Question

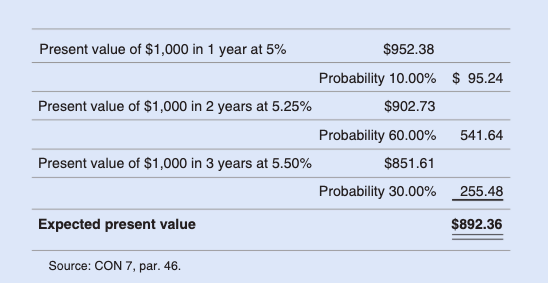

5.5 As noted within the chapter, CON 7 describes techniques for calculating present value, including the following illustration of the expected cash flow approach, reproduced

5.5 As noted within the chapter, CON 7 describes techniques for calculating present value, including the following illustration of the expected cash flow approach, reproduced from CON 7. This example illustrates how the expected cash flow approach can be used to assign probability factors to the likelihood of receiving a $1,000 cash flow in any of three possible future years.

a. Review the guidance in CON 7 and, in your own words, explain in approximately one paragraph the difference between the traditional (best estimate) and expected present value techniques for measuring fair value.

b. Assume that you are a lender determining the present value of this sample receivable illustrated in CON 7. Under the traditional approach, what would the present value of that receivable be?

c. Show the math that would be necessary 10 add a fourth scenario: a collection of the $1,000 in 5 years at 6%, with a probability of 10%. (No need for a calculator, just write out how you would compute this scenario).

d. Which approach would you expect users of the lender's financial statements to prefer, and why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started