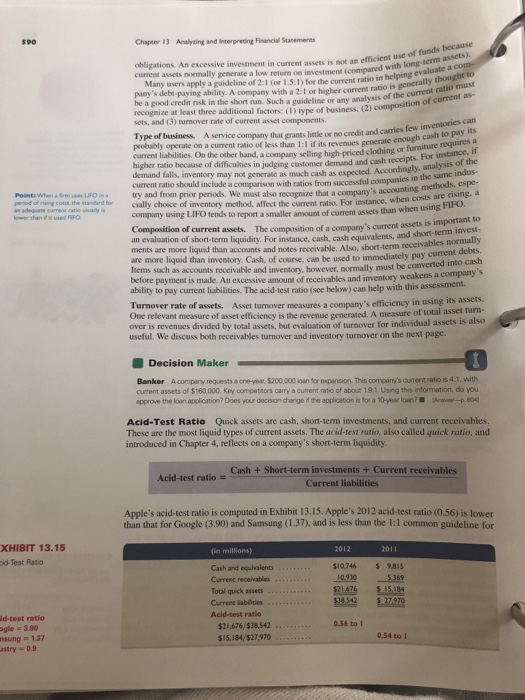

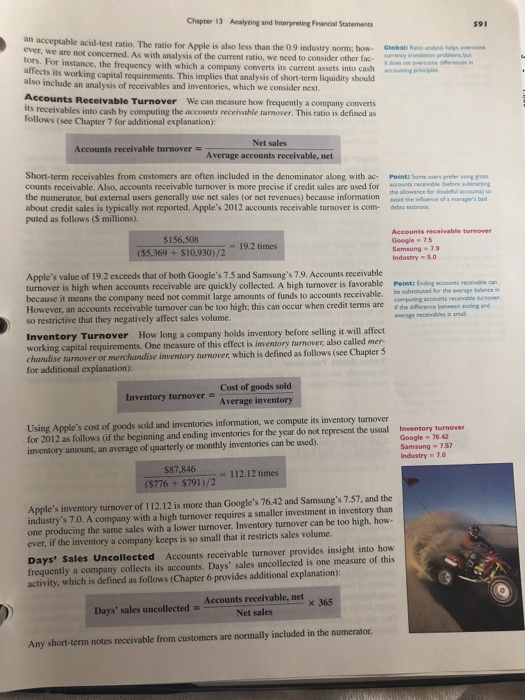

589 Chapter 13 Analyaing and Interpreting Financial Stacements A ratio expresses a mathematical relation between two quantities It can be expressed as a per- cent, ralc, or proportion. For instance, a change in an account balance from $100 to $250 can be expressed as (1)150% increase. (2) 2.5 times, or (3)2.5 to l (or 2.5:1), Computation of a ratio is a simple arithmetic operation, but its imterpretation is nox. To be meaningful, a ratio must refer to an economically important relation. For example, a direct and crucial relation exists between an item's sales price and its cost. Accordingly, the ratio of cost of goods sold to sales is meaningful. In con- trast, no obvious relation exists between freight costs and the balance of long-serm investments This section describes an important set of financial ratios and its application. The selected Pointi Some souerces for indury ratios are organized into the four building blocks of financial statement analysis: (1) liquidity nos are Au Stmn S by and efficiency, (2) solvency, (3) profitability, and (4) market prospects. All of these were explained at relevant points in prior chapters. The parpose here is to organize and apply Brdtree Sa&Pr's Industry them under a summary framework. We use four common standards, in varying degrees, for Suy and Reuters.comfrnee comparisons: intracompany, competitor, industry, and guidelines. Liquidity and Efficiency Liquidity refers to the availability of resources to meet short-term cash requirements. It is af- fected by the timing of cash inflows and outflows along with prospects for future performance. Analysis of liquidity is aimed at a company's funding requirements. Eficiency refers to how productive a company is in using its assets. Efficiency is usually measured relative to how much revenue is generated from a certain level of assets. Both liquidity and efficiency are important and complementary. If a company fails to meet its current obligations, its continued existence is doubtful. Viewed in this light, all other measures of analysis are of secondary importance. Although accounting measurements assume the companys continued existence, our analysis must always assess the validity of this assumption using liquidity measures. Moreover, inefficient use of assets can cause liquidity problems. A lack of liquidity oftern precedes lower profitability and fewer opportunities. It can foretell a loss of owner control. To a company's creditors, lack of liquidity can yield delays in collecting interest and principal payments or the loss of amounts due them. A company's customers and suppliers of goods and services also are affected by short-term liquidity problems. Implications include a company's inability to execute contracts and potential damage to important customer and supplier relationships. This section de- scribes and illustrates key ratios relevant to assessing liquidity and efficiency Working Capital and Current Ratio The amount of current assets less current liabili- ties is called working capital, or net working capital. A company needs adequate working capi- tal to meet current debts, to carry sufficient inventories, and to take advantage of A company that runs low on working capital is less likely to meet current obligations or to con- tinue operat dollar am defined as follows (see Chapter 3 for additional explanation): ing. When evaluating a company's working capital. we must not only look at the ount of current assets less current liabilities, but also at their ratio. The current ratio is Current assets Current li Current ratio Drawing on information in Exhibit 13.1, Apple's working capital and current ratio for both 2012 and 2011 are shown in Exhibit 13,14. Also, Google (4.22), Samsung (1.86), and the industry's current ratio (2.5) are shown in the margin. Apple's 2012 ratio (1.50) is lower competitors ratios, but it is not in dan ger of defaulting on loan payments. A high current ratio suggests a strong li quidity position and an ability to meet Current assets current obligations. A company can, how- ever, have a current ratio that is too high. An excessively high current ratio means that the company has invested too much in current assets compared to its current EXHIBIT 13.14 Apple's Working Capital (in millions) 44,988 and Current Ratio 57653$ 38.54227.970 Currens lablities Working capital Current ratio S19.111 $17010 Current ratio Google 4.22 1.50 to I $57,623/538,542 $44,988/$27,970- Samsung 1.86 1.61 to Industry 2.5