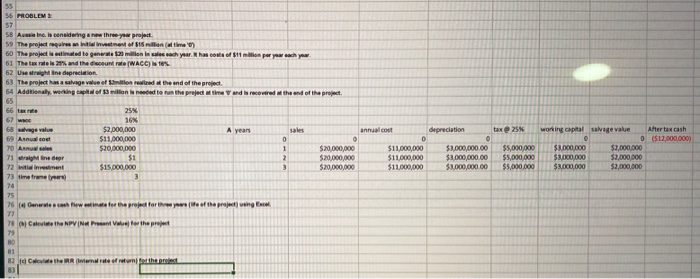

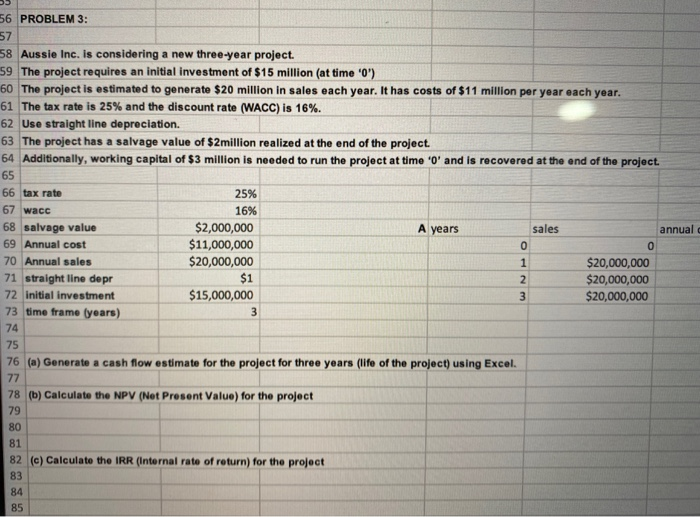

56 PROBLEME 57 58 Aussine is considering a three-yos projet 59 The project requires an initial Istment of 515 million (at times) 60 The project is estimated to generate $20 million in sales cher has to of $11 million per your ch you 61 The tax rate is 28% and the discount rate (WACC) 18% 62 Usestrihine depreciation 63 The project has a salvage value of no read the end of the project 54 Additionally working capital of 3 million needed to run the project at time and is recovered the end of the project 65 56 ter 25% depreciation tax 25 68 savage value $2,000,000 A years 69 Annet $11,000,000 70 Araw $20,000,000 71 Minder $1 72 Witnet $15,000,000 73 timerne 3 74 75 76 Generate cash flow state for the project for three yee of the project ng Bol 0 1 2 3 $20,000,000 $20.000.000 $20,000,000 annualcost 0 $11,000,000 $11,000,000 $11.000.000 $3,000,000.00 $3,000,000.00 $3,000,000.00 $5,000,000 $5,000,000 $5.000.000 working capital salvage value After tax cash 0 ($12,000,000) $3.000.000 $2,000,000 SBO DOO $2,000,000 $3.000.000 $2,000,000 78 Caleve the NPVN refer the project 70 NO 82 14 Cate the IRR ofron the 83 annual 0 56 PROBLEM 3: 57 58 Aussie Inc. is considering a new three-year project. 59 The project requires an initial investment of $15 million (at time 'O") 60 The project is estimated to generate $20 million in sales each year. It has costs of $11 million per year each year. 61 The tax rate is 25% and the discount rate (WACC) is 16%. 62 Use straight line depreciation. 63 The project has a salvage value of $2million realized at the end of the project. 64 Additionally, working capital of $3 million is needed to run the project at time 'O' and is recovered at the end of the project. 65 66 tax rate 25% 67 wacc 16% 68 salvage value $2,000,000 A years sales 69 Annual cost $11,000,000 0 70 Annual sales $20,000,000 1 $20,000,000 71 straight line depr $1 $20,000,000 72 initial investment $15,000,000 3 $20,000,000 73 time frame (years) 3 74 75 76 (a) Generate a cash flow estimate for the project for three years (life of the project) using Excel. 77 78 (b) Calculate the NPV (Net Present Value) for the project 79 80 81 82 (c) Calculate the IRR (Internal rate of return) for the project 83 84 85 2