5,6 and 7 please. show answers on excel. thanks.

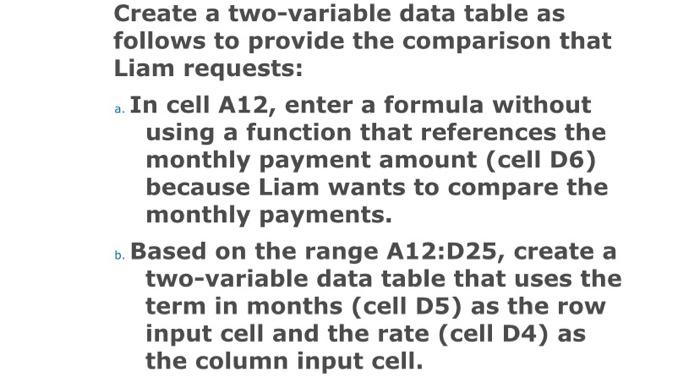

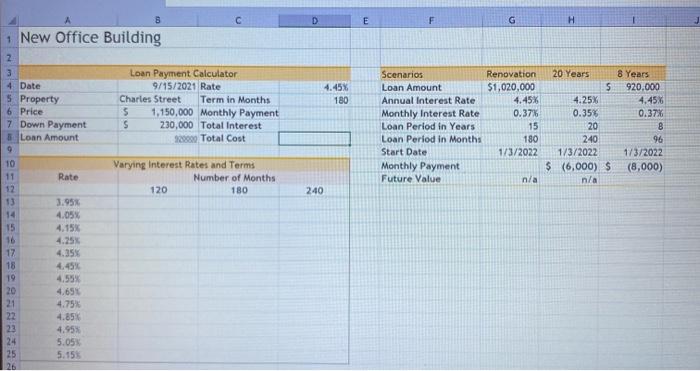

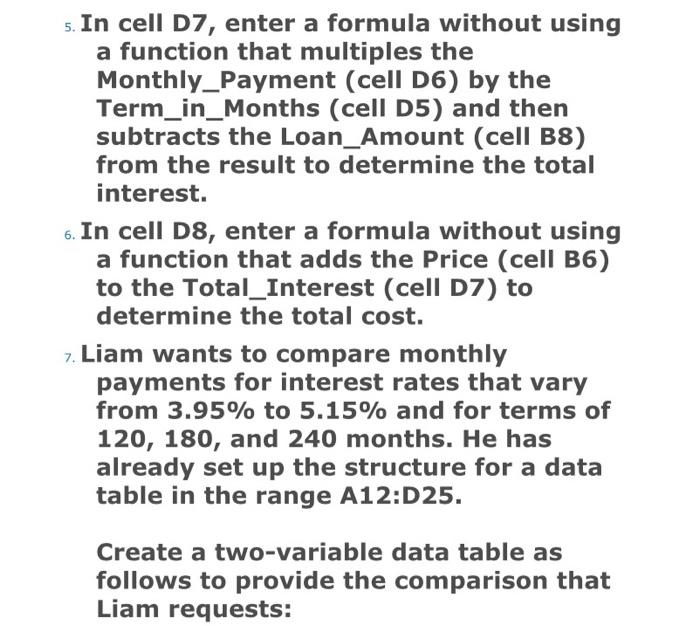

5. In cell D7, enter a formula without using a function that multiples the Monthly_Payment (cell D6) by the Term_in_Months (cell D5) and then subtracts the Loan_Amount (cell B8) from the result to determine the total interest. In cell D8, enter a formula without using a function that adds the Price (cell B6) to the Total_Interest (cell D7) to determine the total cost. 7. Liam wants to compare monthly payments for interest rates that vary from 3.95% to 5.15% and for terms of 120, 180, and 240 months. He has already set up the structure for a data table in the range A12:D25. Create a two-variable data table as follows to provide the comparison that Liam requests: Create a two-variable data table as follows to provide the comparison that Liam requests: a. In cell A12, enter a formula without using a function that references the monthly payment amount (cell D6) because Liam wants to compare the monthly payments. b. Based on the range A12:D25, create a two-variable data table that uses the term in months (cell D5) as the row input cell and the rate (cell D4) as the column input cell. nal Figure 1: Loan Calculator Worksheet Date 5. S. LO Loan Am Amate Interest Rate La Priyan Loan ere the Startete Future 13.000 0.000 New Office Building Loan Calculator 9/15/2021 Rate Property Charles Street Temahe $1,650,000 Monthly Payment 2014. > Down Payment 5 230,000 Total $ 0.1 Lanmount 5 220.000 Total Com $1.601.23 10 vary tem 11 Rate 7,014 130 11 11 2.5 4.7.10 14 4.00 MOS 6.12.20 5.50 15 4.15 10 S. 90435 5 6.220.63 3. 17 4,75 515 8.35 TOSOS 4.59 9.9.25 7.14 5.1.23 20 2015 7.10 $ WS 7,165 . 9.00 TIS 7.2016 5,995.00 9,73956 7.2305 20 5.09 2.780.93 7.29.295 . 5.11 22 2. L WAT 5 cos 5 5 CWS W V nal Figure 2: Equipment Loan Worksheet Equipment Loan med Ware Number of www Most Wantes et tar S. SU S S St. UMS, ni. Su . www.ee . SSSSSEMESO SE SA 13.46 SUR SA SUS 30 S SUM 5. # 11 . 8 D E F G H New Office Building Z 3 4 Date 5 Property 6 Price 7 Down Payment Loan Amount 4.45% 180 Loan Payment Calculator 9/15/2021 Rate Charles Street Term Months 5 1,150,000 Monthly Payment S 230,000 Total Interest 92000 Total Cost Scenarios Loan Amount Annual Interest Rate Monthly Interest Rate Loan Period in Years Loan Period in Months Start Date Monthly Payment Future Value Renovation $1,020,000 4.45% 0.37% 15 180 1/3/2022 20 Years 5 4.25% 0.35% 20 240 1/3/2022 $ (6,000) $ n/a 8 Years 920.000 4.45% 0.37% 8 96 1/3/2022 (8,000) Rate Varying Interest Rates and Terms Number of Months 120 180 n/a 240 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 3.95% 4.05% 4.15% 4.25% 4.35% 4.45% 4,55% 4.654 4.75 4.85% 4.95% 5.05% 5.15% 1. Liam Richardson is the business manager for the Smith & Lyngate Insurance agencies in the state of Maryland. Liam is interested in increasing the number of agents in Baltimore and plans to buy an office building for the new operation. He has asked for your help in creating a loan analysis that summarizes information about the loans to cover the cost of the building. Go to the Loan Calculator worksheet. The cells in the range B6:B8 have defined names, but one is incomplete and could be confusing. Cell A2 also has a defined name, which is unnecessary for a cell that will not be used in a formula. Update the defined names in the worksheet as follows: .. Delete the Loan_Calculator defined name. b. For cell B8, edit the defined name to use Loan_Amount as the name. 2. In cell B8, calculate the loan amount by entering a formula without using a function that subtracts the Down_Payment from the Price. 