Answered step by step

Verified Expert Solution

Question

1 Approved Answer

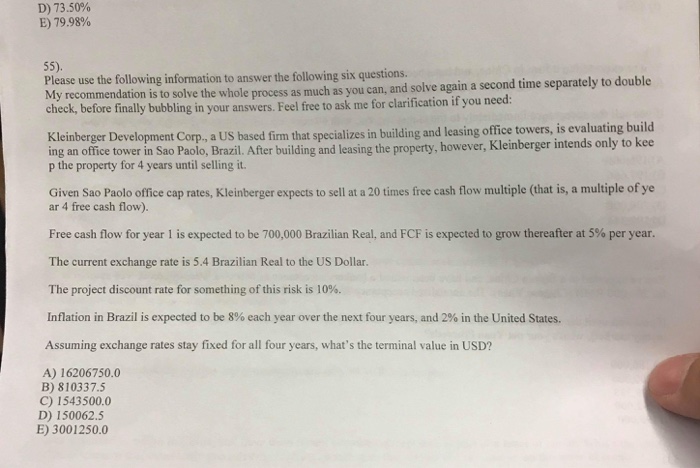

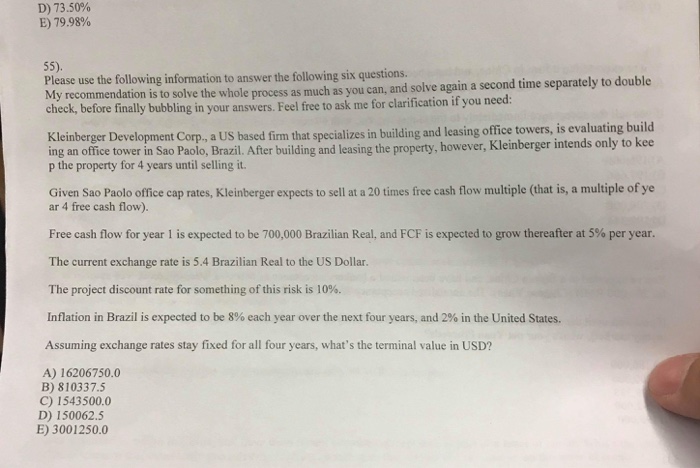

55. D) 73.50% E) 79.98% Please use the following information to answer the following six questions. n is to solve the whole process as much

55.

D) 73.50% E) 79.98% Please use the following information to answer the following six questions. n is to solve the whole process as much as you can, and solve again a second time separately to double check, before finally bubbling in your answers. Feel free to ask me for clarification if you need: Kleinberger Development Corp, a US based firm that specializes in building and leasing office towers, is evaluating b ing an office tower in Sao Paolo, Brazil. After building and leasing the property, however, Kleinberger int p the property for 4 years until selling it. uild ends only to kee Given Sao Paolo office cap rates, Kleinberger expects to sell at a 20 times free cash flow multiple (that is, a multiple of ye ar 4 free cash flow). Free cash flow for year 1 is expected to be 700,000 Brazilian Real, and FCF is expected to grow thereafter at 5% per year. The current exchange rate is 5.4 Brazilian Real to the US Dollar. The project discount rate for something of this risk is 10%. Inflation in Brazil is expected to be 8% each year over the next four years, and 2% in the United States. Assuming exchange rates stay fixed for all four years, what's the terminal value in USD? A) 16206750.0 B) 810337.5 C) 1543500.0 D) 150062.5 E) 3001250.0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started