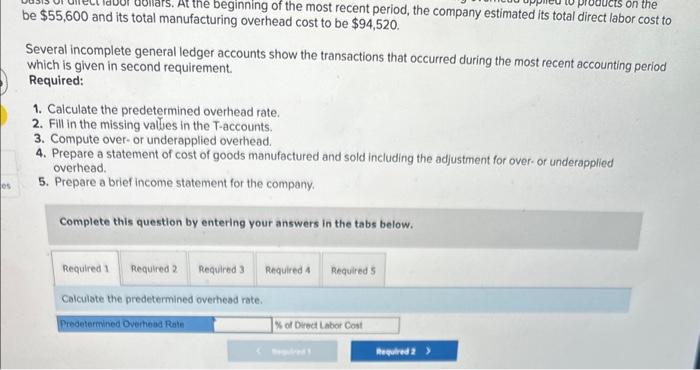

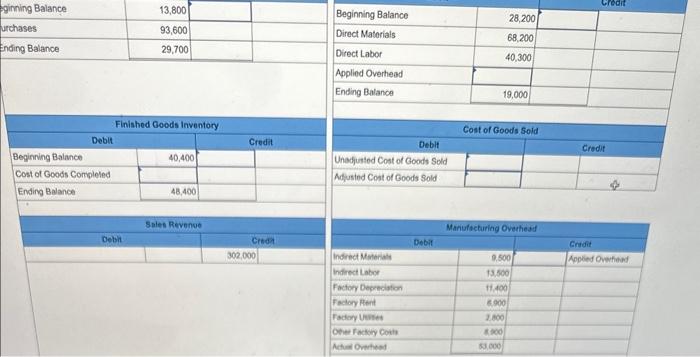

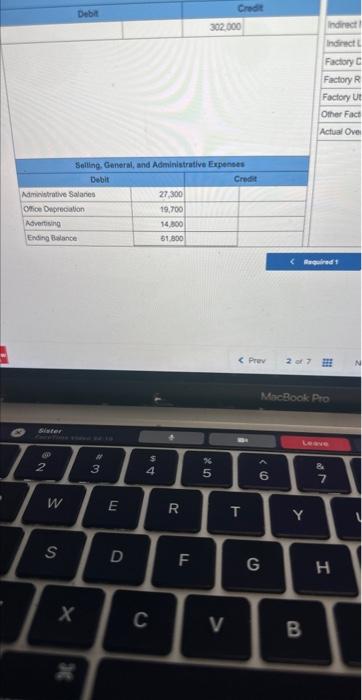

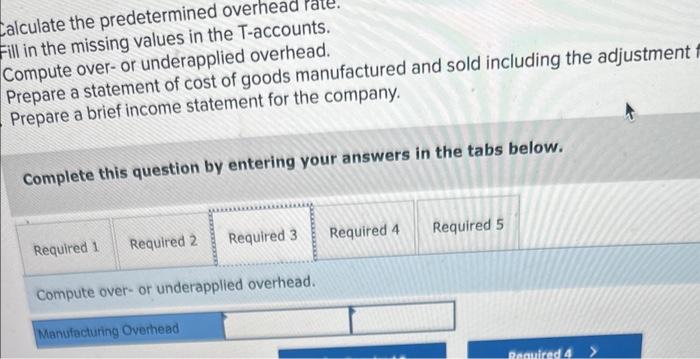

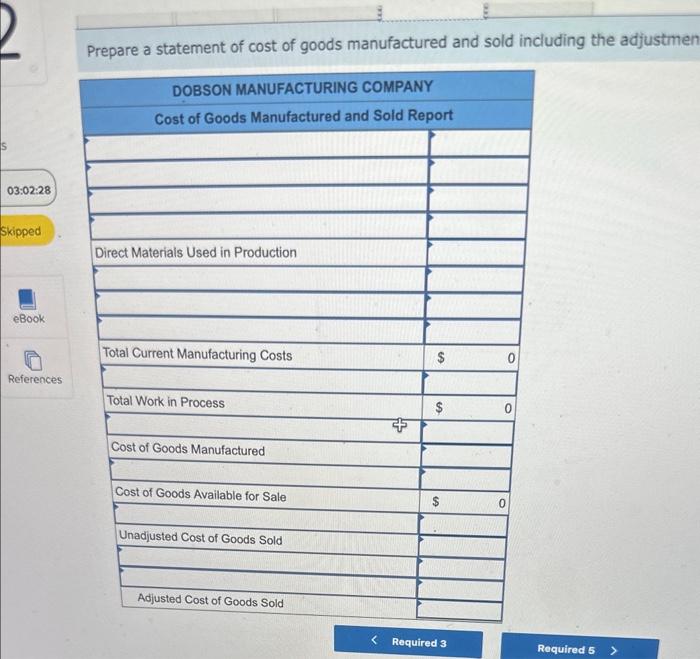

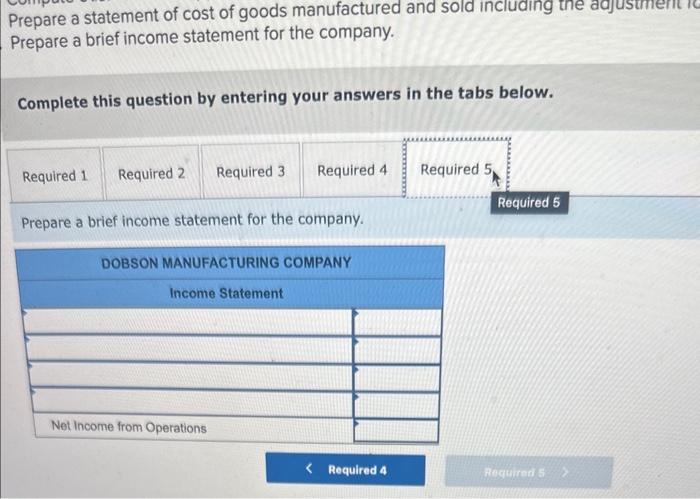

$55,600 and its total manufacturing overhead cost to becent period, the company estimated its total direct labor cost to Several incomplete general ledger accounts show the transactions that occurred during the most recent accounting period which is given in second requirement. Required: 1. Calculate the predetermined overhead rate. 2. Fill in the missing values in the T-accounts. 3. Compute over-or underapplied overhead. 4. Prepare a statement of cost of goods manufactured and sold including the adjustment for over-or underapplied overhead. 5. Prepare a brief income statement for the company. Complete this question by entering your answers in the tabs below. Calculate the predetermined overhead rate. gginning Balance urchases Ending Balance \begin{tabular}{|l|r|r|} \hline Beginning Balance & 28,200 & \\ \hline Direct Materials & 68,200 & \\ \hline Direct Labor & 40,300 & \\ \hline Applied Overhead & & \\ \hline Ending Balance & 19,000 & \\ \hline \end{tabular} alculate the predetermined overnead rate. Fill in the missing values in the T-accounts. Compute over- or underapplied overhead. Prepare a statement of cost of goods manufactured and sold including the adjustment Prepare a brief income statement for the company. Complete this question by entering your answers in the tabs below. Compute over- or underapplied overhead. Preoare a statement of cost of goods manufactured and sold including the adjustmer Prepare a statement of cost of goods manufactured and sold incluaing the adjustmemtic Prepare a brief income statement for the