Answered step by step

Verified Expert Solution

Question

1 Approved Answer

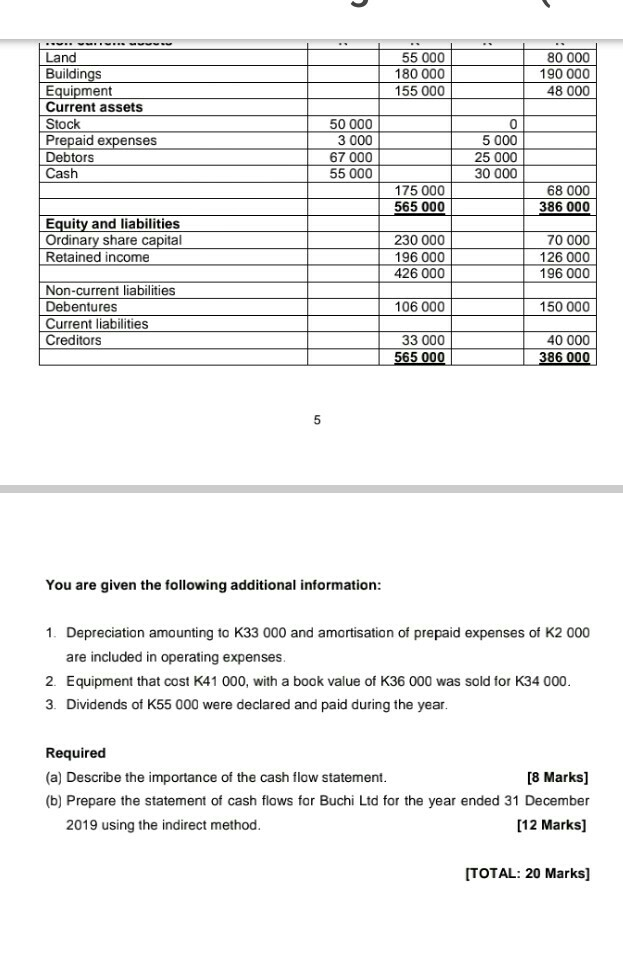

55 000 180 000 155 000 80 000 190 000 48 000 Land Buildings Equipment Current assets Stock Prepaid expenses Debtors Cash 50 000 0

55 000 180 000 155 000 80 000 190 000 48 000 Land Buildings Equipment Current assets Stock Prepaid expenses Debtors Cash 50 000 0 1 5 000 25 000 30 000 67 000 55 000 175 000 565 000 68 000 386 000 Equity and liabilities Ordinary share capital Retained income 230 000 196 000 426 000 70 000 126 000 196 000 106 000 150 000 Non-current liabilities Debentures Current liabilities Creditors 33 000 565 000 40 000 386 000 You are given the following additional information: 1. Depreciation amounting to K33 000 and amortisation of prepaid expenses of K2 000 are included in operating expenses 2. Equipment that cost K41 000, with a book value of K36 000 was sold for K34 000. 3. Dividends of K55 000 were declared and paid during the year. Required (a) Describe the importance of the cash flow statement. [8 Marks] (b) Prepare the statement of cash flows for Buchi Ltd for the year ended 31 December 2019 using the indirect method. [12 Marks] [TOTAL: 20 Marks] 55 000 180 000 155 000 80 000 190 000 48 000 Land Buildings Equipment Current assets Stock Prepaid expenses Debtors Cash 50 000 0 1 5 000 25 000 30 000 67 000 55 000 175 000 565 000 68 000 386 000 Equity and liabilities Ordinary share capital Retained income 230 000 196 000 426 000 70 000 126 000 196 000 106 000 150 000 Non-current liabilities Debentures Current liabilities Creditors 33 000 565 000 40 000 386 000 You are given the following additional information: 1. Depreciation amounting to K33 000 and amortisation of prepaid expenses of K2 000 are included in operating expenses 2. Equipment that cost K41 000, with a book value of K36 000 was sold for K34 000. 3. Dividends of K55 000 were declared and paid during the year. Required (a) Describe the importance of the cash flow statement. [8 Marks] (b) Prepare the statement of cash flows for Buchi Ltd for the year ended 31 December 2019 using the indirect method. [12 Marks] [TOTAL: 20 Marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started