3. Liam also wants to use defined names in other calculations to help him interpret the formulas. 5. In cell D7, enter a formula without using a function that multiples the Monthly_Payment (cell D6) by the Term_in_Months (cell D5) and then subtracts the Loan_Amount (cell B8) from the result to determine the total interest. In cell D8, enter a formula without using a function that adds the Price (cell B6) to the Total_Interest (cell D7) to determine the total cost. 7. Liam wants to compare monthly payments for interest rates that vary from 3.95% to 5.15% and for terms of 120, 180, and 240 months. He has already set up the structure for a data table in the range A12:D25. Create a two-variable data table as follows to provide the comparison that Liam requests: Create a two-variable data table as follows to provide the comparison that Liam requests: a. In cell A12, enter a formula without using a function that references the monthly payment amount (cell D6) because Liam wants to compare the monthly payments. b. Based on the range A12:D25, create a two-variable data table that uses the term in months (cell D5) as the row input cell and the rate (cell D4) as the column input cell. nal Figure 1: Loan Calculator Worksheet Date 5. S. LO Loan Am Amate Interest Rate La Priyan Loan ere the Startete Future 13.000 0.000 New Office Building Loan Calculator 9/15/2021 Rate Property Charles Street Temahe $1,650,000 Monthly Payment 2014. > Down Payment 5 230,000 Total $ 0.1 Lanmount 5 220.000 Total Com $1.601.23 10 vary tem 11 Rate 7,014 130 11 11 2.5 4.7.10 14 4.00 MOS 6.12.20 5.50 15 4.15 10 S. 90435 5 6.220.63 3. 17 4,75 515 8.35 TOSOS 4.59 9.9.25 7.14 5.1.23 20 2015 7.10 $ WS 7,165 . 9.00 TIS 7.2016 5,995.00 9,73956 7.2305 20 5.09 2.780.93 7.29.295 . 5.11 22 2. L WAT 5 cos 5 5 CWS W V nal Figure 2: Equipment Loan Worksheet Equipment Loan med Ware Number of www Most Wantes et tar S. SU S S St. UMS, ni. Su . www.ee . SSSSSEMESO SE SA 13.46 SUR SA SUS 30 S SUM 5. # 11 . 8 D E F G H New Office Building Z 3 4 Date 5 Property 6 Price 7 Down Payment Loan Amount 4.45% 180 Loan Payment Calculator 9/15/2021 Rate Charles Street Term Months 5 1,150,000 Monthly Payment S 230,000 Total Interest 92000 Total Cost Scenarios Loan Amount Annual Interest Rate Monthly Interest Rate Loan Period in Years Loan Period in Months Start Date Monthly Payment Future Value Renovation $1,020,000 4.45% 0.37% 15 180 1/3/2022 20 Years 5 4.25% 0.35% 20 240 1/3/2022 $ (6,000) $ n/a 8 Years 920.000 4.45% 0.37% 8 96 1/3/2022 (8,000) Rate Varying Interest Rates and Terms Number of Months 120 180 n/a 240 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 3.95% 4.05% 4.15% 4.25% 4.35% 4.45% 4,55% 4.654 4.75 4.85% 4.95% 5.05% 5.15% 1. Liam Richardson is the business manager for the Smith & Lyngate Insurance agencies in the state of Maryland. Liam is interested in increasing the number of agents in Baltimore and plans to buy an office building for the new operation. He has asked for your help in creating a loan analysis that summarizes information about the loans to cover the cost of the building. Go to the Loan Calculator worksheet. The cells in the range B6:B8 have defined names, but one is incomplete and could be confusing. Cell A2 also has a defined name, which is unnecessary for a cell that will not be used in a formula. Update the defined names in the worksheet as follows: .. Delete the Loan_Calculator defined name. b. For cell B8, edit the defined name to use Loan_Amount as the name. 2. In cell B8, calculate the loan amount by entering a formula without using a function that subtracts the Down_Payment from the Price. 3. Liam also wants to use defined names in other calculations to help him interpret the formulas