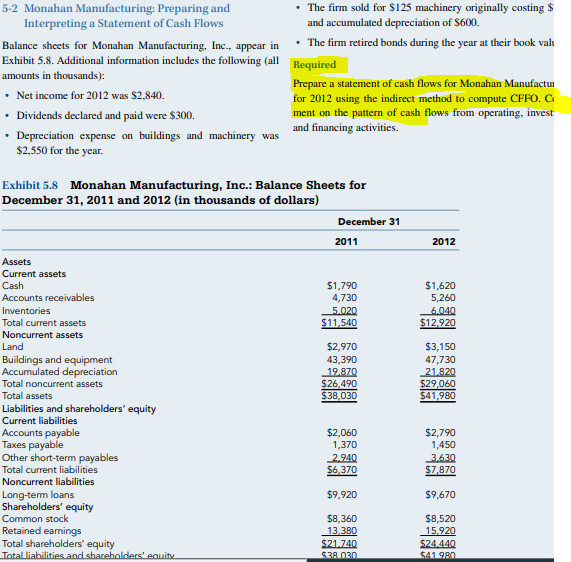

5-2 Monahan Manufacturing: Preparing and The firm sold for $125 machinery originally costing $ Interpreting a Statement of Cash Flows and accumulated depreciation of $600. Balance sheets for Monahan Manufacturing, Inc., appear in . The firm retired bonds during the year at their book vali Exhibit 5.8. Additional information includes the following (all Required amounts in thousands): Prepare a statement of cash flows for Monahan Manufactu Net income for 2012 was $2,840. for 2012 using the indirect method to compute CFFO. Dividends declared and paid were $300. ment on the pattern of cash flows from operating, invest Depreciation expense on buildings and machinery was and financing activities. $2,550 for the year. . 2012 $1,620 5,260 6.040 $12920 Exhibit 5.8 Monahan Manufacturing, Inc.: Balance Sheets for December 31, 2011 and 2012 (in thousands of dollars) December 31 2011 Assets Current assets Cash $1,790 Accounts receivables 4,730 Inventories 5.020 Total current assets $11,540 Noncurrent assets Land $2,970 Buildings and equipment 43,390 Accumulated depreciation 19.870 Total noncurrent assets $26,490 Total assets $38,030 Liabilities and shareholders' equity Current liabilities Accounts payable $2,060 Taxes payable 1,370 Other short-term payables 2.940 Total current liabilities $6,370 Noncurrent liabilities Long-term loans $9.920 Shareholders' equity Common stock $8,360 Retained earnings 13.380 Total shareholders' equity $21.740 Total liabilities and shareholders' eauit $39.030 $3,150 47,730 21.820 $29,060 $41,980 $2,790 1,450 3.630 $7,870 $9,670 $8,520 15.920 $24.440 541 990 5-2 Monahan Manufacturing: Preparing and The firm sold for $125 machinery originally costing $ Interpreting a Statement of Cash Flows and accumulated depreciation of $600. Balance sheets for Monahan Manufacturing, Inc., appear in . The firm retired bonds during the year at their book vali Exhibit 5.8. Additional information includes the following (all Required amounts in thousands): Prepare a statement of cash flows for Monahan Manufactu Net income for 2012 was $2,840. for 2012 using the indirect method to compute CFFO. Dividends declared and paid were $300. ment on the pattern of cash flows from operating, invest Depreciation expense on buildings and machinery was and financing activities. $2,550 for the year. . 2012 $1,620 5,260 6.040 $12920 Exhibit 5.8 Monahan Manufacturing, Inc.: Balance Sheets for December 31, 2011 and 2012 (in thousands of dollars) December 31 2011 Assets Current assets Cash $1,790 Accounts receivables 4,730 Inventories 5.020 Total current assets $11,540 Noncurrent assets Land $2,970 Buildings and equipment 43,390 Accumulated depreciation 19.870 Total noncurrent assets $26,490 Total assets $38,030 Liabilities and shareholders' equity Current liabilities Accounts payable $2,060 Taxes payable 1,370 Other short-term payables 2.940 Total current liabilities $6,370 Noncurrent liabilities Long-term loans $9.920 Shareholders' equity Common stock $8,360 Retained earnings 13.380 Total shareholders' equity $21.740 Total liabilities and shareholders' eauit $39.030 $3,150 47,730 21.820 $29,060 $41,980 $2,790 1,450 3.630 $7,870 $9,670 $8,520 15.920 $24.440 541 990