company. Complete this question by entering your answers in the tabs below. Prepare a brief income statement for the company. $55,600 and its total manufacturing overhead cost to becent period, the company estimated its total direct labor cost to Several incomplete general ledger accounts show the transactions that occurred during the most recent accounting period which is given in second requirement. Required: 1. Calculate the predetermined overhead rate. 2. Fill in the missing values in the T-accounts. 3. Compute over-or underapplied overhead. 4. Prepare a statement of cost of goods manufactured and sold including the adjustment for over-or underapplied overhead. 5. Prepare a brief income statement for the company. Complete this question by entering your answers in the tabs below. Calculate the predetermined overhead rate. gginning Balance urchases Ending Balance \begin{tabular}{|l|r|r|} \hline Beginning Balance & 28,200 & \\ \hline Direct Materials & 68,200 & \\ \hline Direct Labor & 40,300 & \\ \hline Applied Overhead & & \\ \hline Ending Balance & 19,000 & \\ \hline \end{tabular} alculate the predetermined overnead rate. Fill in the missing values in the T-accounts. Compute over- or underapplied overhead. Prepare a statement of cost of goods manufactured and sold including the adjustment Prepare a brief income statement for the company. Complete this question by entering your answers in the tabs below. Compute over- or underapplied overhead. Preoare a statement of cost of goods manufactured and sold including the adjustmer Prepare a statement of cost of goods manufactured and sold incluaing the adjustmemtic Prepare a brief income statement for the company. Complete this question by entering your answers in the tabs below. Prepare a brief income statement for the company