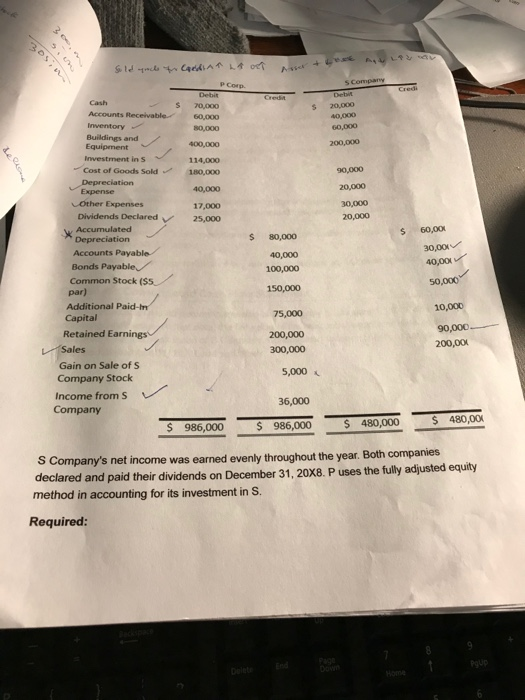

5to, un uy sakiau 14, and of curlidali your submission Option #1: Elimination Entries and Consolidated Worksheet P Corporation acquired 70 percent ownership of S Company on January 1, 20x6.at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 30 percent of the book value of S. On January 1, 20X8. Portfolio sold 1,000 shares of S Company for $20,000 to A Corporation and recorded a $5,000 gain. Trial balances for the companies on December 31, 20x8, contain the following data: peiche Purch 701. ok sa undermene stuk value - o nohal " the book value of sl WER 8. 9 U Caps Lock A S D F H J K Shite 5. SOE Sold grace to Cardian LA of 5 Company Gre Credit $ 5 Dehi 70,000 60,000 80,000 20.000 40,000 GO DOO 200,000 7 400,000 114,000 180,000 90,000 20,000 Cash Accounts Receivable Inventory Buildings and Equipment Investment in S Cost of Goods Sold Depreciation Expense Other Expenses Dividends Declared Accumulated Depreciation Accounts Payable Bonds Payable Common Stock (SS par) Additional Paidir Capital Retained Earnings 40,000 17,000 25,000 30,000 20,000 60,000 $ 80,000 40,000 100,000 30,00 40,00 50,000 150,000 10,000 75,000 200,000 300,000 90,000 200,00 Sales 5,000 Gain on Sale of s Company Stock Income from Company 36,000 $ 986,000 $ 986,000 $ 480,000 $ 480,004 S Company's net income was earned evenly throughout the year. Both companies declared and paid their dividends on December 31, 20X8. P uses the fully adjusted equity method in accounting for its investment in S. Required: 20x8 2. Prepare a consolidation worksheet for 20x8. 1. Prepare the elimination entries needed to complete a full consolidation worksheet for Use Excel formulas to make or evidence each of your calculations of all dollar amounts Do not enter any dollar amounts directly, unless it is unavoidable for obvious reasons. Use Prepare and submit one Excel spreadsheet for this assignment. Use the following naming Use terms, evidence, and concepts from class readings, including professional Support the writing portion of the assignment (if applicable) with credible sources. Requirements: - Show calculations for all questions. the tab function at the bottom of the Excel file to complete the assignment convention for your file: MyNameCTA4Option 1. business language Review the week's CT Assignment grading rubric for more information on expectations and how you will be graded. Do not hesitate to ask your instructor if you have any questions about this assignment. Option #2: Consolidated Cash Flow Statement P Corporation acquired 80 percent ownership of Company on January 1, 20X6, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 20 percent of the book value of S Company. Consolidated balance sheets at January 1, 20X8, and December 31, 20X8, are as follows: 5to, un uy sakiau 14, and of curlidali your submission Option #1: Elimination Entries and Consolidated Worksheet P Corporation acquired 70 percent ownership of S Company on January 1, 20x6.at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 30 percent of the book value of S. On January 1, 20X8. Portfolio sold 1,000 shares of S Company for $20,000 to A Corporation and recorded a $5,000 gain. Trial balances for the companies on December 31, 20x8, contain the following data: peiche Purch 701. ok sa undermene stuk value - o nohal " the book value of sl WER 8. 9 U Caps Lock A S D F H J K Shite 5. SOE Sold grace to Cardian LA of 5 Company Gre Credit $ 5 Dehi 70,000 60,000 80,000 20.000 40,000 GO DOO 200,000 7 400,000 114,000 180,000 90,000 20,000 Cash Accounts Receivable Inventory Buildings and Equipment Investment in S Cost of Goods Sold Depreciation Expense Other Expenses Dividends Declared Accumulated Depreciation Accounts Payable Bonds Payable Common Stock (SS par) Additional Paidir Capital Retained Earnings 40,000 17,000 25,000 30,000 20,000 60,000 $ 80,000 40,000 100,000 30,00 40,00 50,000 150,000 10,000 75,000 200,000 300,000 90,000 200,00 Sales 5,000 Gain on Sale of s Company Stock Income from Company 36,000 $ 986,000 $ 986,000 $ 480,000 $ 480,004 S Company's net income was earned evenly throughout the year. Both companies declared and paid their dividends on December 31, 20X8. P uses the fully adjusted equity method in accounting for its investment in S. Required: 20x8 2. Prepare a consolidation worksheet for 20x8. 1. Prepare the elimination entries needed to complete a full consolidation worksheet for Use Excel formulas to make or evidence each of your calculations of all dollar amounts Do not enter any dollar amounts directly, unless it is unavoidable for obvious reasons. Use Prepare and submit one Excel spreadsheet for this assignment. Use the following naming Use terms, evidence, and concepts from class readings, including professional Support the writing portion of the assignment (if applicable) with credible sources. Requirements: - Show calculations for all questions. the tab function at the bottom of the Excel file to complete the assignment convention for your file: MyNameCTA4Option 1. business language Review the week's CT Assignment grading rubric for more information on expectations and how you will be graded. Do not hesitate to ask your instructor if you have any questions about this assignment. Option #2: Consolidated Cash Flow Statement P Corporation acquired 80 percent ownership of Company on January 1, 20X6, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 20 percent of the book value of S Company. Consolidated balance sheets at January 1, 20X8, and December 31, 20X8, are as follows